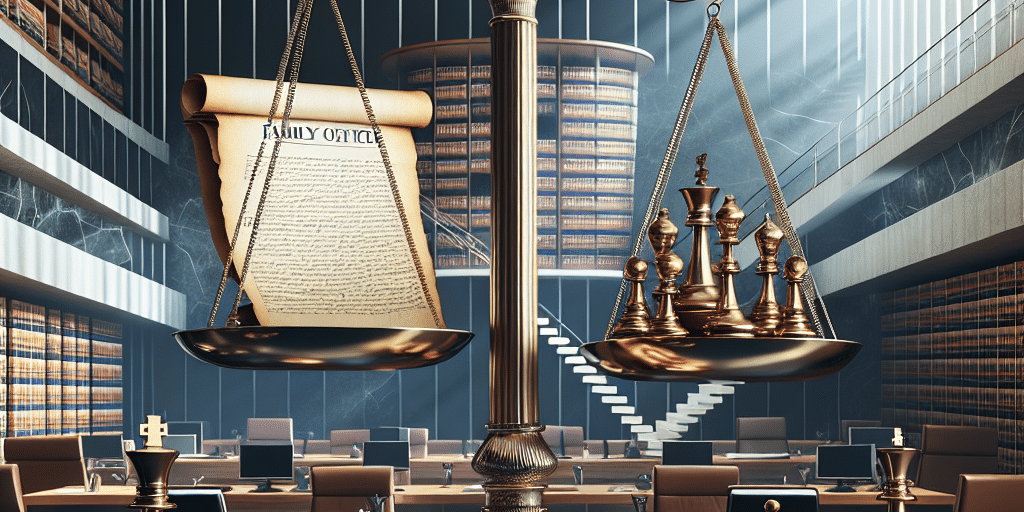

As the landscape of legislation continues to evolve, family offices are finding themselves at the crossroads of regulatory change. This dynamic environment poses both challenges and opportunities for families managing substantial wealth.

Understanding Family Offices

Family offices serve as investment management arms for high-net-worth individuals and families, focusing on preserving wealth across generations while also responding to various economic and regulatory challenges. They manage everything from investments, estate planning, philanthropy, and tax strategies.

Current Legislative Trends Impacting Family Offices

The past few years have seen significant shifts in legislation that directly affect family offices, including:

- Tax Reforms: Changes in capital gains tax rates and wealth tax discussions can affect family wealth strategies.

- Regulatory Compliance: Increasing requirements for disclosure and compliance, particularly regarding anti-money laundering (AML) and foreign investments.

- Environmental, Social, and Governance (ESG) Initiatives: New regulations are encouraging family offices to adopt ESG principles, impacting investment decisions.

Strategic Adjustments for Family Offices

In light of the changing legislative landscape, family offices need to adopt more agile operating strategies. Consider the following:

- Regular Assessment of Legal Frameworks: Continually monitor and evaluate how new laws impact investments and operations.

- Proactive Risk Management: Establish robust compliance programs to mitigate potential regulatory risks.

- Diversified Investment Approaches: Adapt investment strategies to align with emerging legislative trends, such as ESG-compliant funds.

- Collaboration with Legal Experts: Enhance partnerships with legal advisors specializing in evolving regulations relevant to family wealth management.

Conclusion

The flux in legislation presents both challenges and opportunities for family offices. By remaining proactive and flexible, family offices can navigate these changes effectively, ensuring the preservation and growth of wealth across generations.