The Rise of Family Offices

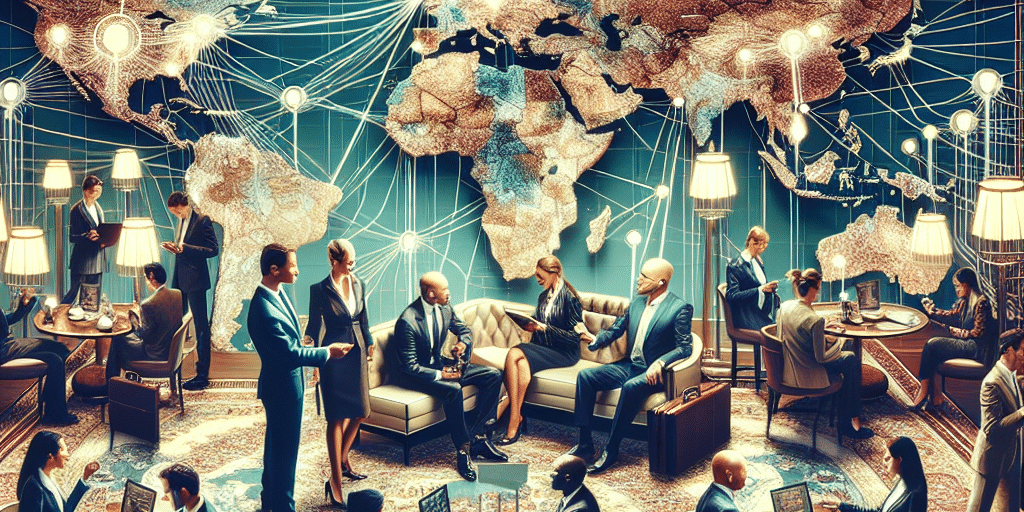

In recent years, the concept of family offices has gained traction globally. These private entities, established by ultra-high-net-worth families, focus on managing wealth and investment strategies to preserve and grow assets across generations. With their unique needs and challenges, family offices seek unparalleled networking opportunities to connect with other affluent families, industry experts, and potential investment partners.

The Role of Private Clubs

Private clubs have long been known for providing exclusive environments where affluent individuals gather to socialize, conduct business, and build relationships. These clubs often serve as incubators for opportunities, where members can exchange ideas, form alliances, and gain insights into various industries. For family offices, these settings are not just venues for leisure; they are strategic platforms for expanding their networks on a global scale.

Benefits of Private Club Membership for Family Offices

- Access to Exclusive Events: Family offices that are members of private clubs gain access to high-profile events, galas, and conferences where influential figures often gather.

- Facilitated Introductions: Membership often entails a system of referrals and introductions, allowing family offices to meet like-minded individuals and potential partners without the typical barriers of cold outreach.

- Shared Knowledge and Resources: Clubs provide forums for members to share insights on investment strategies, wealth management, and philanthropy, enhancing the collective intelligence of the group.

- Cultural Exchange: In a globalized economy, private clubs often attract an international membership base, enabling family offices to draw on diverse perspectives and business practices from around the world.

Examples of Prominent Private Clubs

Some private clubs, including The Lingua Franca in London, SoHo House with locations worldwide, and The Union Club in New York City, cater specifically to high-net-worth individuals and present excellent opportunities for family offices. These establishments often curate events that focus on financial literacy, innovation, and networking, ensuring family office members extract maximum value from their memberships.

Challenges and Considerations

While there are many advantages to leveraging private clubs, family offices must also navigate challenges. Membership can be expensive, and the exclusivity may result in a limited network pool. Additionally, finding clubs that align with their values and investment philosophies is crucial for ensuring compatibility with potential partners.

Conclusion

As the landscape of wealth management evolves, family offices continue to seek innovative ways to connect and collaborate. By engaging with private clubs, these families can fulfill their networking needs, enhance their investment strategies, and foster lasting partnerships. In a world where relationships often translate into opportunities, leveraging the unique offerings of private clubs is an intelligent strategic move for family offices aiming to thrive in an interconnected global economy.