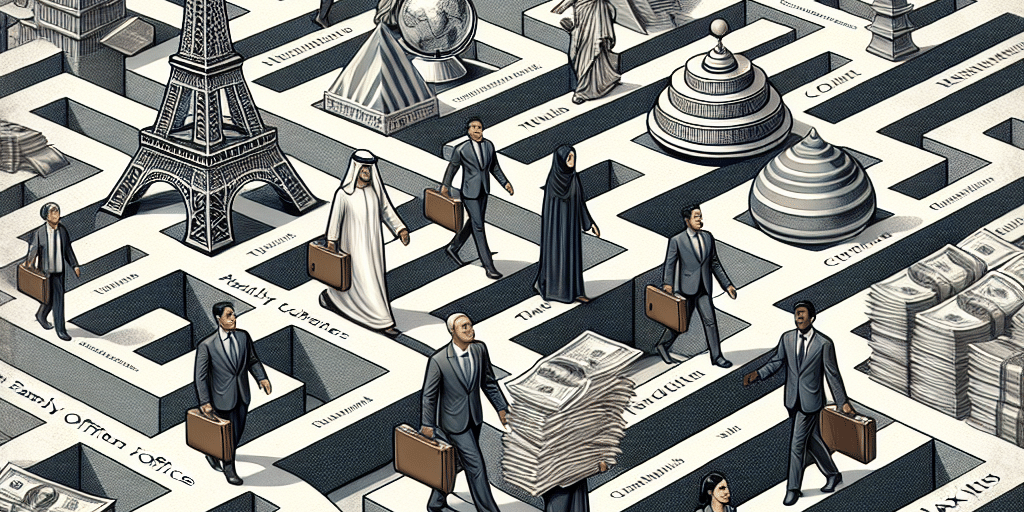

In today’s increasingly interconnected world, family offices are emerging as sophisticated entities tasked with managing the wealth, investments, and legacies of high-net-worth families. As these families engage in cross-border activities, understanding and navigating the complex landscape of global tax regulations becomes paramount. With varying tax laws, treaties, and compliance requirements in different jurisdictions, international family offices must adopt best practices to ensure effective tax management and strategic planning.

Understanding the Complexity of Global Taxation

Family offices operate in multiple jurisdictions, exposing them to a myriad of tax obligations. Key challenges include:

Diverse Tax Regimes: Countries employ vastly different tax regimes, from income tax to estate tax, capital gains tax, and inheritance tax. Understanding these distinctions is crucial for maintaining compliance and minimizing liabilities.

Tax Treaties: Bilateral tax treaties can provide relief from double taxation; however, misinterpretation can lead to regulatory infractions. Navigating these agreements requires a nuanced understanding of international tax law.

Compliance Requirements: Increasing scrutiny from tax authorities, including those pertaining to anti-money laundering (AML) and the Foreign Account Tax Compliance Act (FATCA), necessitates meticulous documentation and reporting practices.

- Changing Regulations: Ongoing tax reform in various jurisdictions can further complicate compliance, making it essential for family offices to stay informed and adaptable.

Best Practices for International Family Offices

To navigate the multifaceted global tax environment effectively, family offices can adopt several best practices:

1. Engage Expert Advisors

Hiring specialized tax advisors with expertise in international tax law is crucial. These professionals can help family offices navigate jurisdiction-specific regulations, keep abreast of changes, and provide nuanced advice tailored to each family’s unique situation.

2. Conduct Thorough Tax Assessments

Periodic assessments of the family office’s tax obligations can identify potential risks and opportunities. By conducting a thorough review of income, assets, investments, and any potential exposure to various tax liabilities, family offices can develop informed strategies.

3. Establish Clear Ownership Structures

Carefully structured ownership models can facilitate efficient tax planning and compliance. Utilizing trusts, limited liability companies (LLCs), or foundations can help families manage taxes effectively across jurisdictions while ensuring asset protection and succession planning.

4. Monitor Regulatory Changes

In an environment of frequent legislative changes, ongoing education and monitoring of tax regulations are essential. Family offices should subscribe to relevant tax news updates, participate in industry forums, and establish connections with tax authorities to remain knowledgeable about any potential changes in the law.

5. Implement Robust Record-Keeping Procedures

Meticulous documentation and record-keeping are vital for compliance. Family offices should establish robust data management systems, ensuring that all financial transactions, communications, and tax filings are recorded and easily retrievable.

6. Develop International Tax Strategies

Crafting tailored tax strategies that consider the family’s overall investment landscape, objectives, and location is vital. This might include leveraging tax incentives, deductions, and credits available in different jurisdictions, while also considering the family’s estate planning needs.

7. Foster Transparency and Communication

Transparency with tax authorities can build goodwill and mitigate scrutiny. Maintaining open communication channels and ensuring compliance with reporting obligations, such as FATCA for U.S. citizens abroad, can reduce the likelihood of unexpected penalties or audits.

8. Collaborate with Other Family Offices

Networking with other family offices can yield valuable insights into best practices and emerging trends. Sharing experiences regarding tax compliance and strategic planning can serve as a powerful tool for collective learning and adaptation.

Conclusion

As family offices delve into international markets, they must navigate a complex web of global tax regulations. By following best practices, such as engaging expert advisors, conducting thorough assessments, maintaining clear ownership structures, and fostering transparency, family offices can adeptly manage their tax obligations. Ultimately, a proactive approach to tax planning does not merely mitigate risks but can also enhance wealth preservation and facilitate the family’s long-term financial goals. Navigating the intricacies of global tax regulations is not just a matter of compliance; it’s fundamental to securing the family legacy for generations to come.