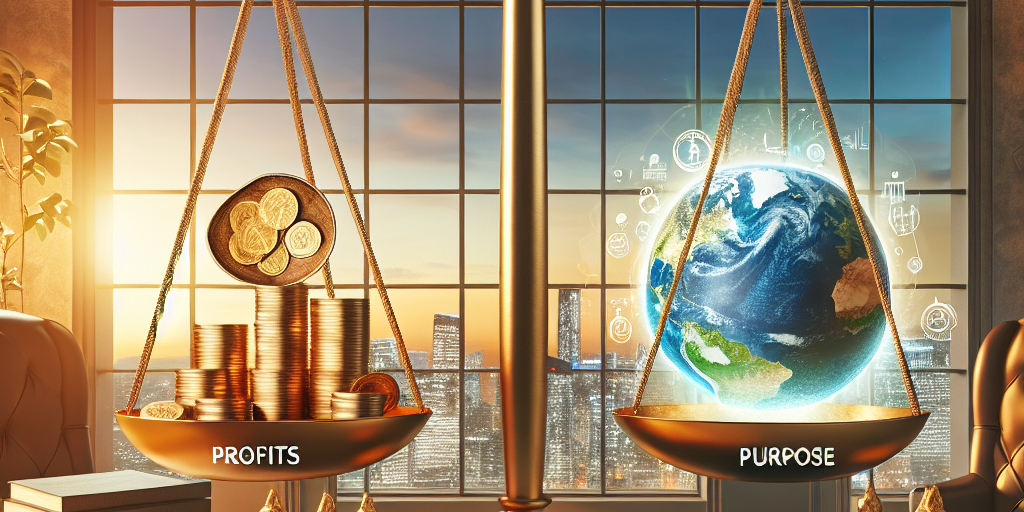

As the global economy continues to evolve, the importance of Environmental, Social, and Governance (ESG) factors has never been clearer. Family offices, which manage the wealth of affluent families, are at the forefront of integrating these principles into their investment strategies. This article explores how family offices can balance profits with purpose and actively drive ESG impact.

The Rise of ESG in Investment Strategies

In recent years, there has been a significant shift in how investors view their role in society. Increasing awareness of climate change, social justice, and corporate accountability has led family offices to consider ESG factors seriously. According to a report by Morgan Stanley, 85% of individual investors are interested in sustainable investing. This trend showcases a growing desire to align investment portfolios with personal values.

Why Family Offices Should Embrace ESG

Family offices have a unique opportunity to lead the change in sustainable investing. Here are several reasons why they should embrace ESG principles:

- Long-term vision: Family offices are often focused on the long-term growth and sustainability of their wealth, making them well-suited to incorporate ESG considerations.

- Reputation and branding: In a highly competitive marketplace, a commitment to ESG can strengthen a family office’s reputation and attract like-minded partners and clients.

- Risk management: Investing with ESG criteria can help mitigate risks associated with regulatory changes, climate change, and reputational damage.

- Impact investing: Family offices have the ability to fund initiatives that create positive social and environmental impact, reinforcing their legacy and values.

Strategies for Implementing ESG in Family Offices

Implementing ESG measures within family office investment strategies requires conscious effort and clear action plans. Here are some effective strategies:

- Establish ESG frameworks: Create guidelines and criteria for evaluating ESG aspects in potential investments.

- Diversify investments: Allocate resources into green technologies, renewable energy, and socially responsible finance sectors.

- Engage stakeholders: Foster discussions with family members and stakeholders about the importance of ESG and gather feedback for improving ESG strategies.

- Regular reporting: Monitor and report on the ESG impact of investments, ensuring accountability and transparency.

Challenges in Balancing Profits and Purpose

While the benefits of integrating ESG into investment strategies are substantial, family offices often face challenges, including:

- Short-term financial pressures: The pursuit of quick returns can lead to a reluctance to adopt longer-term ESG strategies.

- Measuring impact: Quantifying the impact of ESG investments can be complex and challenging.

- Skills and knowledge gaps: Understanding ESG factors requires expertise that may not be readily available within all family offices.

Conclusion

Family offices have a crucial role to play in driving ESG impact, balancing profits with purpose. By integrating ESG principles into their investment strategies, they can contribute positively to society while ensuring sustainable wealth growth. As the world increasingly prioritizes sustainability, family offices will need to embrace this shift to ensure relevance in the evolving investment landscape.