In recent years, the financial landscape has undergone significant transformation driven by evolving consumer protection regulations. For family offices, the implications of these changes are profound, affecting everything from investment strategies to client engagement. Understanding these regulations and their impact is critical for maintaining financial integrity while fulfilling fiduciary responsibilities.

The Rise of Consumer Protection Regulations

Consumer protection regulations have emerged as a response to growing concerns about transparency, ethical practices, and the welfare of clients in the financial services sector. Governments and regulatory bodies worldwide have instituted measures designed to safeguard consumers, ensuring they have access to accurate information, fair treatment, and adequate redress mechanisms.

Key Regulations Influencing Family Offices

-

Fiduciary Standards: Regulations mandating fiduciary responsibility require family offices to act in the best interests of their clients. This shift ensures that family offices prioritize long-term client welfare over short-term gains.

-

Disclosure Requirements: Stricter requirements for disclosure of fees, potential conflicts of interest, and risks associated with investments are reshaping how family offices communicate with clients. Transparency has become a cornerstone of client relations, fostering trust and accountability.

-

Data Protection Laws: The implementation of laws such as the General Data Protection Regulation (GDPR) in Europe has heightened the focus on data privacy and protection. Family offices must invest in robust compliance mechanisms to protect sensitive client information.

-

Investment Suitability Standards: Regulations mandating that firms ensure investment products are suitable for clients have led family offices to adopt more rigorous client profiling and due diligence processes.

The Impact on Family Office Operations

As these regulations take hold, family offices must adapt their operations to remain compliant while also meeting client expectations. Here are some of the key areas undergoing transformation:

1. Enhanced Transparency

Family offices are transitioning toward more transparent operations. This includes clearer communication around fees and performance metrics, which not only complies with regulations but also builds trust with clients. Regular performance reports, comprehensive disclosure of investment strategies, and open discussions around potential conflicts of interest have become essential.

2. Emphasis on Education and Advocacy

With increased regulatory scrutiny, educating clients about their investments is now a top priority. Family offices are investing in educational resources, workshops, and one-on-one sessions to inform clients about market conditions, investment options, and risks. This proactive engagement not only aids compliance but also empowers clients to make informed decisions.

3. Rigorous Compliance Frameworks

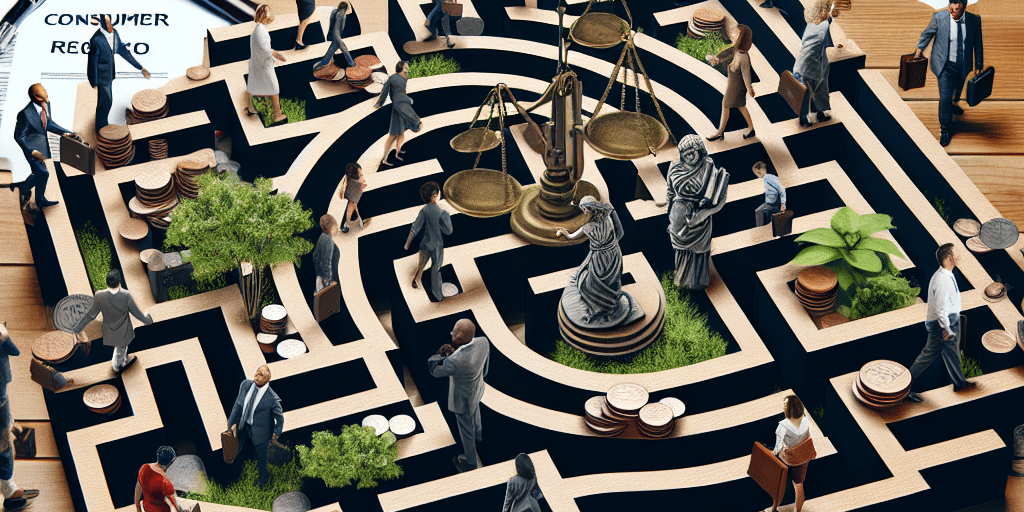

To navigate the complex maze of consumer protection regulations, family offices are establishing more robust compliance frameworks. This includes hiring compliance officers, creating internal audit teams, and employing advanced monitoring tools to assess adherence to regulatory requirements. The need for a holistic compliance culture is paramount in a landscape where regulatory breaches can have severe consequences.

4. Technological Integration

Advancements in technology are helping family offices streamline compliance efforts. Automation tools for document management, risk assessment, and client communication have become crucial for maintaining regulatory standards. Data analytics can provide insights into clients’ needs and behaviors, allowing family offices to align their services accordingly, enhancing both compliance and client satisfaction.

Navigating Challenges and Opportunities

While regulatory changes may present challenges, they also offer opportunities for family offices to distinguish themselves in a competitive landscape. By embracing a culture of compliance and transparency, family offices can strengthen relationships with clients, enhance their reputations, and potentially attract new business.

Building Stronger Client Relationships

Adapting to a new regulatory environment may initially seem burdensome, but it allows family offices to develop stronger, more trust-based relationships with their clients. Increased transparency and communication foster loyalty and can lead to long-term partnerships that benefit both parties.

Adopting a Proactive Approach

Family offices that take a proactive stance towards compliance will be better positioned to navigate regulatory changes. This involves not just meeting the minimum requirements but actively seeking to exceed standards, thereby enhancing their service offerings and client satisfaction.

Conclusion

Navigating the evolving landscape of consumer protection regulations presents both challenges and opportunities for family offices. By embracing transparency, investing in education, establishing robust compliance frameworks, and leveraging technology, family offices can not only comply with these regulations but also build stronger relationships with their clients. As the financial ecosystem continues to evolve, those family offices that adapt effectively will position themselves as leaders in the sector, ensuring they thrive amidst change.