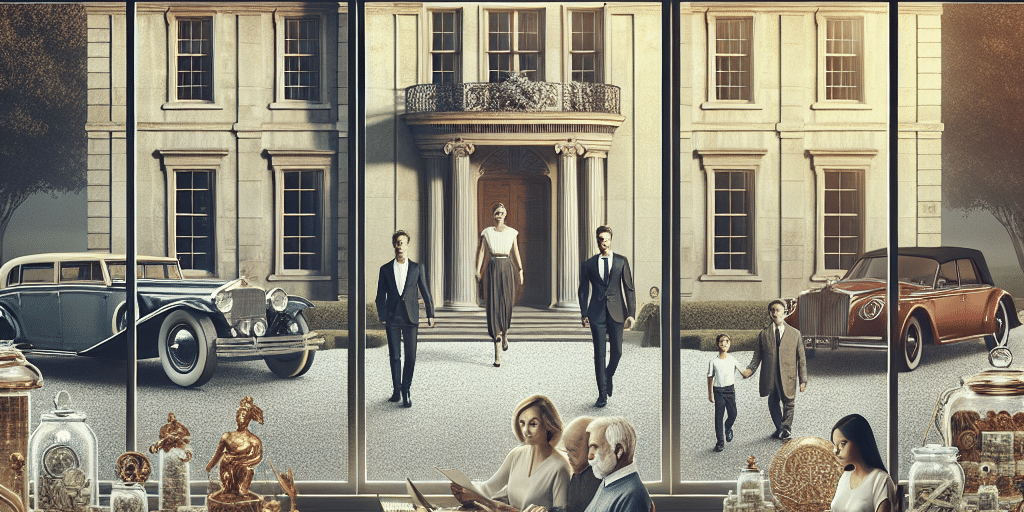

In an era where financial landscapes are increasingly complex and dynamic, family offices have emerged as essential guardians of wealth, focusing on preserving and enhancing multi-generational luxury assets. These private investment firms, established by affluent families, offer tailored solutions for a range of financial and lifestyle needs, ensuring that both tangible and intangible assets remain intact for future generations.

The Role of Family Offices

Family offices serve to manage an affluent family’s wealth holistically. Beyond traditional investment strategies, they encompass estate planning, tax optimization, philanthropy, and family governance, maintaining not only financial health but also family legacy. With the global luxury market reaching unprecedented heights, the preservation of luxury assets—be it fine art, real estate, vintage automobiles, or yachts—has become a pivotal aspect of wealth management.

Understanding Luxury Assets

Luxury assets represent not just financial value but also cultural and emotional significance. These can include:

- Art Collections: Masterpieces from renowned artists often appreciate significantly over time, but they require careful management to preserve both value and condition.

- Real Estate: High-end properties in prime locations serve both as investments and family retreats, necessitating ongoing maintenance and strategic enhancements.

- Classic Vehicles and Yachts: These assets need specialized care to ensure they don’t just retain value but also continue to be enjoyed by future generations.

Strategies for Preservation

Family offices adopt various strategies to effectively manage and preserve luxury assets:

1. Expert Valuation and Appraisal

Regular assessments of luxury assets are crucial, allowing family offices to understand current market trends. Expert valuations provide insights into the financial worth of collections, ensuring families can make informed decisions about selling, investing, or simply holding onto their assets.

2. Comprehensive Risk Management

Multi-generational wealth faces numerous risks, including market fluctuations, theft, and damage. Family offices implement comprehensive insurance solutions and physical security measures for luxury items, such as climate-controlled storage for art and current safety protocols for high-value vehicles and properties.

3. Cultural Stewardship

Beyond financial considerations, many families view their luxury assets as cultural artifacts. Family offices often involve family members in the stewardship process, educating them about the historical context and significance of their collections. This approach fosters a deeper connection and sense of responsibility towards luxury assets.

4. Engaging in Philanthropy

Many wealthy families engage in philanthropic initiatives, especially using their luxury assets. They may lend art pieces to museums or provide access to their properties for charity events. This not only preserves the assets but also enhances the family’s social responsibility and public image.

5. Education and Governance

Family governance structures, such as family councils or governance frameworks, are crucial to ensuring that all members understand the value of their assets. By creating educational programs about investment strategies, asset management, and the importance of preserving these luxury items, family offices facilitate better decision-making for the future.

The Challenges Ahead

Though family offices are adept at guarding wealth, they face challenges such as evolving market dynamics and shifting family values. Next-gen family members may have different interests, pushing for diversification or even liquidation of certain assets. Thus, adaptability and open communication become vital.

Conclusion

As the custodians of generational wealth, family offices play a critical role in preserving luxury assets across generations. Through strategic planning, education, risk management, and philanthropic engagement, families can ensure their treasures and heirlooms endure, reflecting both their financial acumen and cultural heritage. In a world where wealth can swiftly dissipate, family offices stand as a testament to the enduring power of legacy, acting as diligent guardians of luxury.