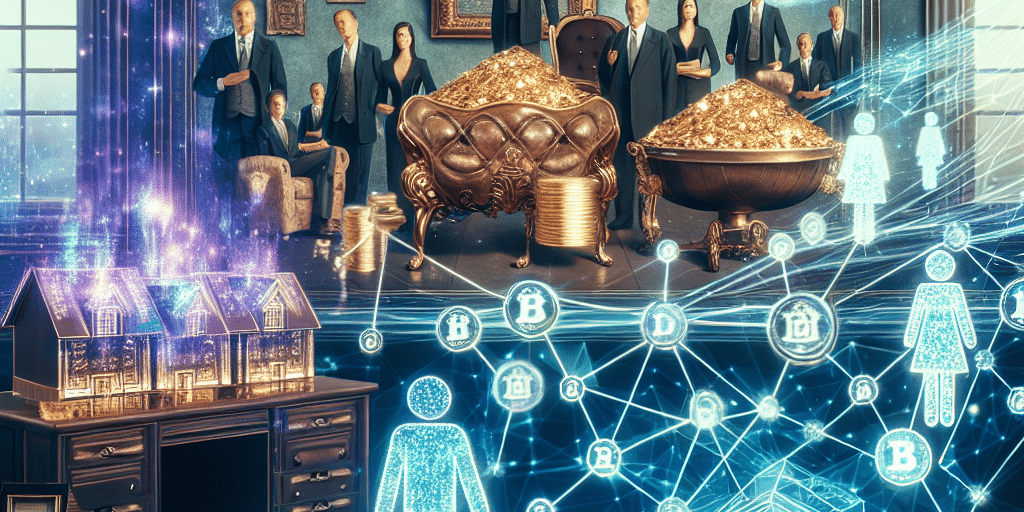

In a rapidly evolving financial landscape, family offices are traditionally known for their bespoke investment strategies, personalized wealth management, and inheritance planning. However, a new wave of technology is challenging the status quo: blockchain. This decentralized ledger technology, originally designed to underpin cryptocurrencies like Bitcoin, is now transforming how family offices manage assets, streamline operations, and optimize investment strategies.

Understanding Family Offices

Family offices exist to manage the financial assets, investments, and personal affairs of affluent families. They provide a tailored wealth management service that can include investment advisory, financial planning, tax optimization, and succession planning. With the growth of family wealth reinforcing the need for efficient management, these offices are under constant pressure to innovate and maximize returns. Enter blockchain, which offers distinct advantages that could redefine their operational processes.

What is Blockchain?

Blockchain technology is essentially a distributed ledger that records transactions across several computers in such a way that the recorded transactions cannot be altered retroactively. This significant feature of immutability ensures transparency and trust in the data shared. The decentralized nature of blockchain allows multiple parties to access the same data simultaneously while maintaining privacy and security.

Reshaping Asset Management

1. Enhanced Transparency and Trust

One of the primary benefits of blockchain for family offices is its ability to foster transparency. All transactions recorded on a blockchain are visible and can be audited in real-time. This transparency can significantly alleviate concerns regarding fraud and misrepresentation. Family offices can provide their clients with detailed and trustworthy reports on asset performance, returns, and potential risks, thus enhancing the trust factor that ties wealthy families to their advisors.

2. Efficient Reporting and Compliance

Blockchain simplifies the reporting process by automatically updating and reconciling data entries across various accounts and platforms. For family offices managing multiple investments and diverse portfolios, this capability reduces manual errors and streamlines compliance with regulatory requirements. Smart contracts, another deployment of blockchain technology, can automate compliance tasks, ensuring that agreements are enforced without the need for intermediaries.

3. Tokenization of Assets

Tokenization—the process of converting rights to an asset into a digital token on a blockchain—has made it possible for family offices to diversify their portfolios beyond traditional assets like stocks and bonds. Real estate, art, and even private equity can be tokenized, allowing for fractional ownership. This means a family office can diversify investments and access high-value assets without the prohibitive capital commitments typically required in these markets.

4. Improved Security

Data breaches in finance can have severe consequences, leading to loss of assets and trust. Blockchain provides enhanced security features due to its encrypted and decentralized nature. Each participant in the network holds a copy of the entire ledger—making unauthorized changes virtually impossible. For family offices, this ensures that critical financial information remains secure and private.

5. Streamlined Operations and Lower Costs

By reducing the need for intermediaries such as banks and brokers, blockchain can significantly lower transaction costs. Family offices can leverage blockchain to facilitate faster and more cost-effective transactions—whether dealing with international transfers or real estate transactions. The unique features of blockchain also enable a more direct relationship between buyers and sellers, further cutting down costs and improving efficiency.

6. Access to Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) presents an attractive opportunity for family offices looking to enhance returns. DeFi platforms leverage blockchain technology to remove intermediaries in financial transactions, allowing users to trade, lend, and borrow assets directly. Family offices can tap into these platforms to access innovative investment opportunities while benefiting from significantly lower fees and higher yields compared to traditional finance.

The Future of Wealth Management

As the asset management landscape continues to evolve, family offices adopting blockchain technologies are poised to gain significant competitive advantages. By leveraging the benefits of blockchain—from transaction transparency to improved security—family offices can not only streamline their operations but also enhance the value they deliver to their clients.

Adopting blockchain technology, however, does not come without its challenges. Regulatory uncertainty, the need for technical expertise, and concerns surrounding the volatility of blockchain-based assets remain hurdles to widespread adoption. Nevertheless, as the technology matures and regulatory frameworks develop, family offices that embrace blockchain will likely lead the charge into the future of wealth management.

Conclusion

Blockchain is revolutionizing the way family offices manage assets, introducing levels of transparency, efficiency, and security that were previously unattainable. As technology continues to advance, forward-thinking family offices will not only need to adapt but also innovate their strategies to harness the full potential of blockchain, positioning themselves at the forefront of a new era in wealth management. In this dynamic landscape, the integration of technology is no longer optional—it is imperative for securing and growing family legacies in an increasingly complex financial world.