In an era where climate change, sustainability, and environmental responsibility have become critical concerns, family offices are increasingly seeking ways to align their investment strategies with their values. Green investments, particularly in sustainable real estate, have emerged as a pivotal area for family offices looking to participate in the global transition to a more sustainable future. This guide aims to demystify sustainable real estate investing for family offices, exploring the opportunities, benefits, challenges, and strategies involved.

Understanding Sustainable Real Estate

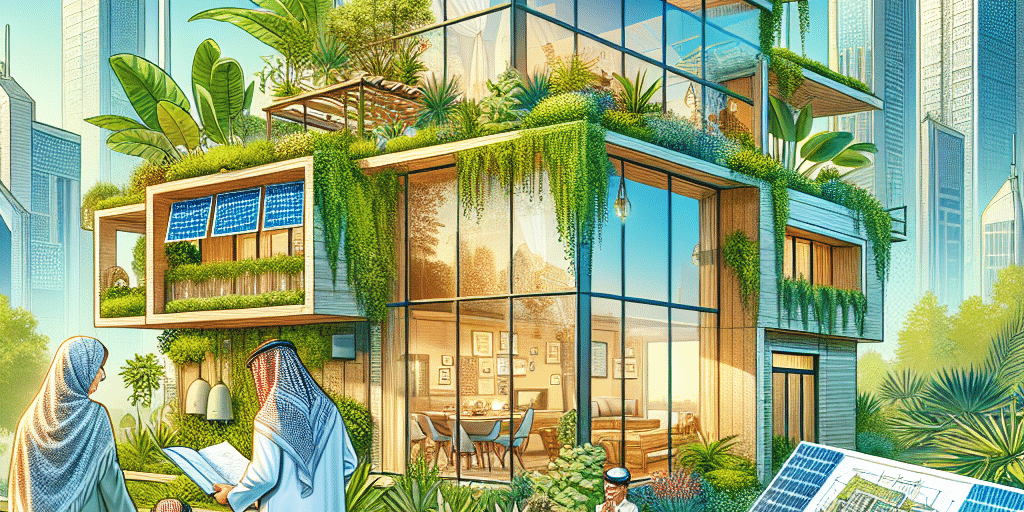

Sustainable real estate refers to properties that are designed, built, operated, and maintained in compliance with environmentally friendly practices. This includes the use of energy-efficient systems, sustainable building materials, and technologies aimed at reducing a property’s ecological footprint. Examples of these include green leases, renewable energy installations, rainwater harvesting systems, and building designs that promote natural lighting and ventilation.

Key Trends in Sustainable Real Estate

Rising Demand for Green Spaces: As urban areas continue to expand, there is an increasing demand for properties that offer greenery and promote biodiversity, which can enhance the quality of life for residents and contribute to ecosystem health.

Regulatory Changes: Governments worldwide are implementing stricter regulations and incentives aimed at reducing carbon emissions and enhancing sustainable practices in real estate development. Family offices should stay updated on local laws and guidelines to leverage potential tax benefits.

Innovative Financing Solutions: Green bonds, green mortgages, and impact investment funds specifically targeting sustainable real estate are becoming more accessible. Family offices can explore various financing options that align with their sustainable investment goals.

- Technological Advancements: Proptech and smart building technologies allow for enhanced energy efficiency and effective property management, making sustainable investments more viable and profitable.

Benefits of Investing in Sustainable Real Estate

Long-Term Financial Performance: Studies have shown that sustainable buildings can outperform their traditional counterparts in terms of occupancy and rental rates and may have lower operational costs due to energy efficiency.

Enhanced Resilience: Properties designed with sustainability in mind are often more resilient to climate-related risks such as floods and extreme weather, mitigating potential losses and increasing property longevity.

Attracting Investors and Tenants: An increasing number of investors and tenants are prioritizing sustainability. Properties with green certifications or sustainable features are often more attractive, leading to higher demand and tenant retention.

- Positive Brand Image and Legacy: For family offices, investing in sustainable real estate can enhance their reputation and legacy, demonstrating a commitment to responsible investing and environmental stewardship.

Challenges to Consider

Higher Initial Costs: While sustainable properties can lead to long-term savings, they often come with higher upfront costs. Family offices must carefully evaluate their investment capacity and financial strategy.

Market Maturity: The sustainable real estate market is still in a maturation phase. Family offices need to conduct thorough research and due diligence to identify the right opportunities, tenants, and locations.

Technical Knowledge: Understanding best practices in sustainable building techniques and technologies is vital. Engaging in partnerships with experienced developers or consultants can bridge this knowledge gap.

- Measuring Impact: Quantifying the social and environmental impact of investments can be challenging. Family offices should establish clear metrics and frameworks to evaluate their sustainability goals and compliance.

Strategies for Family Offices

Conduct Comprehensive Market Research: Understanding local markets, regulations, and sustainability trends is crucial. Family offices should prioritize research and engagement with industry experts.

Diverse Investment Portfolio: Consider diversifying investments within sustainable real estate, including residential, commercial, or mixed-use properties, to spread risk and enhance potential returns.

Leverage Partnerships: Partner with experienced developers, sustainability consultants, and like-minded investors to harness knowledge, experience, and resources effectively.

Implement ESG Frameworks: Develop and adhere to environmental, social, and governance (ESG) criteria in the investment process to ensure alignment of values and objectives with family goals.

- Invest in Continuous Education: Stay informed about new technologies, regulations, and best practices in sustainable real estate. Regular attendance at industry conferences, webinars, and workshops is beneficial.

Conclusion

Green investments in sustainable real estate present a unique opportunity for family offices to make a positive impact while achieving financial returns. By embracing sustainable practices, family offices can not only enhance their wealth but also contribute to a healthier planet for future generations. With strategic planning, thorough research, and a commitment to sustainability, family offices can successfully navigate the complexities of this evolving investment landscape and establish a legacy that reflects their values.