Empowering Generosity: How Donor-Advised Funds Transform Family Office Philanthropy

In an era marked by increasing wealth inequality and urgent social challenges, philanthropy has emerged as a significant force for positive change. Among the myriad of charitable giving mechanisms available, donor-advised funds (DAFs) have risen in prominence, particularly within family offices—private wealth management advisory firms that serve ultra-high-net-worth families. These funds are not just financial vehicles; they represent a profound shift in how affluent families approach philanthropy, allowing for greater flexibility, engagement, and impact.

Understanding Donor-Advised Funds

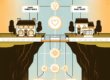

A donor-advised fund is a charitable giving account that offers donors a wide range of benefits. Once a donor contributes assets to a DAF, they can receive an immediate tax deduction and retain the ability to recommend grants to specific charities over time. This unique structure offers a blend of philanthropy and investment, allowing families to grow their contributions while retaining advisory control over their charitable distributions.

DAFs are administered by public charities, enabling donors to remain engaged in decision-making processes without the complexities of running private foundations. This model opens the door to exploring a diverse range of charitable causes, as donors can align their giving philosophies with their family values, legacy, and interests.

The Transformative Impact of DAFs on Family Office Philanthropy

-

Simplified Giving Process: Traditional philanthropy often involves significant administrative burdens, from compliance to record-keeping. DAFs streamline this process, allowing family offices to focus on impact rather than the complexities of philanthropic management. This simplification saves time and helps family members engage in the philanthropic mission more directly, strengthening their commitment to their chosen causes.

-

Enhanced Family Engagement: One of the critical challenges for family offices is fostering a sense of shared purpose among family members. DAFs encourage collaborative decision-making, serving as a platform for family discussions on values, priorities, and preferred causes. Family members can participate in grant recommendations, create philanthropic strategies together, and even involve the next generation in learning about philanthropy. This engagement can instill a sense of responsibility and stewardship among younger family members, ensuring the family’s philanthropic legacy continues.

-

Flexibility in Giving: The structure of DAFs allows for flexibility that many traditional giving methods cannot match. Donors can contribute assets during peak earning years, secure immediate tax advantages, and distribute grants when opportunities arise. This flexibility allows families to respond to emerging needs and crises, making philanthropic efforts more dynamic and impactful.

-

Strategic Investment in Change: DAFs are not just about immediate giving; they can also support strategic investment in systemic change. Family offices can utilize DAF assets to fund innovative solutions, pilot programs, or ventures that align with their philanthropic mission. This long-term perspective can catalyze significant social impact, fostering sustained change rather than temporary relief.

-

Leveraging Knowledge and Networks: Many family offices prioritize relationships and connections within their philanthropic missions. DAFs often provide access to networks of grantmakers, nonprofit leaders, and thought leaders. These networks can enhance a family’s ability to understand the landscape of their chosen causes, thereby making more informed grant-making decisions. Leveraging collective knowledge can lead to smarter, more strategic investments in social impact.

- Confidentiality and Control: For families that value privacy, DAFs offer a way to engage in philanthropy without the public scrutiny that often comes with private foundations. Families can maintain control over their giving and streamline their philanthropic efforts while deciding when and how to publicly disclose their contributions. This discretion can appeal to families who prefer to maintain a low profile regarding their philanthropic activities.

Navigating Challenges and Maximizing Impact

While donor-advised funds offer numerous advantages, family offices must navigate some challenges. The time commitment required for meaningful philanthropy shouldn’t be underestimated, and families may need to create structures or employ advisors to guide their philanthropic initiatives effectively. Additionally, the allure of DAFs can sometimes lead to prolonged periods of inactivity, with funds sitting idle rather than being distributed. Families need to establish clear objectives and timelines for their giving to ensure that the funds are actively contributing to their intended causes.

Conclusion: A Path Forward for Family Offices

As the world grapples with complex challenges, the role of philanthropy is more vital than ever. Donor-advised funds present a transformative tool for family offices, enabling them to empower generosity and foster a culture of giving within their ecosystems. By embracing DAFs, affluent families can create lasting impact, build intergenerational connections, and ensure their philanthropic legacy resonates far beyond their years. In doing so, they not only address immediate needs but also invest in a more equitable future for all.