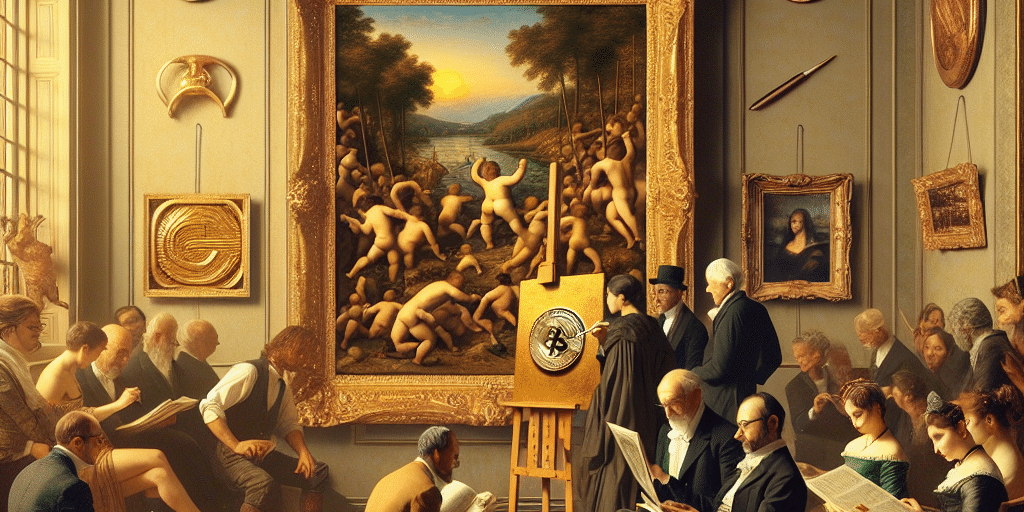

Artistry Meets Investment: The Rise of Art Collecting Among Family Offices

In recent years, the art world has witnessed a significant trend: family offices are increasingly turning to art collecting as a viable investment strategy. Traditionally, art collecting was often viewed as a pastime for the wealthy elite, but now it is emerging as a sophisticated approach to portfolio diversification, wealth preservation, and even social engagement. This article explores how family offices are reshaping the landscape of art collection, the motivations behind their investment choices, and the implications for both the art market and the collectors themselves.

The Appeal of Art as an Asset Class

One of the primary reasons family offices are gravitating towards art is the asset’s historical performance. While traditional markets can be volatile, fine art has demonstrated resilience over time. According to various studies, the art market has consistently outperformed other asset classes like stocks and bonds, particularly during economic downturns. For many family offices, art not only offers financial potential but also provides a hedge against inflation, serving as a tangible asset that can appreciate in value over the long term.

Moreover, art is uniquely non-correlated with traditional investments. This unique characteristic allows family offices to mitigate risks associated with stock market fluctuations and economic uncertainties. By incorporating art into their portfolios, these investors can achieve a more balanced and diversified investment strategy that shields them from broader market movements.

The Personal Touch: Passion Meets Portfolio

Beyond financial returns, family offices are often driven by a personal passion for art. Collecting art offers an opportunity to not only invest wealth but also to cultivate cultural discussions, build legacies, and showcase personal values. Many of these investors find joy in the aesthetic experience of art, using their collections to enrich their personal lives and foster connections within their communities.

Family offices often prioritize collecting works that reflect their interests and values, whether that’s contemporary art, emerging artists, or historic masterpieces. This trend has prompted a growing demand for expertise in art acquisition, as collectors seek to navigate the complex and often opaque art market. As a result, many family offices employ art advisors or collaborate with reputable galleries to make informed decisions that align with their personal tastes and financial goals.

Art as Philanthropy: Aligning Investments with Values

For many family offices, the integration of art collecting with philanthropic endeavors has become a key consideration. Collaborations with artists, sponsorship of exhibitions, or donations to museums are ways that these investors bring societal value to their financial engagements. In doing so, they not only enhance their reputations as stewards of culture but also create opportunities for community engagement and social impact.

Furthermore, this philanthropic approach aligns seamlessly with the growing trend of impact investing. Family offices are now more attuned to how their investment choices can influence culture and society, making art collection a compelling area through which to express their commitment to supporting creative communities.

The Digital Transformation: NFTs and the Future of Art Collecting

The rise of digital art and Non-Fungible Tokens (NFTs) has injected an entirely new dimension into the art collection landscape. Family offices are now looking to diversify their art holdings by including digital assets, which offer unique advantages such as easy fractional ownership and instant liquidity. As the popularity of NFTs continues to surge, savvy investors recognize the potential for digital art to garner significant returns.

Family offices are beginning to navigate this uncharted territory with caution and curiosity. Many are investing in digital art platforms, while others are partnering with tech-savvy art consultants to understand the nuances of blockchain technology and how it can transform art ownership and provenance.

Conclusion: The Future of Art Collecting Among Family Offices

As the intersection of art and investment continues to evolve, family offices are poised to play a pivotal role in shaping the future of art collecting. By combining passion with financial strategy, these investors are redefining what it means to be an art collector in the 21st century. Their continued interest in art as a form of investment will not only impact the market dynamics but will also contribute to the cultural fabric of society, ensuring that art remains a vital part of our collective heritage.

In essence, the rise of art collecting among family offices represents a remarkable convergence of artistry and investment, reminding us that the motivations behind collecting art are as diverse and nuanced as the artworks themselves. As more family offices enter the art market, they bring with them not only financial resources but also a commitment to the narratives and communities that art embodies. This new class of collectors is set to leave a lasting legacy that celebrates both the beauty of art and the wisdom of investment.