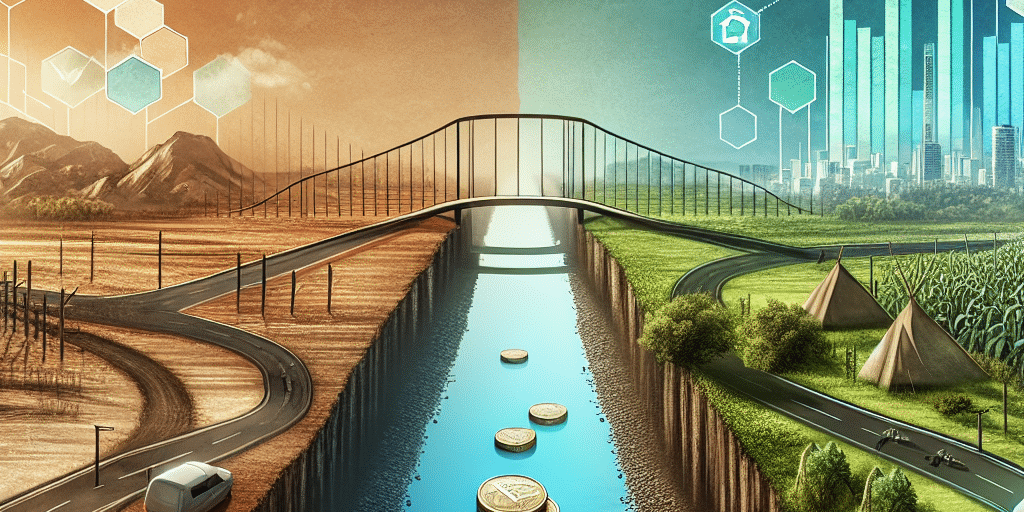

Bridging the Gap: How Impact Investing Drives Progress Toward Sustainable Development Goals

The United Nations Sustainable Development Goals (SDGs) serve as an ambitious blueprint to address the world’s most pressing challenges by 2030. With 17 interconnected goals that range from poverty alleviation to climate action, the SDGs call for unprecedented collaboration across governments, businesses, and civil society. Yet, a significant funding gap remains in meeting these goals—estimated at $2.5 trillion per year in developing countries alone. Impact investing has emerged as a pivotal strategy to bridge this gap by directing capital toward solutions that generate positive social and environmental outcomes alongside financial returns.

Understanding Impact Investing

Impact investing refers to investments made with the intention of generating measurable social and environmental impacts while also yielding a financial return. Unlike traditional philanthropy, which often focuses on grant-making, impact investing operates on the premise that you can secure a return while creating positive change. This dual focus on profit and purpose aligns neatly with the foundational principles of the SDGs.

Impact investments can take various forms, including private equity, debt, and venture capital targeting sectors such as renewable energy, education, healthcare, and sustainable agriculture. These investments are particularly significant in developing regions, where access to capital is often limited, yet the needs are profound and pressing.

The Disconnect: Funding Gaps and Resource Allocation

Despite the apparent alignment between impact investing and the SDGs, there exists a stark disconnect between available funding and the requirements for sustainable development. Traditional investments frequently overlook sectors that are vital for societal progress, as they often prioritize short-term financial returns over long-term impact. This misalignment further exacerbates global inequalities and hinders efforts to achieve the SDGs.

Impact investing offers a solution by reallocating capital toward high-impact ventures that may not fit the conventional investment model. For example, microfinance initiatives empower low-income entrepreneurs, while renewable energy projects facilitate access to clean energy for underserved communities. By targeting the sectors that align with the SDGs, impact investment can mobilize resources that significantly contribute to reducing poverty, improving health, and fostering equitable economic growth.

Driving Progress: Real-World Examples

Renewable Energy Access: Companies like Off-Grid Electric in Tanzania provide solar solutions to communities that lack reliable electricity. By utilizing impact investment, the company can expand its operations and transform lives, resulting in increased educational opportunities and economic activities—contributing directly to SDG 7 (Affordable and Clean Energy) and SDG 8 (Decent Work and Economic Growth).

Affordable Housing: Impact investments in affordable housing projects help mitigate urban poverty. Organizations like Habitat for Humanity International leverage such investments to provide low-income families with safe spaces to live, advancing SDG 11 (Sustainable Cities and Communities).

- Sustainable Agriculture: The Agri-Business Capital (ABC) Fund invests in smallholder farmers, enhancing food security and responsible agricultural practices. This initiative supports SDG 2 (Zero Hunger) while empowering local economies and fostering resilience against climate change.

The Role of Technology and Innovation

Technological advancement plays a significant role in the growth of impact investing. Fintech solutions enable easier access to capital for small and medium-sized enterprises (SMEs) in developing nations. Furthermore, blockchain technology enhances transparency and traceability in the impact investing space, ensuring that funds are used effectively and that investors can track the outcomes of their investments.

Innovation-driven impact funds are emerging that leverage data analytics to measure and report the social and environmental performance of their portfolios, providing investors with concrete evidence of their contributions toward the SDGs. This focus on accountability and transparency not only attracts more capital but also cultivates trust among all stakeholders involved.

Challenges and Considerations

Despite its potential, impact investing faces several challenges that must be navigated to realize its full potential in achieving the SDGs. These include:

Standardization of Metrics: The absence of universally accepted metrics for measuring impact can lead to inconsistencies and confusion. Developing standardized frameworks is essential for enhancing the credibility and comparability of impact investment.

Market Maturity: Impact investing is still an emerging field, and while it has gained traction, many investors remain hesitant due to perceived risks and uncertainties.

- Regulatory Frameworks: Governments play a critical role in shaping the environment for impact investment. Supportive policies can incentivize investments towards the SDGs, while any regulatory barriers can stifle growth.

Conclusion

Impact investing represents a formidable opportunity to bridge the funding gap toward achieving the Sustainable Development Goals. By fostering a new era of finance where profit aligns with purpose, impact investing can cultivate innovative solutions that address global challenges. As stakeholders across sectors collaborate to harness the potential of this investment strategy, we edge closer to a world where sustainable development is no longer a distant dream but a tangible reality. The path forward requires commitment, clarity, and cooperation, as together we can drive progress and create a better future for all.