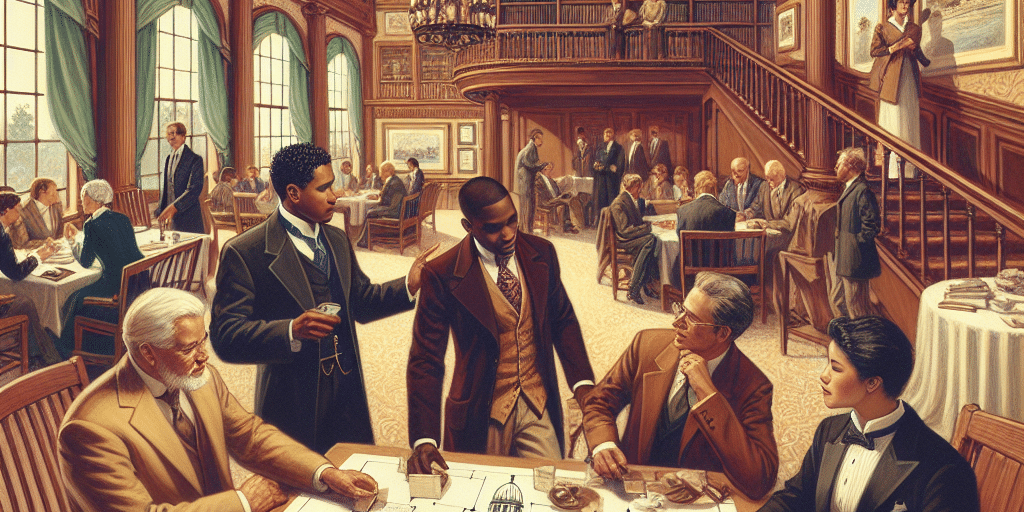

In the realm of wealth management and family governance, succession planning is a pivotal process that influences the future trajectory of family offices. Private clubs, often viewed as exclusive havens for wealth and influence, play a crucial role in shaping these transitions.

The Role of Family Offices

Family offices are private wealth management advisory firms that serve high-net-worth individuals and families. These offices are focused on managing investments, planning for tax efficiencies, and preserving family wealth across generations. As families grow and evolve, so too do their needs. This makes succession planning imperative, especially when it comes to transferring values, insights, and wealth to the next generation.

Understanding Private Clubs

Private clubs offer exclusivity and an environment designed for networking, socializing, and collaboration among members who often share similar values and backgrounds. They serve as vital cultural and social hubs for affluent families. Some of the most important aspects of private clubs in relation to family office transitions include:

- Networking Opportunities: Members can form connections with other families and professionals who understand the complexities of wealth management.

- Education and Mentorship: Clubs often provide resources and programs to educate younger generations on wealth stewardship and responsible family governance.

- Cultural Continuity: Shared experiences and values among members help reinforce family identity and legacy, crucial in succession planning.

Encouraging Family Engagement

Private clubs offer a platform for families to engage across generations. Many clubs foster environments where parents and children can interact in casual settings, discuss family values, and prepare younger members for future responsibilities. This engagement is essential for:

- Encouraging open dialogue about wealth and its impact.

- Promoting shared family experiences that solidify bonds.

- Incorporating the next generation into governance discussions and decision-making.

Facilitating Transition Planning

Through various resources, private clubs can also facilitate smoother transition planning for family offices. This can include:

- Workshops: Educational workshops on financial literacy, philanthropy, and investment strategies tailored for younger family members.

- Roundtable Discussions: Giving families access to thought leaders and industry experts who can provide insights into successful transition practices.

- Peer Learning: Allowing families to learn from each other’s successes and challenges in navigating succession.

Conclusion

As families seek to preserve their legacies and navigate the complexities of wealth transitions, private clubs stand out as vital players in this dynamic. They offer not only resources and education but also a supportive community that reinforces the values necessary for successful family office transitions. By leveraging these unique environments, families can ensure that their legacies endure across generations, grounded in shared values and informed by collective experiences.