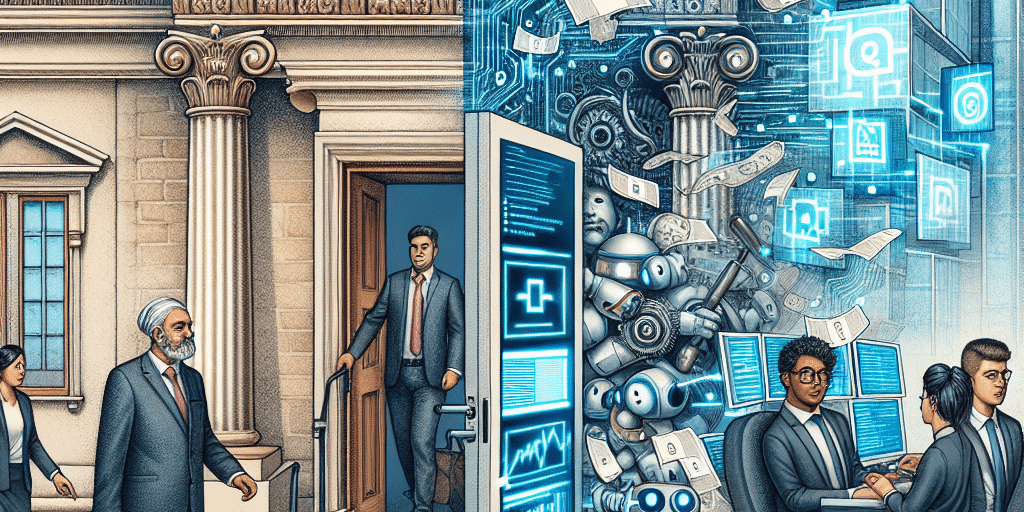

In recent years, family offices — private wealth management advisory firms that serve ultra-high-net-worth individuals and families — have faced a wave of regulatory changes that are reshaping how they operate. As governments around the world introduce new laws aimed at enhancing transparency, compliance, and accountability, family offices must adapt to these transformations to sustain their legacy and ensure effective wealth management. This article will explore the evolving regulatory landscape and its implications for family office foundations.

Understanding Family Office Foundations

Family offices are designed to provide comprehensive financial and personal services to wealthy families, often including investment management, estate planning, tax optimization, philanthropy, and even lifestyle management. They can be structured as single-family offices (serving one family) or multi-family offices (serving multiple families).

In essence, a family office foundation acts as a nexus for managing family wealth across generations, and as such, it must navigate various regulations that govern its operations.

The Rise in Regulatory Scrutiny

1. Increased Transparency Requirements

In response to global concerns about wealth inequality, tax evasion, and financial crimes, many countries have enacted regulations that necessitate greater transparency around the financial activities of family offices. For example, the implementation of initiatives like the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) aims to combat tax evasion by requiring family offices to report details about foreign assets and income.

These new requirements compel family offices to maintain meticulous records and proactively communicate with tax authorities, transforming how they manage compliance and reporting processes.

2. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Family offices are not exempt from anti-money laundering laws. As these regulations become stricter, family offices must perform in-depth due diligence on investments and clients. This involves understanding the source of funds and ensuring their investments do not inadvertently contribute to illicit activities.

To navigate these changes, family offices may need to invest in compliance infrastructure, including software solutions and trained personnel, to streamline the due diligence process and mitigate risks associated with AML/KYC compliance.

3. Data Privacy and Cybersecurity Regulations

As family offices increasingly leverage digital systems for wealth management, they also face the challenge of complying with data privacy laws. In the EU, for instance, the General Data Protection Regulation (GDPR) mandates stringent measures for handling personal data. This requires family offices to implement robust cybersecurity measures to protect sensitive family information from breaches, aligning their operations with best practices while ensuring compliance with regulations.

4. Philanthropy and Charitable Giving Guidelines

Regulatory shifts are also impacting family office foundations’ philanthropic initiatives. New guidelines surrounding charitable donations often emphasize accountability and the need to demonstrate tangible outcomes. This requires family offices to establish clear metrics for evaluating the effectiveness of their philanthropic efforts, challenging them to move beyond traditional giving models.

Strategies for Adapting to Change

As the regulatory landscape continues to evolve, family offices can adopt several strategies to navigate these changes effectively:

1. Invest in Compliance Infrastructure

To keep pace with regulatory demands, family offices should consider investing in compliance technology that can automate reporting, monitor transactions, and manage risk more efficiently. By leveraging these tools, they can reduce the burden of compliance and focus on the family’s strategic goals.

2. Enhance Education and Training

Continued education for family office staff around new regulations is essential. Regular training sessions can ensure that everyone is updated on compliance protocols, evolving laws, and best practices in data management and philanthropy.

3. Engage with External Advisors

Hiring external legal and financial advisors who specialize in navigating the regulatory landscape can provide family offices with invaluable insights and guidance. These professionals can offer expertise in specific areas and help family offices remain agile in the face of ongoing changes.

4. Implement Robust Governance Practices

Establishing a governance framework that includes best practices for decision-making, risk management, and operational transparency can enhance accountability and ensure that family offices have the right practices in place to comply with new regulations.

Conclusion

The ever-changing regulatory landscape presents both challenges and opportunities for family office foundations. As they navigate these changes, proactive adaptation will be key to ensuring compliance while continuing to fulfill their mission of protecting and growing family wealth. By embracing technology, enhancing internal capabilities, and investing in strategic partnerships, family offices can emerge more resilient and better positioned to thrive in the future.

In doing so, they not only safeguard their financial legacies but also contribute positively to the communities and causes they support, embodying a more responsible and conscientious approach to wealth management.