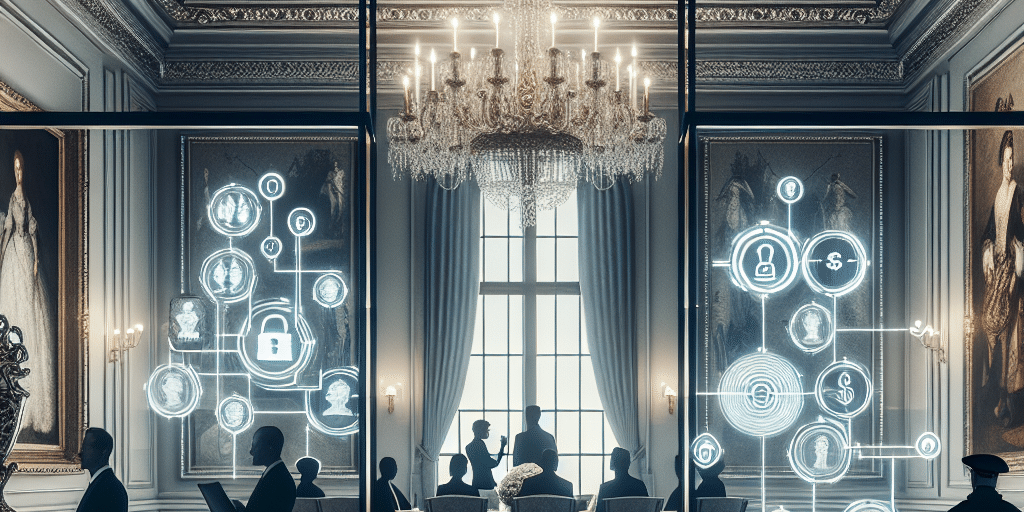

In an era where information is a prized commodity, the sanctity and security of financial discussions have never been more paramount, especially for family offices. These private wealth management advisory firms serve ultra-high-net-worth individuals and families, providing a suite of services ranging from investment management to estate planning. However, with significant wealth comes the responsibility of safeguarding not only financial assets but also personal privacy. As families gather to discuss matters of great importance, the role of security — both digital and physical — becomes crucial.

The Nature of Family Office Gatherings

Family office gatherings can take various forms, whether they be formal meetings, informal get-togethers, or retreats. These gatherings are often used to discuss critical issues such as investment strategies, philanthropic initiatives, succession planning, and family governance. Naturally, the sensitive nature of these conversations mandates a strong emphasis on privacy and security.

The Importance of Confidentiality

At the heart of any family office meeting lies the need for confidentiality. Unlike publicly traded companies that must adhere to stringent disclosure regulations, family offices operate in relative obscurity. This lack of oversight allows families the freedom to discuss their financial affairs but also makes them susceptible to external threats.

Sensitive financial information can attract undesirable attention. Competitors, hackers, and even opportunistic family members can exploit any lapse in confidentiality. Keeping discussions private helps protect not only financial assets but the family’s reputation. Therefore, implementing comprehensive confidentiality measures, including NDAs for non-family members, is essential.

Physical Security Measures

When organizing a family office gathering, incorporating robust physical security measures is crucial. Access control systems, video surveillance, and trained security personnel help ensure that the event space is secure. Private events may also consider employing off-duty law enforcement or private security firms to maintain a secure environment.

Choosing the right venue is equally vital. Remote or exclusive locations can provide an added layer of security, minimizing the chances of unauthorized access. Additionally, offering secure transportation for family members and their guests to and from the venue mitigates potential vulnerabilities.

Digital Security Protocols

In today’s digital age, much of our sensitive information is stored online. Cybersecurity threats can compromise the integrity of private conversations and financial data if not adequately protected. Family offices must invest in robust cybersecurity measures, including:

Secure Communication Channels: Utilizing encrypted communication platforms ensures that sensitive discussions remain confidential. Avoid public networks and encourage secure channels for all family communications.

Data Protection: Implementing strong firewalls, anti-virus software, and encryption for sensitive documents protects against unauthorized access. Regular audits of digital systems can help identify and address vulnerabilities.

Educating Family Members: Family members should be educated on cybersecurity best practices. Regular training sessions can raise awareness about phishing scams and other common threats.

- Controlled Document Management: Instead of circulating physical documents that can easily get lost or fall into the wrong hands, family offices can use secure document management systems to control access and track who sees what information.

Engaging Trusted Advisors

Family offices often work with a network of advisors, ranging from financial planners and lawyers to tax specialists and investment managers. While these relationships are critical, they also introduce another layer of complexity regarding privacy and security. Choosing trusted advisors who hold confidentiality in high regard is essential.

Before involving external parties in discussions, family offices should put in place thorough vetting processes. Requesting background checks and referrals, and ensuring that all parties adhere to strict confidentiality policies can foster a safer environment.

Creating a Culture of Security

Ultimately, protecting the wealth and privacy of a family hinges on cultivating a culture that prioritizes security. Regular discussions on the importance of confidentiality and security within the family can ensure that every member understands the gravity of the situation.

An open dialogue about these issues will not only reinforce the need for security but also empower family members to take an active role in protecting their shared interests. Encouraging a proactive mindset can create a resilient framework for managing and safeguarding family wealth.

Conclusion

As families convene to discuss their legacy, investments, and philanthropic pursuits, the importance of maintaining privacy and security cannot be overstated. Family office gatherings are a coruscating opportunity for shared growth, and they require careful planning and execution to safeguard the discussions that define family success. Investing in both physical and digital security measures is not just prudent — it is essential for guarding the wealth that families work tirelessly to build and protect. In an unpredictable world, ensuring the protection of sensitive information and family privacy is a critical step toward lasting financial legacy and peace of mind.