The art market has gained increasing attention from family offices seeking alternative investment opportunities. However, this vibrant market also comes with its own set of challenges and complexities. This article aims to outline cautionary strategies for family offices navigating the art market.

1. Understand the Market Dynamics

Before diving into art investments, family offices should familiarize themselves with the art market’s unique characteristics. The market is influenced by trends, economic factors, and societal interests, which can change rapidly. Thorough research and assessment of market dynamics can help in making informed decisions.

2. Identify Your Investment Objectives

Family offices must clarify their investment objectives, whether they are looking for capital appreciation, personal enjoyment, or portfolio diversification. This clarity helps in creating a focused strategy that aligns with the family’s vision for art investment.

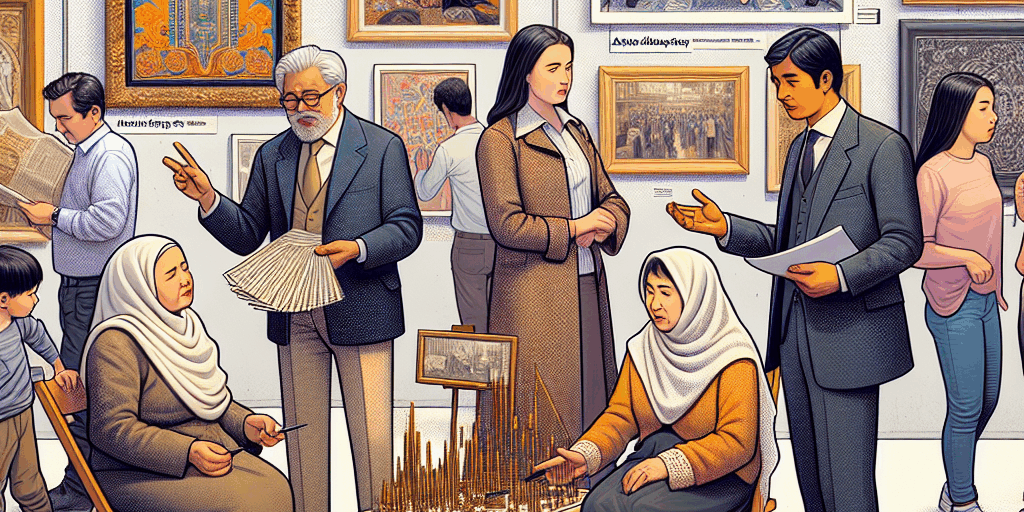

3. Work with Reputable Advisors

Partnering with knowledgeable art advisors, curators, or galleries is crucial. These professionals possess valuable insights and can guide family offices in selecting artworks that are likely to appreciate in value, as well as helping to navigate the intricate buying process.

4. Verify Provenance and Authenticity

Artworks should have verifiable provenance and authenticity to avoid costly mistakes. Family offices should conduct due diligence to verify the artwork’s history, ensuring that it is legitimate and not subject to any legal disputes.

5. Consider Art Storage and Maintenance

Proper storage and maintenance of art pieces are essential to preserve their value. Family offices must decide where the artworks will be stored and how they will be maintained, factoring in associated costs such as insurance and environmental controls.

6. Stay Informed on Legal Aspects

Art investments can have complex legal implications, including tax considerations, export regulations, and inheritance matters. Consulting with legal experts who specialize in art transactions can help navigate these complexities effectively.

7. Plan for Long-Term Ownership

Art investment is often best viewed through a long-term lens. Family offices should be prepared for market fluctuations and resist the temptation to sell at the first sign of a downturn. A patient, long-term approach can yield significant rewards.

Conclusion

While the art market presents exciting opportunities for family offices, it is essential to tread carefully. By understanding market dynamics, seeking expert guidance, and implementing these cautionary strategies, family offices can navigate the art market wisely and build a valuable art collection that aligns with their long-term goals.