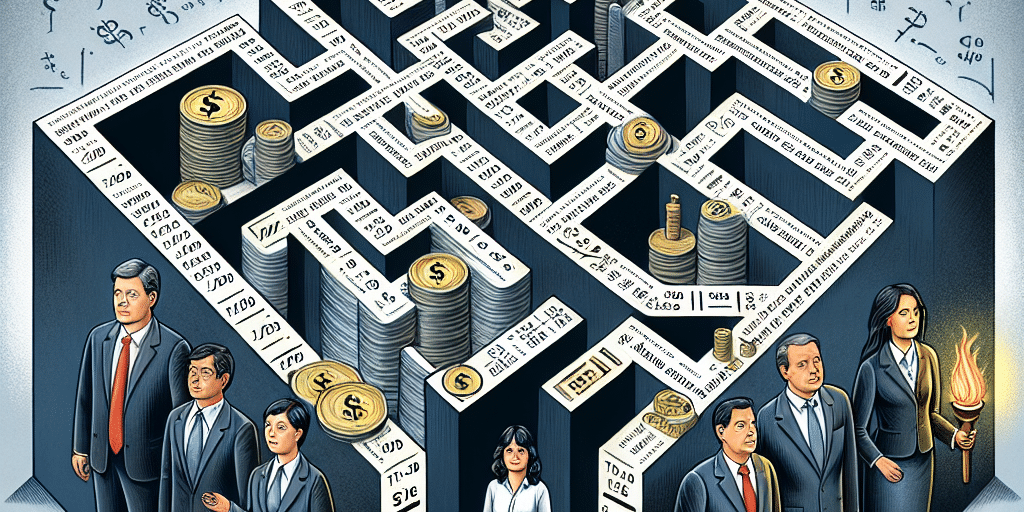

Family businesses are the backbone of many economies, and ensuring a smooth transition of leadership and ownership is critical for their long-term sustainability. However, navigating the complexities of tax laws during the succession process can be overwhelming. This article outlines strategies that can help family businesses minimize tax liabilities and ensure efficient succession planning.

Understanding the Importance of Succession Planning

Succession planning is not just about deciding who will take over the reins of a family business; it encompasses a comprehensive strategy that includes financial, legal, and tax implications. A well-thought-out plan can help maintain family harmony, ensure business continuity, and minimize the tax burden.

Key Considerations in Family Business Succession

Timing of Ownership Transfer: One crucial aspect of succession planning is determining when and how to transfer ownership. Initiating the process early allows the family to evaluate various options and benefit from potential tax advantages. Gradual transfers can be more tax-efficient than transferring all the assets at once.

Valuation of the Business: Accurate business valuation is necessary for any planning. Tax implications arise from valuation methods and timing; an updated valuation can help determine gift and estate tax liabilities.

- Choice of Entity Structure: The legal structure of a family business—be it a corporation, partnership, or limited liability company (LLC)—can significantly influence tax consequences during ownership transition. An LLC, for instance, may offer more flexibility and favorable tax treatment than a traditional corporation.

Strategies for Minimizing Tax Liabilities

Gifting Strategies: Utilizing the gift tax exclusion allows business owners to transfer portions of their ownership interest to heirs without incurring substantial tax liabilities. Annual exclusions and lifetime gifting strategies can be instrumental in gradually moving ownership stakes.

Establishing Trusts: Family trusts can serve as effective tools for managing and transferring wealth. By placing business interests into a trust, families can shield assets from taxes and facilitate a smoother transition of ownership while retaining control over the business during their lifetime.

Utilizing the Family Limited Partnership (FLP): An FLP not only allows family members to participate in the business but also provides significant tax advantages. They can help to minimize estate taxes by locking in valuations and enabling discounts on the transfer of interests.

Life Insurance Policies: Life insurance can provide liquidity to cover estate taxes upon the owner’s death, ensuring that heirs do not have to sell parts of the business to meet tax obligations. Properly structured policies can also be utilized to fund buy-sell agreements, providing additional security for all parties involved.

- Considering Charitable Contributions: Philanthropy can play a crucial role in succession planning. Donating business interests or assets to charities can provide significant tax deductions, reducing the taxable estate while benefiting a worthy cause.

Engaging Professional Help

Considering the myriad of tax laws and succession strategies, engaging professionals with expertise in tax law, estate planning, and business succession is vital. Tax advisors and estate planners can help families navigate the complexities and tailor strategies that best suit their unique circumstances.

Tax Advisors: These professionals can analyze the financial aspects of succession planning and provide insights on tax-efficient strategies, ensuring compliance with current tax laws and maximizing benefits.

Estate Planning Attorneys: An attorney specializing in estate planning can help draft the necessary legal documents, such as wills and trusts, to facilitate smooth transitions and protect family interests.

- Accountants: Professional accountants can support the continuation of financial standards and ensure proper documentation for tax reporting throughout the succession process.

Conclusion

Navigating the tax maze during family business succession ensures a seamless transition while minimizing liabilities. By incorporating tax-efficient strategies and engaging professional guidance, families can relocate their legacy in a manner that preserves both financial health and family harmony. Early planning and proactive decision-making are paramount, paving the way for successful generational transitions in the family business landscape.