Introduction

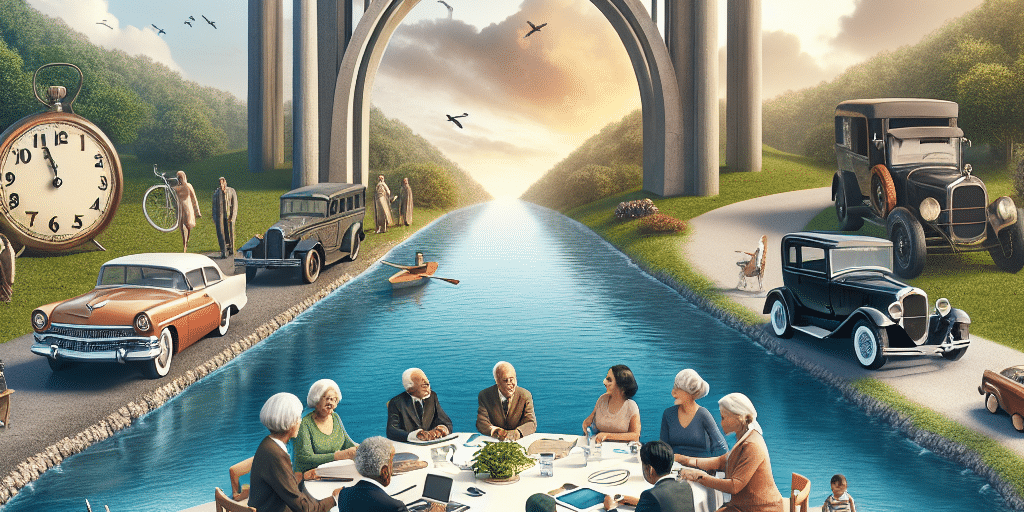

In today’s rapidly evolving world, family offices are faced with the daunting task of managing wealth across multiple generations. Bridging the generational gap is crucial for sustaining family harmony, shared values, and cohesive decision-making. This article explores effective strategies for fostering understanding and collaboration among family members of different age groups.

Understand Each Generation’s Perspective

Each generation has unique experiences, values, and attitudes towards wealth management. Understanding these differences is the first step in bridging the gap:

- Traditionalists (Born 1928-1945): Value frugality, stability, and long-term planning.

- Baby Boomers (Born 1946-1964): Focus on hard work, success, and enjoying the fruits of their labor.

- Generation X (Born 1965-1980): Value independence and may prioritize experiences over material wealth.

- Millennials (Born 1981-1996): Emphasize social impact, collaboration, and technology as part of wealth management.

- Generation Z (Born 1997-2012): Digital natives who prioritize authenticity and global connectivity.

Facilitate Open Communication

Encouraging transparent and respectful dialogue is essential. Here are some ways to achieve it:

- Hold regular family meetings to discuss financial and family matters.

- Encourage each member to share their thoughts and concerns.

- Create a safe space for younger generations to voice their ideas and innovations.

Establish Mutually Agreeable Goals

It is vital for family members to align their objectives. This can lead to enhanced teamwork and collaboration:

- Engage in discussions that highlight shared goals, such as philanthropic efforts or investment strategies.

- Prioritize family values and ensure that decisions reflect those values.

Encourage Mentorship and Knowledge Sharing

Establishing a mentorship program within the family can provide younger members with valuable insights:

- Pair younger family members with older mentors to share wisdom and experience.

- Host educational workshops focused on topics relevant to wealth management and family values.

Leverage Technology

As digital natives, younger generations are comfortable with technology. Utilize this to the family’s advantage:

- Use digital platforms for collaboration and communication.

- Introduce apps that track family investments and shared goals.

Conclusion

Bridging the generational gap requires ongoing effort, understanding, and collaboration. By implementing these strategies, family offices can promote harmony and ensure a shared vision for future generations. This not only protects the family wealth but also strengthens familial ties and legacy.