How Family Offices Navigate Private Auctions for Collectors

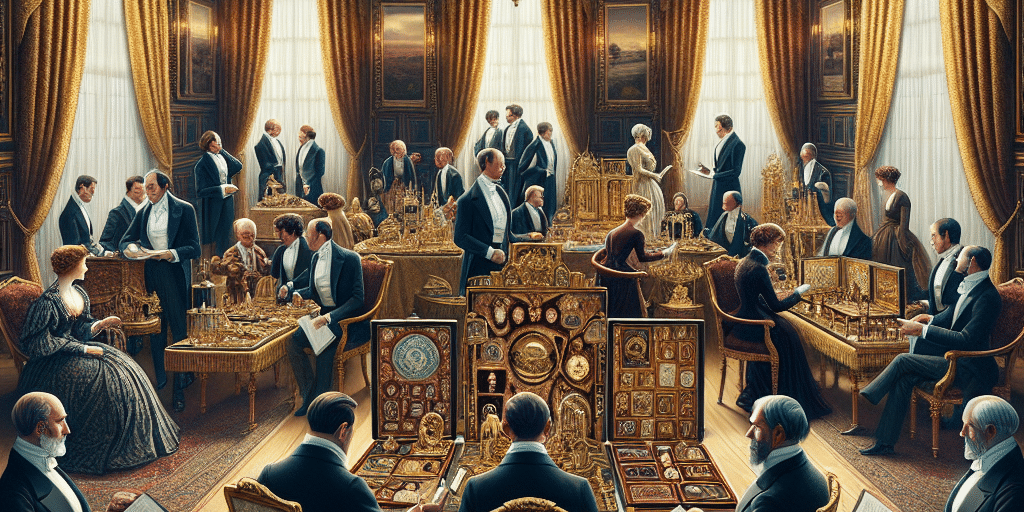

The world of wealth is often marked by exclusivity, sophistication, and a deeply nuanced understanding of the art and collectible markets. Family offices—privately held companies that manage investments and trusts for ultra-high-net-worth families—play a pivotal role in acquiring rare assets at private auctions. This article delves into how these offices operate within the intricate landscape of private auctions, catering to the unique needs of their clients.

1. Understanding Family Offices

A family office is essentially a wealth management advisory firm that serves affluent clients. Its primary goals are to manage investment portfolios, cultivate financial strategies, and facilitate the acquisition of luxury items and collectibles—such as art, antiques, and rare automobiles.

2. The Appeal of Private Auctions

Private auctions offer several benefits that attract family offices:

- Exclusivity: Often limited to invite-only participants, these auctions ensure a private environment that caters to serious collectors.

- Access to Rare Items: Private auctions frequently feature unique items that aren’t available in the general market, adding significant value to collectors.

- Discretion: High-net-worth individuals often prefer to keep their purchases confidential, a preference easily accommodated at private auctions.

3. Navigating the Auction Landscape

Family offices employ various strategies to successfully navigate private auctions:

- Expert Consultation: They typically hire experts in specific fields—art historians, antique specialists, or car enthusiasts—who can provide critical insights into the value and authenticity of items.

- Due Diligence: Extensive research is conducted to establish provenance and ensure investment integrity. This includes verifying the item’s history, condition, and current market trends.

- Networking: Building relationships with auction houses, dealers, and other collectors can provide an edge in securing desirable items before they hit the auction block.

- Bidding Strategies: Family offices often develop clear bidding strategies to stay competitive while adhering to their budgetary constraints.

4. Challenges in Private Auctions

Despite the many benefits, navigating private auctions comes with challenges:

- Emotion vs. Logic: The passion for collecting can sometimes cloud judgment, leading to overbidding.

- Market Volatility: The art and collectibles market can fluctuate dramatically, impacting future valuations.

- Legal and Tax Implications: Understanding the legal documentation and tax responsibilities associated with high-value purchases is crucial.

5. The Future of Collecting in Family Offices

As global wealth continues to rise and collectors become more sophisticated, family offices will need to adapt their strategies. The integration of technology, including online bidding and data analytics, is likely to reshape the future landscape of private auctions.

In conclusion, the world of private auctions offers a fascinating glimpse into the intersection of wealth and passion. For family offices, successfully navigating this environment calls for a combination of expertise, strategy, and a keen understanding of both financial and emotional factors. As these offices continue to evolve, so too will their approach to acquiring the unique treasures that define their clients’ legacies.