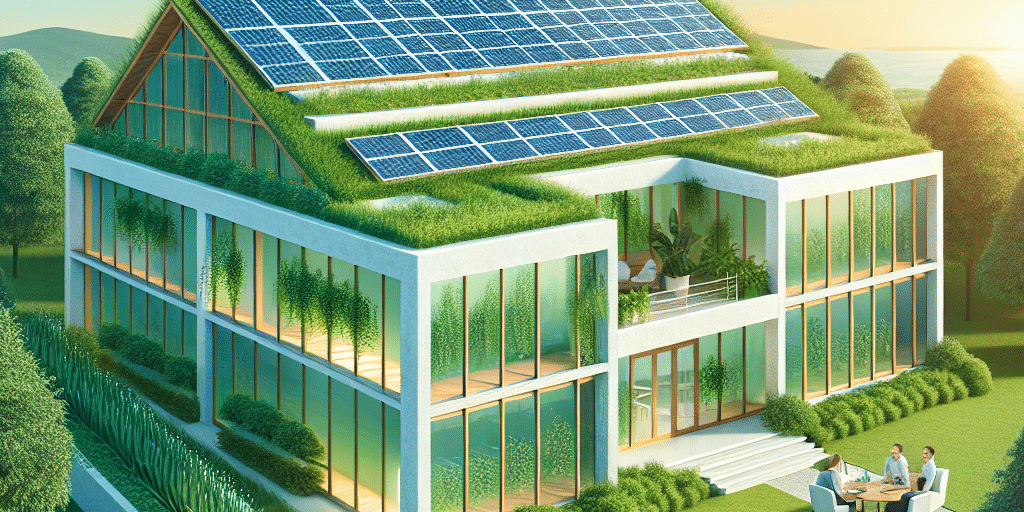

Building a Greener Future: How Family Offices Can Capitalize on Sustainable Real Estate Investments

As the world grapples with the urgent challenges of climate change, resource depletion, and social inequality, the conversation around sustainable investment has never been more timely. Family offices—private wealth management advisory firms serving high-net-worth families—are uniquely positioned to play a pivotal role in this transition. By prioritizing sustainable real estate investments, these entities can not only generate solid financial returns but also contribute to a greener future.

The Case for Sustainable Real Estate

The global real estate market is one of the largest sectors for greenhouse gas emissions, accounting for nearly 40% of energy-related emissions according to the Global Alliance for Buildings and Construction. However, the sustainability movement presents both a challenge and an opportunity for family offices.

Investing in sustainable real estate aligns with several key trends:

Regulatory Pressure: Governments around the world are increasingly implementing regulations aimed at reducing carbon footprints. Properties that meet these standards will likely have a competitive advantage, making them more valuable over time.

Market Demand: There is a growing demand for sustainable living among consumers. A report from the National Association of Realtors indicates that a significant percentage of homebuyers are willing to pay more for green features. Sustainable properties often attract higher occupancy rates and, subsequently, increased rental income.

Long-term Cost Savings: Energy-efficient buildings typically incur lower operating costs due to reduced utilities and maintenance expenses. This translates into better cash flow and profitability for investors.

- Positive Environmental Impact: Through sustainable projects, family offices can contribute to a resilient future, enhancing community well-being and preserving environmental resources for generations to come.

Strategies for Family Offices

To capitalize on sustainable real estate investments, family offices can adopt several strategies:

Incorporate ESG Criteria: Environmental, Social, and Governance (ESG) criteria are essential for evaluating investment opportunities. Family offices should assess potential real estate investments based on their sustainability features, including energy efficiency, sustainable materials, and water conservation systems.

Engage with Industry Experts: Partnering with specialists in sustainable architecture, green building certification (like LEED or BREEAM), and sustainable construction practices can streamline the investment process and ensure compliance with environmental standards.

Diversification within Sustainable Sectors: Family offices can diversify their portfolios by investing in various types of sustainable properties—residential, commercial, industrial, or mixed-use developments. They should look for opportunities in emerging markets as these regions often have less saturated sustainable real estate options.

Invest in Sustainable Technology: Beyond traditional real estate investments, family offices can also explore opportunities in technologies related to sustainable building practices. This includes smart home technologies, renewable energy solutions, and energy-efficient materials.

Pursue Impact Investing: Consider investments that aim for measurable social impact alongside financial returns. This could include affordable housing projects that utilize sustainable building techniques to create eco-friendly, affordable housing for marginalized communities.

- Leverage Tax Incentives: Many governments offer tax incentives and programs encouraging sustainable development. Family offices should stay informed about available rebates, credits, and grants related to green building practices.

Challenges to Consider

While the potential is immense, it is essential to recognize the challenges family offices might face in sustainable real estate investments:

Higher Initial Costs: Sustainable construction practices can be more expensive upfront. Family offices must assess their ability to absorb these costs until the long-term benefits materialize.

Market Familiarity: A lack of familiarity with the green real estate market might hinder effective investment. Education and guidance from sustainability experts can help mitigate this issue.

- Tangible Impact Measurement: Measuring the true environmental and social impacts of investments can be complex but is critical for demonstrating success to stakeholders.

Conclusion

As the world transitions toward a more sustainable future, family offices have a unique opportunity to capitalize on the growing trend of sustainable real estate investments. By integrating sustainable practices into their investment philosophies, family offices can not only achieve compelling financial returns but also play a fundamental role in shaping a more sustainable world.

Investing sustainably does not merely serve family wealth; it holds the potential to preserve the planet’s resources for future generations. Embracing these strategies not only positions family offices as leaders in sustainable investment but also as stewards of a greener future.