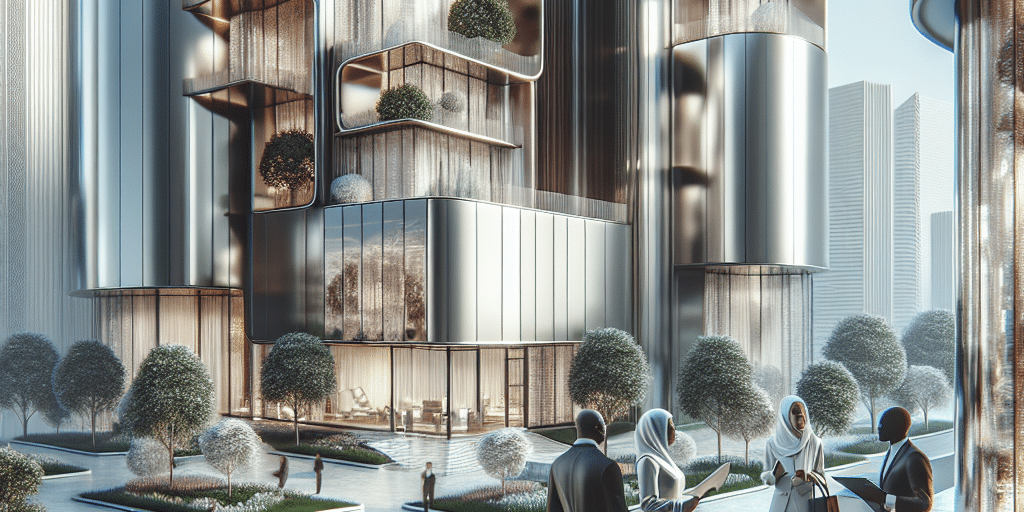

Wealth Management Redefined: How Family Offices are Shaping High-End Real Estate Development

In recent years, the landscape of wealth management has undergone a seismic shift, particularly with the emergence of family offices as pivotal players in high-end real estate development. Traditionally, family offices—private wealth management advisory firms that serve ultra-high-net-worth individuals and families—have focused on asset management, investment strategies, and personalized financial planning. However, their expanding role in real estate is reshaping the sector’s dynamics, driving innovation, and influencing trends in luxury property development.

The Rise of Family Offices in Real Estate

Family offices have emerged as significant actors in the real estate market due to a confluence of factors. The increasing wealth of high-net-worth families, particularly in regions marked by technological innovation and entrepreneurial success, has created an appetite for diverse investment opportunities. Many family offices are pivoting away from traditional investments like stocks and bonds, recognizing the potential for substantial returns and stability in real estate.

Moreover, with the rising number of family offices—estimated to be over 10,000 globally—the collective capital being directed towards real estate is substantial. This trend is driven not only by the potential for income generation and asset appreciation but also by the desire for tangible, lasting investments that enhance family legacy and lifestyle.

Strategic Investment Approaches

Family offices are unique in their approach to investing in real estate. Unlike private equity firms or institutional investors, which often prioritize short-term gains, family offices tend to adopt a long-term perspective. This outlook allows them to invest in high-end developments that may take years, or even decades, to realize their full potential.

-

Direct Development Investments: Many family offices are choosing to engage directly in real estate development rather than solely purchasing existing properties. By doing so, they can influence design and execution, creating bespoke living spaces that reflect their family’s values and preferences. This hands-on approach often results in developments that offer unique lifestyle amenities and integrate well into their respective communities.

-

Sustainable and Innovative Solutions: With increasing awareness of environmental issues, family offices are incorporating sustainability into their real estate strategies. Eco-friendly building practices and sustainable community developments are gaining traction. This focus not only meets growing consumer demand for green living spaces but also aligns with the philanthropic goals many families wish to support.

- Collaboration and Partnerships: Family offices are also forging partnerships with established real estate firms, leveraging their expertise while infusing fresh capital. These collaborations often lead to innovative projects that blend luxury and functionality, catering to affluent buyers seeking more than just a property—such as lifestyle, community, and exclusivity.

The Impact on High-End Real Estate Development

-

Luxury Redefined: As family offices invest in high-end developments, the definition of luxury is evolving. Rather than simply focusing on square footage or opulent finishes, contemporary luxury now emphasizes lifestyle. Developments are increasingly designed with wellness amenities, technology integration, and community engagement in mind.

-

Cultural and Community Integration: Family offices are more likely to incorporate local culture and community needs into their developments. By engaging local artists and craftspeople, they create spaces that resonate with the community while offering high-end amenities. This approach not only enhances the property’s marketability but also fosters goodwill and social responsibility.

- As a Catalyst for Development: The influx of capital from family offices is driving growth in emerging and overlooked markets. These investors are often willing to take risks in areas with potential, leading to revitalization and transformation, ultimately improving overall property values in those regions.

Challenges and Considerations

While family offices are reshaping the high-end real estate landscape, they also face challenges. The complexity of managing diverse portfolios of properties, understanding market dynamics, and navigating regulatory frameworks can be daunting. Additionally, the increasing competition among family offices themselves means that strategic differentiation will be crucial for sustained success.

Conclusion

The influence of family offices in high-end real estate development signifies a shift in how wealth management is approached. By prioritizing long-term value, sustainability, and community integration, family offices are not merely investing in real estate; they are redefining what it means to create a home and a legacy. As they continue to emerge as key players in the sector, the future of high-end real estate promises to be innovative, community-oriented, and aligned with the changing values of wealth holders. In this evolving landscape, family offices are not just managing wealth; they are shaping the very environments in which we live, work, and play.