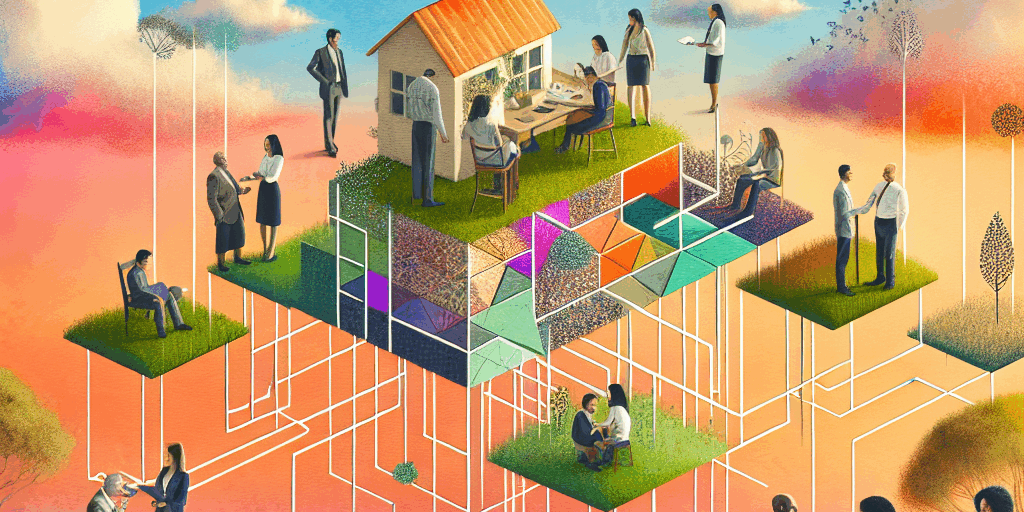

In an increasingly complex financial landscape, the importance of having a reliable network of trusted advisors for family offices cannot be overstated. As family wealth grows, so do the demands for expertise in areas such as investments, legal matters, philanthropy, and succession planning. A well-rounded advisory network can bolster decision-making, provide tailored insights, and ultimately ensure the longevity of your family legacy. Here’s how to cultivate connections and build a robust network of advisors for your family office.

Understanding the Role of Advisors

Before diving into networking strategies, it’s crucial to understand the different types of advisors that may benefit your family office:

-

Investment Advisors: They offer expertise in portfolio management, asset allocation, and investment strategies tailored to the family’s financial goals.

-

Legal Advisors: These professionals provide insights on trust and estate planning, tax strategies, and compliance with relevant laws and regulations.

-

Tax Advisors: They help navigate the complexities of tax issues, optimizing tax efficiency across various income streams.

-

Philanthropic Advisors: For families interested in giving back, these advisors guide charitable giving strategies, helping align philanthropy with the family’s values and objectives.

-

Insurance Consultants: They assess risk management and ensure that the family’s assets are adequately protected.

-

Real Estate Advisors: For families with significant real estate holdings, these experts provide insights on property investment, management, and development.

Building Your Network

1. Identify Your Needs

Begin by conducting a thorough assessment of your family’s needs and objectives. Determine which areas require specialization. Are you looking for growth in investments, succession planning, or charitable giving? Establishing a clear vision will guide you in selecting the right advisors.

2. Leverage Existing Connections

Use your current network as a foundation. Many professionals can recommend reputable advisors in various fields. Speak to trusted family members, friends, or business associates to gather referrals. Additionally, consider attending industry events or conferences, where you can meet potential advisors in person.

3. Conduct Thorough Research

Once you have a list of potential advisors, conduct due diligence. Research their backgrounds, qualifications, and areas of expertise. Look for advisors with a proven track record and positive client testimonials. Use professional networks like LinkedIn to assess their online reputation and activity within relevant groups.

4. Prioritize Compatibility

Beyond expertise, compatibility is paramount. A successful advisor-client relationship hinges on mutual trust and understanding. Schedule informal meetings or coffee chats with prospective advisors to gauge personality, communication styles, and alignment of values.

5. Establish Long-Term Relationships

Great advisors are not just hired guns but partners in your family’s financial journey. Invest time in nurturing these relationships. Schedule regular check-ins, share family updates, and be transparent about goals and challenges. Building a personal rapport creates a foundation of trust.

6. Encourage Collaboration

Foster an environment where your advisors can collaborate. Encourage them to communicate among themselves, sharing insights that may benefit your family’s strategy. A cohesive advisory team can provide comprehensive solutions tailored to your unique situation.

7. Regularly Review Your Network

As your family’s needs evolve, so should your advisory network. Schedule periodic evaluations of your advisors to ensure they continue to align with your goals. Be open to making changes if necessary—in the world of family office management, adaptability is key.

8. Cultivate a Culture of Education

Encourage knowledge sharing not just among the advisors but also within the family. Regularly organize workshops, seminars, or discussions with your advisors to educate family members about financial literacy, investment strategies, and philanthropic opportunities. This not only strengthens family engagement but also empowers members to make informed decisions.

Conclusion

Cultivating connections and building a network of trusted advisors is an essential component for any family office. A dedicated team of experts can navigate complexities, mitigate risks, and ensure that your family’s legacy is preserved for future generations. By prioritizing relationships built on trust, transparency, and collaboration, families can not only enhance their wealth but also create a united front capable of achieving their long-term objectives. In a world where change is the only constant, a strong network of advisors will prove invaluable in navigating the journey ahead.