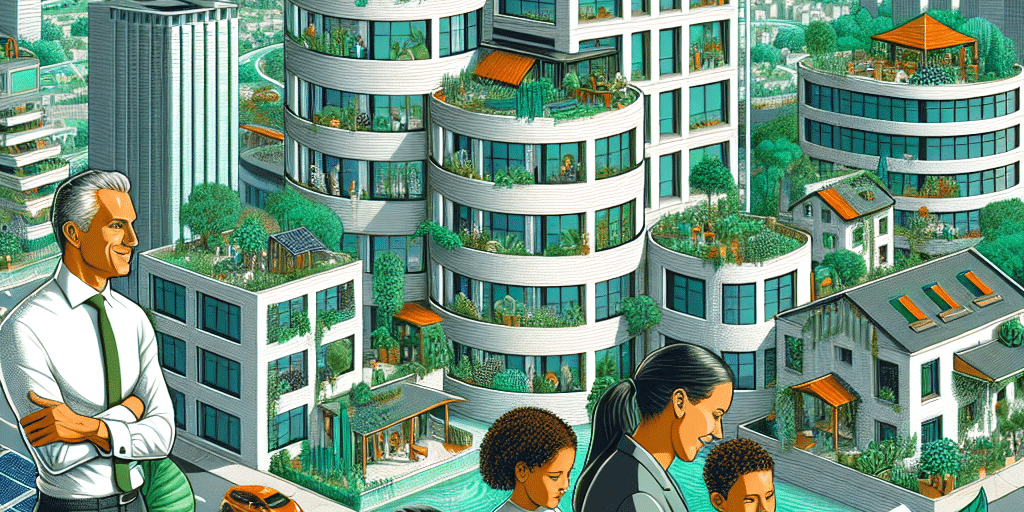

In an era defined by increased awareness of environmental sustainability and the urgent need for innovative solutions to global challenges, family offices are emerging as pioneering players in the circular economy. These investment entities, typically established by high-net-worth families to manage their wealth and legacies, are increasingly aligning their financial strategies with sustainable practices that emphasize resource regeneration, waste reduction, and social responsibility.

Understanding the Circular Economy

At its core, the circular economy is an economic model aimed at minimizing waste and making the most of resources through a closed-loop system. Unlike the traditional linear economy—which follows a “take, make, dispose” pattern—the circular economy emphasizes sustainability by encouraging practices such as recycling, reusing, and refurbishing materials. This shift is vital for mitigating the effects of climate change, preserving ecosystems, and fostering economic resilience.

Family Offices: A Unique Investment Perspective

Family offices manage the wealth and financial affairs of affluent families, often with a multigenerational perspective. Their investment strategies are driven not only by profit but also by the desire to leave a lasting impact. This has positioned family offices as ideal candidates to innovate in the realm of sustainable investment. With their long-term outlook, they can take on risks in green technologies and enterprise models that might be deemed too speculative for traditional investors.

Pioneering Circular Economy Initiatives

Investment in Sustainable Technologies

Many family offices have begun investing in startups that harness renewable energy technologies, waste-to-energy innovations, and sustainable agriculture solutions. By backing these ventures, family offices are not only generating returns but also contributing to a more sustainable future.Supporting Circular Supply Chains

Family offices are increasingly focusing on companies that integrate circular principles into their supply chains. This includes businesses that prioritize renewable materials, adopt waste reduction strategies, and seek to prolong product life cycles through repair and resale initiatives.Impact Investing Funds

Several family offices have established or invested in impact funds that exclusively support projects aimed at addressing social and environmental issues. By providing capital to businesses that prioritize the circular economy, these funds advance progressive practices while delivering competitive financial returns.- Collaborating with Innovators

Family offices often partner with universities, research institutions, and innovation hubs to develop new technologies and sustainable practices. Such collaborations can lead to groundbreaking solutions that redefine traditional business models and reinforce the principles of the circular economy.

Measuring Success: Beyond Financial Returns

For family offices, success in the circular economy is measured not only in financial yields but also in the positive impact made on society and the environment. Metrics such as carbon footprint reduction, resource conservation, and social equity are becoming central to their investment strategies. With the rise of ESG (Environmental, Social, and Governance) investing, family offices are finding that transparency and accountability in sustainable practices enhance their reputations and align with their values.

The Road Ahead

As the circular economy continues to gain traction, family offices will play a pivotal role in its evolution. By leveraging their unique position and resources, they can catalyze change within traditional industries, influence consumer behaviors, and promote innovative solutions that enhance sustainability.

Challenges and Considerations

While the potential is immense, there are challenges that family offices will need to navigate over the coming years. Issues such as regulatory hurdles, varying definitions of sustainability, and the need for greater collaboration among stakeholders will require strategic planning and adaptive strategies. Moreover, the quest for viable investments must be balanced with conducting thorough due diligence to mitigate risks associated with emerging sectors.

Conclusion

In conclusion, family offices are not just custodians of wealth; they are becoming key players in the transition toward a sustainable and circular economy. By aligning their investment strategies with sustainability goals, they are ensuring a healthier planet for future generations while simultaneously providing financial returns. The legacy they create today will not only shape the narrative of their families’ fortunes but also influence the broader economy for years to come. Investing for tomorrow means investing in a circular economy, and family offices are leading the charge.