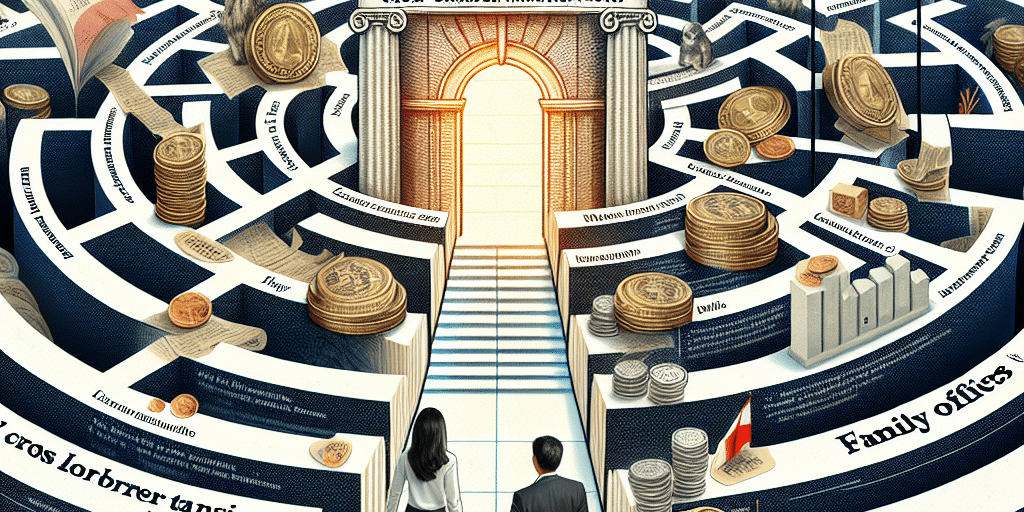

Family offices play an increasingly important role in the global economy. With significant assets to manage and diverse investment opportunities worldwide, they often engage in cross-border transactions. However, navigating these transactions can be a legal labyrinth, requiring a keen understanding of various regulations, tax implications, and compliance requirements.

The Importance of Legal Frameworks

Each country has its own legal framework governing business transactions, which can lead to complex situations for family offices involved in cross-border investments. Legal considerations include:

- Regulatory compliance in multiple jurisdictions

- Understanding local laws and customs

- Treaties and trade agreements that may impact transactions

Tax Implications

Taxation is a crucial factor when considering cross-border transactions. Family offices must be well-informed about:

- The potential for double taxation

- Tax treaties between countries

- Transfer pricing regulations

Engaging a tax advisor with cross-border expertise can minimize risks and ensure compliance.

Asset Protection and Wealth Preservation

When investing abroad, family offices must also think about asset protection and wealth preservation strategies, such as:

- Utilizing offshore trusts and entities

- Understanding inheritance laws in different jurisdictions

- Assessing geopolitical risks

Legal Due Diligence

Before committing to cross-border transactions, thorough legal due diligence is essential. This involves:

- Evaluating the legal structure of potential investments

- Conducting background checks on partners and counterparties

- Reviewing contracts and agreements for enforceability

Engaging Local Experts

Family offices should work with local legal and tax experts who understand the intricacies of their respective markets. These professionals can provide valuable insights and guidance, making the navigation of the legal landscape smoother.

Conclusion

Cross-border transactions present lucrative opportunities for family offices, but they also come with significant legal complexities. By understanding the legal frameworks, tax implications, and the necessity of thorough due diligence, family offices can successfully navigate the legal labyrinth and make sound investment decisions.