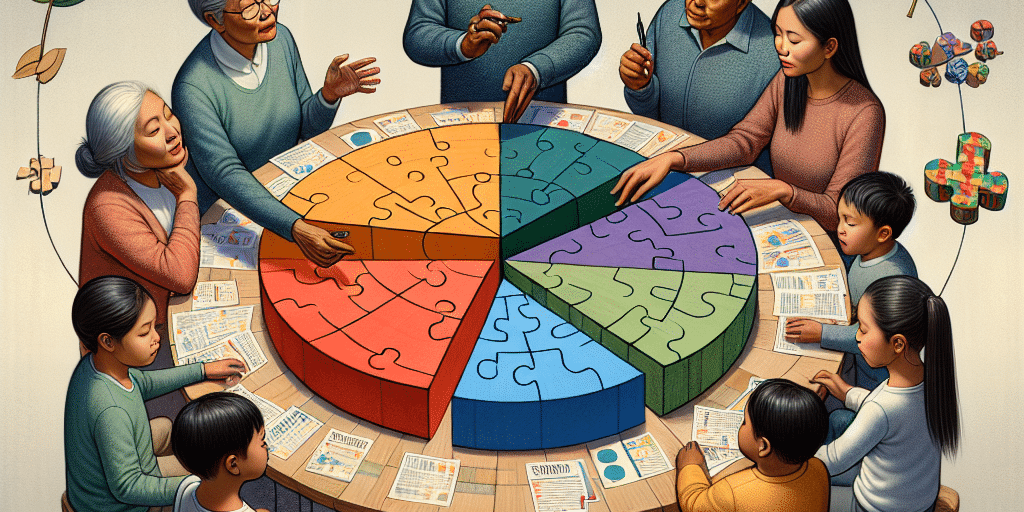

In today’s world, family wealth is not just about financial assets; it encapsulates values, relationships, and aspirations. As families accumulate wealth across generations, the challenge becomes not just managing this wealth, but governing it effectively. Family governance plays a pivotal role in navigating shared wealth, ensuring not just the preservation of assets but also the maintenance of family harmony and legacy.

What is Family Governance?

Family governance refers to the structures, policies, and practices that guide decision-making within a family regarding their shared wealth. It includes establishing a framework for communication, conflict resolution, and strategic planning to align family members with common goals. The aim is to foster a collaborative environment where all family members feel valued and included.

The Components of Family Governance

Family Constitution: A written document outlining the family’s values, vision, and governance structure. This serves as a foundational reference to guide decisions and manage disputes.

Board of Directors: Some families opt to create a family board, comprising family members and trusted advisors. This board oversees investment decisions, philanthropic endeavors, and estate planning.

Regular Meetings: Open lines of communication are crucial. Regular family meetings allow members to discuss financial health, set goals, and address concerns, promoting transparency and collective ownership.

Education and Training: Ensuring family members, especially younger generations, understand financial management and the responsibilities that come with wealth is vital. Programs and workshops can empower family members to make informed decisions.

- Conflict Resolution Mechanisms: Disagreements are inevitable in any family, especially when money is involved. Establishing clear protocols for conflict resolution can help mitigate tensions and maintain family unity.

The Importance of Family Governance in Managing Wealth

Preserving Family Legacy: Family governance frameworks help articulate and preserve the values that define a family’s legacy. By aligning financial decisions with these values, families can ensure that their wealth serves not just material needs but also supports their missions and philanthropic interests.

Enhancing Communication: Wealth can often create barriers among family members. A structured governance approach encourages open dialogue, allowing families to address issues before they escalate into larger conflicts.

Empowering Future Generations: Engaging younger family members in governance discussions prepares them for future leadership roles. When they understand the family’s financial landscape and governance structure, they are better equipped to contribute meaningfully.

Strategic Decision-Making: With a robust governance framework in place, families can make informed, strategic decisions about investments, risk management, and wealth distribution, rather than reactive choices driven by emotional impulses.

- Encouraging Philanthropy: Many wealthy families are increasingly focused on giving back. A well-structured governance model can help frame discussions about philanthropy, ensuring that charitable endeavors align with the family’s values and vision.

Challenges to Effective Family Governance

Despite its benefits, establishing effective family governance can be challenging:

- Resistance to Change: Older generations may feel threatened by the involvement of younger members in governance discussions.

- Complex Family Dynamics: Blended families, differing financial interests, and varying levels of engagement can complicate governance efforts.

- Lack of Professional Guidance: Many families may not seek external advisors, resulting in governance structures that lack expertise.

Steps to Establishing Family Governance

Start with Open Dialogue: Initiate conversations about family values and vision for the future.

Engage Professional Advisors: Consider hiring advisors who specialize in family wealth and governance to facilitate discussions and create a structured governance framework.

Draft a Family Constitution: Collaboratively write a document that encapsulates the family’s values, governance structure, and conflict resolution protocols.

Regularly Review Governance Practices: As families evolve, so should governance structures. Regular reviews ensure that the framework remains relevant and effective.

- Cultivate a Culture of Inclusion: Encourage all family members to contribute ideas and feedback, fostering a sense of ownership over the governance process.

Conclusion

Navigating shared wealth is a complex journey that requires thoughtful governance and open communication. Family governance not only fosters collaboration and transparency but also helps preserve a family’s legacy for future generations. By establishing effective governance structures, families can transform financial management from a source of potential discord into an opportunity for unity and shared purpose. The focus is not merely on wealth preservation but on building a thriving family culture that can adapt and flourish in the face of life’s inevitable changes.