Family Offices: The New Frontier in Seed-Stage Venture Capital

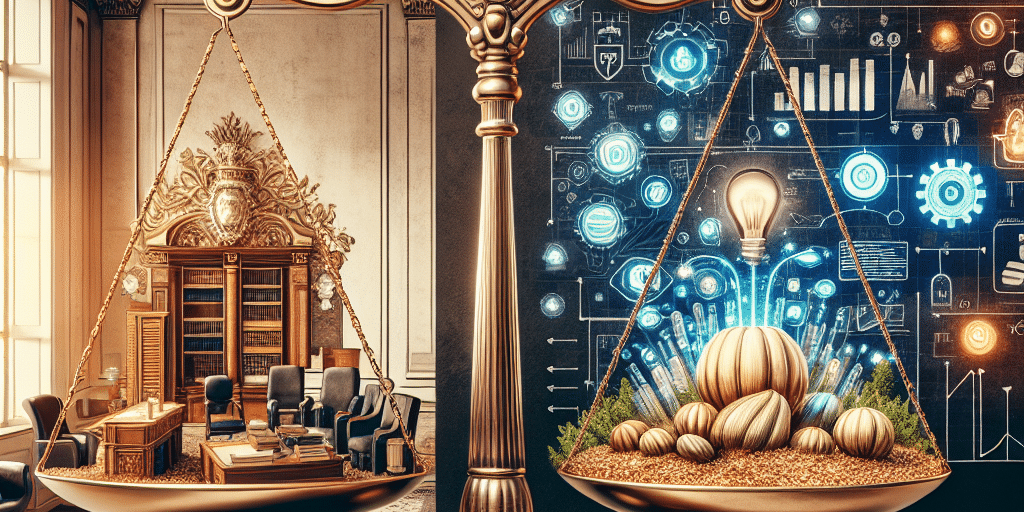

In recent years, a significant shift has occurred in the landscape of venture capital, particularly in the seed-stage funding sector. Family offices, traditionally established for wealth management and preservation, are now emerging as influential players in startup financing. This article explores how family offices are revolutionizing seed-stage venture capital, driving innovation, and reshaping the entrepreneurial ecosystem.

The Rise of Family Offices

Family offices, which manage investments for high-net-worth families, have existed for centuries but have gained unprecedented attention in the past decade. Unlike traditional venture capital firms, family offices adopt a more holistic approach to investment, focusing not only on financial returns but also on aligning their investments with their values and long-term objectives. As wealth continues to concentrate among the ultra-rich, the rise of family offices is both a symptom and a catalyst of this economic trend.

An Appetite for Innovation

Family offices are initially drawn to seed-stage investments for several reasons:

Potential for High Returns: Early-stage investing offers the possibility of outsized returns if a startup becomes successful. Family offices, no longer bound by the rigid structures of institutional funds, can take calculated risks aligned with their financial goals.

Strategic Alignment: Many family offices prioritize investing in sectors that resonate with their values, such as sustainability, health tech, or education. This alignment not only benefits the family financially but also supports causes they are passionate about.

Direct Engagement with Founders: Family offices often involve family members directly in the investment process. This engagement creates opportunities for mentorship, fostering relationships with entrepreneurs, and cultivating an ecosystem of innovation.

Long-Term Vision: Unlike traditional VC firms that may have a fixed fund lifecycle, family offices can invest with a longer time horizon. This stability allows them to nurture startups through initial challenges, positioning themselves as partners rather than just financiers.

Challenges and Opportunities

While family offices present a new source of capital for seed-stage ventures, they also face unique challenges:

Lack of Experience: Many family offices are new to the venture capital space and may lack the expertise to navigate the intricacies of startup investments. Building internal capabilities or partnering with seasoned advisors can help mitigate this risk.

Limited Network: Established venture funds often benefit from extensive networks that facilitate deal sourcing and due diligence. Family offices must actively work to cultivate relationships within the entrepreneurial ecosystem to identify promising opportunities.

Navigating Co-Investment Dynamics: Collaborating with other investors can be beneficial, but family offices must be careful about decision-making dynamics and alignment of interests.

Despite these challenges, the opportunities for family offices in the seed-stage venture landscape are vast. As they develop their investment strategies, family offices are increasingly leveraging data analytics, networking events, and sector expertise to refine their approaches.

Case Studies: Successful Family Office Investments

Several family offices have gained attention for their successful seed-stage investments:

The Pritzker Family: Known for their involvement in the Pritzker Group, this family office has invested in a range of startups, including successful exits like Sweetgreen and Boxed. Their approach melds financial insight with sector expertise.

The Walton Family: Leveraging their retail legacy, the Walton Family Foundation has invested heavily in tech startups that align with their goals of improving education. Their investments in companies like EverFi reflect a commitment not only to financial returns but also to societal impact.

The Chan Zuckerberg Initiative: Though primarily a philanthropic entity, their venture arm actively invests in innovative technologies and education-focused startups, providing insights and capital to entrepreneurs pushing the boundaries of their fields.

The Future of Family Offices in Venture Capital

As the venture capital landscape continues to evolve, family offices are poised to become central players in seed-stage investing. Their unique blend of capital, commitment to values, and long-term vision offers a refreshing counterpoint to traditional venture capital firms. As they gain experience and refine their strategies, family offices can help create a more diverse, innovative, and resilient entrepreneurial ecosystem.

In conclusion, family offices are more than just a new source of capital; they represent a transformational force in seed-stage venture capital. By embracing their role as both investors and mentors, family offices can foster innovation that aligns with their values, yielding returns that go beyond the financial—returning to community and society at large. As this trend continues, the startup landscape could see an influx of innovative ideas and solutions that address some of our most pressing challenges.