The Rise of Family Offices

Family offices, once a niche domain serving ultra-high-net-worth families, have emerged as a critical player in the financial ecosystem. They manage wealth with a long-term perspective and often seek out innovative investment opportunities. This evolution opens pathways for collaboration with entrepreneurs and venture capitalists (VCs).

Understanding the Synergy

Entrepreneurs, especially in the tech-driven startup space, require not just capital but also mentorship and strategic guidance. Meanwhile, VCs focus on scaling businesses quickly, making quick investment decisions based on their portfolios. Family offices can offer a unique blend of both—patient capital and strategic insight.

- Long-term Vision: Unlike traditional VCs, family offices can invest with a longer horizon, allowing startups to grow organically.

- Diverse Expertise: Many family offices consist of members with varied professional backgrounds, providing invaluable insights to entrepreneurs.

- Network Access: Family offices often have expansive networks that can be advantageous for startups seeking partnerships or clients.

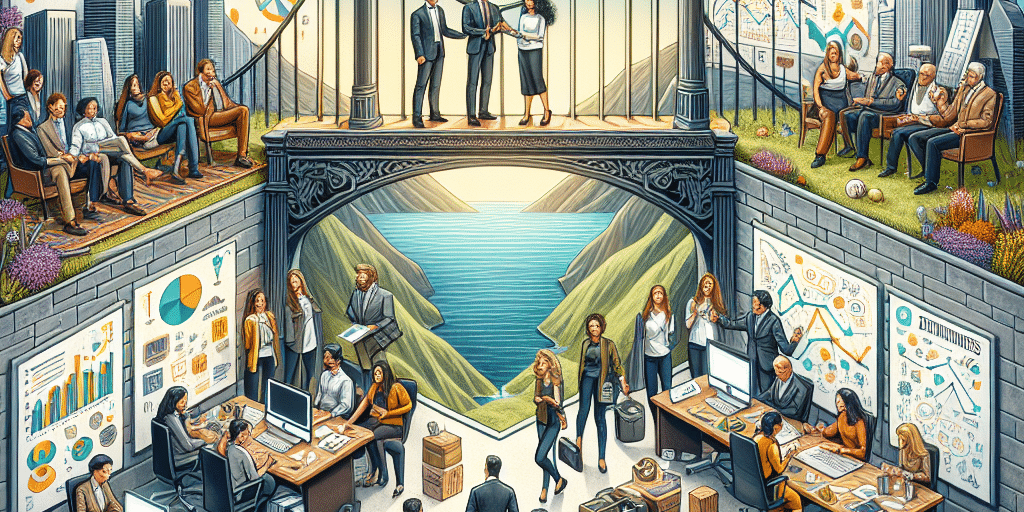

Strategies for Connection

Establishing a connection between family offices, entrepreneurs, and VCs requires intentional strategies. Here are some ways to bridge these worlds:

- Networking Events: Encourage participation in industry conferences, seminars, and networking events where all parties can engage informally.

- Collaborative Platforms: Utilize online platforms tailored for investors and startups to facilitate introductions and discussions.

- Mentorship Programs: Develop mentorship initiatives where seasoned investors from family offices guide entrepreneurs on navigating challenges.

Challenges to Navigate

While the potential for collaboration is immense, challenges exist. Family offices may lack the agility of VCs, and entrepreneurs might find traditional family office investment processes cumbersome. A clear understanding of each other’s expectations and timelines is essential to minimize friction.

Looking Ahead

As the landscape evolves, family offices are increasingly stepping into the limelight, positioning themselves as strategic partners for entrepreneurs and VCs alike. By bridging the gap between traditional wealth management and dynamic startup ecosystems, they can unlock opportunities for innovative businesses that drive economic growth.