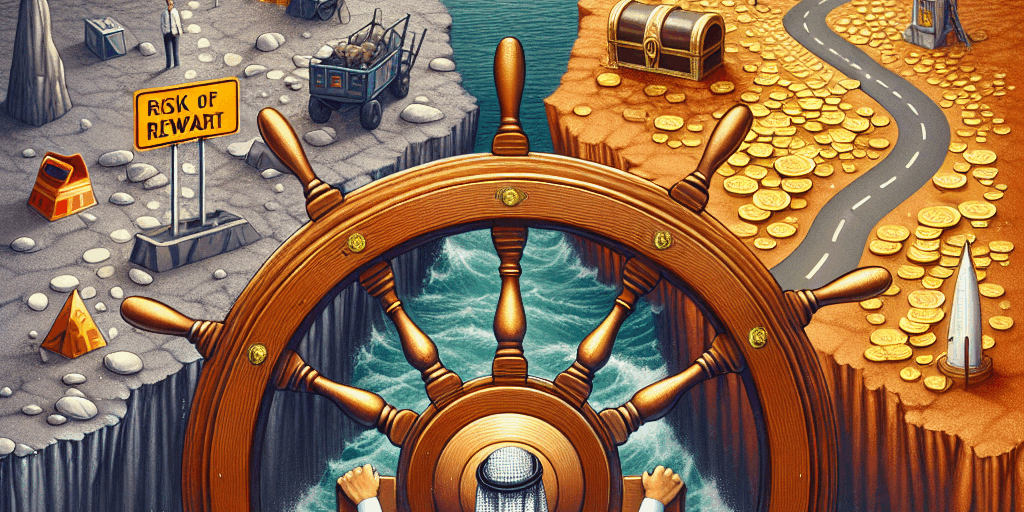

Title: Navigating Distress: The Dual Edges of Risk and Reward in Family Office Investments

Introduction

In the world of finance, risk and reward are commodities that investors constantly weigh against each other. Family offices, which manage the wealth of affluent families, are no exception. As these entities navigate the complex landscape of investment, the dual edges of risk and reward become particularly pronounced during periods of economic distress. Understanding how to maneuver through turbulent times is essential for family offices seeking sustainable growth and wealth preservation.

The Unique Nature of Family Offices

Family offices operate in a distinct realm compared to traditional investment funds. They are characterized by their long-term investment horizons, personalized strategies, and an emphasis on wealth preservation alongside wealth creation. The motivations behind their investments often go beyond pure financial returns; they also encompass values, legacy, philanthropic interests, and the stability of future generations.

As a result, family offices must balance their investment strategies carefully, especially during distressing periods. While turbulence can create opportunities, it presents significant risks that can jeopardize financial security and family reputations.

Understanding Distress in Investment Markets

Economic distress can arise from various sources – geopolitical tensions, financial crises, pandemics, or societal upheavals. Such situations often lead to market volatility, where asset prices fluctuate wildly, creating a challenging environment for investors. For family offices, this volatility can trigger emotional responses, leading to rushed decisions that may not align with their long-term objectives.

During distress, asset classes like equities, real estate, and alternative investments can become dislocated and undervalued. For example, distressed assets might offer attractive buying opportunities, but their inherent risks—credit default, liquidity issues, and economic downturns—must be carefully assessed.

The Risk-Reward Dichotomy

- Identifying Opportunities Amid Distress

Economic downturns often unearth previously hidden investment opportunities. Family offices can capitalize on these situations by acquiring undervalued assets or investing in distressed sectors. Dislocated markets frequently lead to bargain prices for high-quality companies, creating an entry point for long-term growth.

Investments in sectors such as technology or healthcare may flourish during crises, as their fundamental dynamics can remain resilient despite economic headwinds. Family offices can enhance their portfolios by diversifying into these counter-cyclical assets.

- Embracing Disciplined Risk Management

In times of distress, the importance of risk management becomes amplified. Family offices must develop robust frameworks to evaluate potential investments and quantify risk exposure. This includes stress-testing portfolios under various economic scenarios, leveraging expert insights, and investing in risk mitigation strategies such as hedging or diversifying across asset classes.

Adopting a disciplined approach means resisting the urge to react impulsively to market signals. Family offices often shy away from following market fads, instead concentrating on their overarching investment philosophy and the unique needs of the family.

- Patient Capital: A Long-Term Perspective

One of the most significant advantages family offices possess is their ability to adopt a long-term investment perspective. Unlike public funds beholden to quarterly earnings, family offices can afford to be patient, allowing their investments time to recover and grow. This perspective is crucial during distress when assets may take time to rebound.

Moreover, long-term capital can provide the flexibility to step into opportunities that others may overlook, leveraging their ability to invest with patience and discipline.

- Evaluating the Role of Alternative Investments

Alternative investments, including private equity, hedge funds, and real estate, play an increasingly vital role in family offices’ portfolios. During times of distress, these sectors may provide both a hedge against volatility and a pathway for diversification.

Investing in private equity, for instance, can be a means to tap into unique opportunities in distressed companies that would not typically be available through public markets. However, family offices must balance this with the potential liquidity constraints and time horizon of these types of investments.

Conclusion: Crafting a Resilient Investment Strategy

Navigating distress in investment markets is a complex and nuanced challenge for family offices. The dual edges of risk and reward necessitate a disciplined approach, combining a long-term perspective with active risk management strategies. By understanding the unique motivations and goals of a family office, decision-makers can better position themselves to seize opportunities while navigating potential pitfalls.

As economic landscapes continue to evolve, family offices must remain vigilant and adaptable, recognizing that distress, while fraught with risk, also opens the door to exceptional opportunities for those who are prepared and informed. In mastering this balance, family offices can not only protect and grow their wealth but also ensure it serves future generations meaningfully and sustainably.