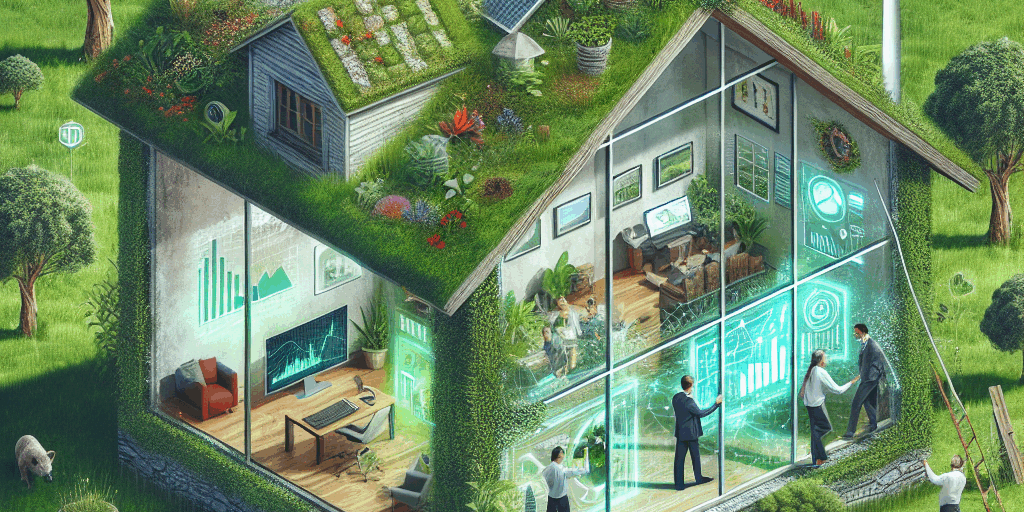

As global awareness of climate change and environmental degradation increases, family offices are uniquely positioned to lead the charge in sustainable real estate investing. This approach not only addresses pressing environmental issues but also offers a variety of financial and reputational benefits. This article explores the imperative for family offices to embrace sustainable real estate investment strategies.

The Rise of Sustainable Investing

In recent years, the concept of sustainable investing has gained significant traction. Defined as investing with consideration for environmental, social, and governance (ESG) factors, sustainable investing encourages investors to look beyond traditional financial metrics. Family offices, which manage the wealth and investments of affluent families, have an opportunity to play a crucial role in this transformation.

Benefits of Sustainable Real Estate Investing

1. Financial Performance

Studies show that sustainability-focused real estate investments often exhibit superior financial performance. Energy-efficient buildings generally have lower operating costs and higher occupancy rates, leading to enhanced returns over time. Furthermore, sustainable properties tend to attract premium rents, appealing to environmentally conscious tenants.

2. Risk Mitigation

Investing in sustainable real estate helps mitigate risks associated with climate change and regulatory changes. Properties that do not adhere to sustainability standards may face devaluation as regulations tighten, making it essential for family offices to invest in compliant, forward-thinking developments.

3. Enhanced Reputation

For family offices, reputation is critical. By investing in sustainable real estate, families can enhance their public image and show commitment to corporate social responsibility. This not only strengthens relationships with clients and stakeholders but also makes a lasting impact on future generations.

Strategies for Sustainable Real Estate Investing

Family offices can adopt various strategies to integrate sustainability into their real estate portfolios:

1. Green Building Certifications

Pursuing buildings that have certifications such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method) ensures adherence to high sustainability standards.

2. Energy Efficiency Retrofits

Investing in retrofitting existing properties with energy-efficient technologies not only reduces carbon footprints but also improves long-term value.

3. Community Engagement

Investing in developments that promote community well-being can significantly impact social responsibility. Family offices can support projects that provide affordable housing, sustainable transportation, and green spaces.

Conclusion

Building a greener future through sustainable real estate investing is not only an ethical choice but also a financially sound strategy for family offices. By aligning their investments with sustainable principles, family offices can safeguard their wealth, mitigate risks, and enhance their societal reputation. As stewards of both financial and environmental capital, family offices have a unique opportunity to shape the future.

For more information on sustainable real estate investing, visit Sustainable Investment Forum.