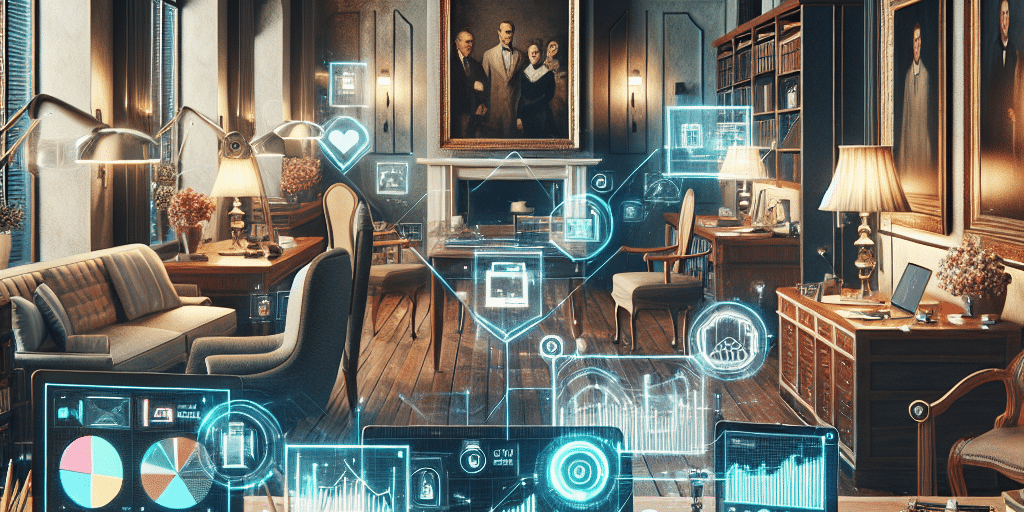

In today’s rapidly evolving financial landscape, family offices—private wealth management advisory firms established by ultra-high-net-worth families—are adopting innovative technologies to reshape their approach to real estate investments. Traditionally known for their conservative investments diversified across various asset classes, family offices are now leveraging technological advancements to enhance decision-making, streamline operations, and increase profitability in the real estate sector. This article explores how technology is transforming family office real estate investments and the benefits this evolution brings.

Data-Driven Decision Making

One of the most significant shifts in real estate investment strategies is the increasing reliance on data analytics. Family offices are tapping into big data to gain insights into market trends, property values, and demographic shifts. By utilizing predictive analytics, these firms can analyze potential investments with unprecedented accuracy, allowing them to identify opportunities and mitigate risks before committing capital.

For example, sophisticated algorithms can assess market conditions by evaluating historical data, rent growth trends, and regional economic indicators. With this analytical approach, family offices can make informed decisions, such as determining the best time to buy or sell properties or identifying emerging markets that demonstrate growth potential.

Digital Platforms for Investment Management

The rise of digital platforms has also facilitated a more streamlined investment process for family offices. These platforms provide tools for automating workflows, enhancing communication, and simplifying transaction management. For instance, cloud-based property management software allows family offices to oversee portfolio performance in real time, providing insights into occupancy rates, operational costs, and tenant satisfaction.

Moreover, automated reporting features enable family offices to generate financial statements and performance reports efficiently, freeing up valuable time for strategic decision-making. By integrating these digital solutions, family offices can operate more efficiently and allocate resources toward high-impact activities.

Virtual Reality (VR) and Augmented Reality (AR)

The advent of virtual reality (VR) and augmented reality (AR) technologies is revolutionizing property marketing and site visits. Family offices are increasingly employing VR and AR tools in their investment processes, allowing potential investors and stakeholders to discover properties from anywhere in the world.

Through virtual tours, family offices can showcase properties in immersive detail, significantly reducing the time and expense associated with physical site visits. This technology enhances the evaluation process and allows family offices to assess properties and investments more effectively, regardless of geographic constraints.

Blockchain and Transparency

Blockchain technology is making headway in the real estate sector, particularly regarding transparency and security. Family offices are beginning to incorporate blockchain into their investment strategies to secure transactions and streamline the due diligence process. Smart contracts—self-executing contracts with the terms of the agreement directly written into code—enable secure and efficient transactions, reducing reliance on intermediaries and minimizing fraud risks.

By leveraging blockchain, family offices can ensure that their transactions are transparent, easily traceable, and immutable. This increased trust in the investment process enhances relationships with partners and stakeholders, paving the way for more robust investment strategies.

Sustainability and Social Responsibility

As awareness of environmental and social issues rises, family offices are increasingly making investments with sustainability and social responsibility in mind. Technology plays a pivotal role in enabling these initiatives. Advanced software can assess a property’s carbon footprint and sustainability metrics, helping family offices identify opportunities for green building improvements and efficiency upgrades.

By integrating sustainable practices into real estate investments, family offices not only mitigate risks associated with regulatory changes but also align their portfolios with the values of socially conscious investors. As a result, they can attract a new generation of stakeholders who prioritize ethical investment.

Conclusion

As family offices adapt to an evolving investment landscape, embracing technology is no longer a luxury but a necessity. The integration of data analytics, digital platforms, VR/AR, blockchain, and sustainable practices is revolutionizing the approach to real estate investments. By harnessing these technological advancements, family offices can enhance decision-making, operational efficiency, and risk management, ultimately positioning themselves for success in a competitive marketplace.

The future of real estate investment is here, and family offices are leading the charge for a more innovative, transparent, and sustainable industry. As these transformations continue to unfold, stakeholders can expect a significant shift in how real estate investments are approached, managed, and executed.