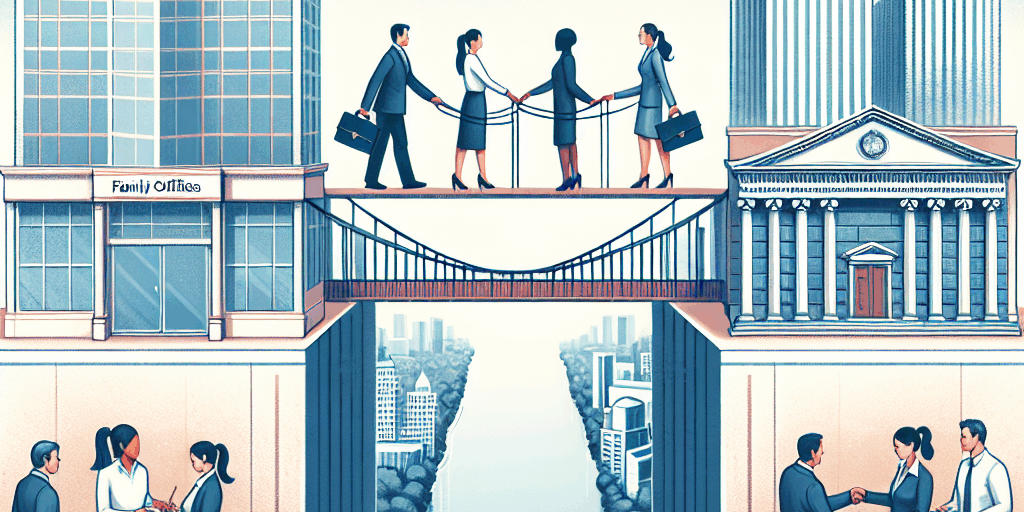

In the ever-evolving landscape of wealth management, family offices and private banks face unique challenges and opportunities. Historically, these institutions have maintained a somewhat transactional relationship, often centered around financial transactions rather than genuine partnership. However, as family offices seek to innovate and enhance their wealth management strategies, the need to reinvent these relationships has never been greater. This article explores effective strategies for family offices to bridge the gap with private banks, fostering stronger, more collaborative partnerships.

Understanding the Landscape

The Role of Family Offices

Family offices serve as a central hub for managing the wealth of affluent families, offering a range of services from investment management to estate planning. As wealth continues to grow, family offices are increasingly focusing on holistic strategies that emphasize generational wealth preservation, impact investing, and lifestyle management.

The Function of Private Banks

Private banks cater to high-net-worth individuals and families by providing personalized banking and investment services. These institutions often face pressure to adapt to the changing needs of their clients, particularly as younger generations of wealthy individuals prioritize values such as sustainability and social responsibility.

Strategies for Reinvention

1. Emphasizing Communication and Transparency

Open and honest communication is essential for building trust. Family offices should engage in regular dialogues with their private banking partners, sharing insights about their goals, values, and investment philosophies. Transparency fosters a collaborative environment where both parties can align strategies and make informed decisions.

2. Leveraging Technology and Innovation

The rise of digital tools has transformed the wealth management landscape. Family offices should advocate for the integration of technology within their banking relationships, promoting platforms that provide real-time data, portfolio analytics, and streamlined communication channels. By embracing fintech innovations, family offices and private banks can enhance decision-making and improve overall efficiencies.

3. Focusing on Customization and Personalization

One-size-fits-all approaches are inadequate in today’s dynamic environment. Family offices should encourage private banks to offer tailored solutions that reflect their unique values and investment goals. This involves customizing investment portfolios to align with specific interests, such as sustainable ventures or emerging technologies, fostering a more engaged partnership.

4. Building Relationships Beyond Transactions

Successful partnerships extend beyond financial transactions. Family offices should seek to build genuine relationships with their banking partners through networking and collaboration on philanthropic initiatives. Jointly hosting events, such as investment seminars or community service projects, can promote mutual understanding and demonstrate commitment to shared values.

5. Seeking Expertise and Advisory Services

Navigating complex wealth management landscapes can be daunting. Family offices should leverage the expertise that private banks offer in investment strategies, legal frameworks, and tax implications. Engaging with specialized advisors within the bank allows family offices to capitalize on insights that can enhance their wealth management strategies.

6. Prioritizing Values and Impact Investing

As societal concerns grow, many family offices are prioritizing impact investing—allocating capital to projects that yield social and environmental benefits alongside financial returns. Private banks can support these initiatives by offering access to ESG (Environmental, Social, and Governance) investments, aligning their offerings with the values of family offices.

7. Constructing a Long-Term Vision

Both family offices and private banks should approach their relationship with a long-term perspective. Discussions should focus on future goals, including potential challenges and market shifts. By constructing a shared vision for the future, both entities can remain agile and responsive, adapting strategies as needed.

Conclusion

The relationship between family offices and private banks is ripe for transformation. By prioritizing communication, collaboration, and customization, family offices can bridge the gap with their banking partners, creating alliances that benefit all parties involved. As the landscape of wealth management continues to evolve, those who embrace these strategies will not only strengthen their financial positions but also pave the way for meaningful, lasting partnerships in an increasingly complex world. Embracing this shift will not only serve the immediate needs of family offices but will also inspire a new era of wealth management built on trust, innovation, and shared values.