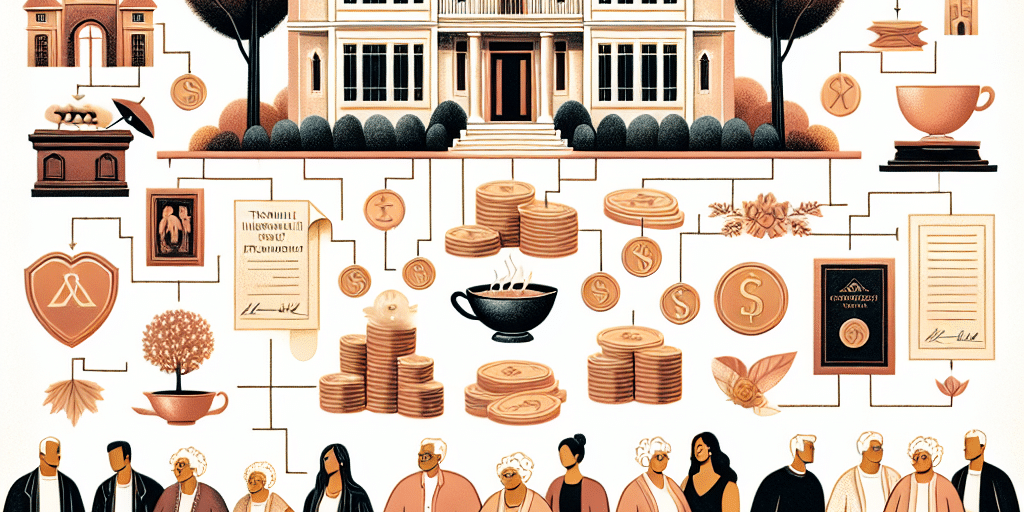

In an ever-evolving world, the desire to leave a lasting impact and secure the financial future of loved ones is a priority for many individuals. Multi-generational inheritance planning is not just about passing down wealth; it’s about establishing a legacy that encompasses values, traditions, education, and financial stability across generations. This comprehensive guide will walk you through the essential steps and considerations in building a legacy that can endure the test of time.

Understanding Multi-Generational Inheritance Planning

Inheritance planning involves strategic decisions surrounding the distribution of your assets after your death. Multi-generational planning takes this concept further, emphasizing the importance of preserving wealth and values across multiple generations. The goal is to create a robust framework that ensures financial security while instilling principles such as responsibility, stewardship, and philanthropy in heirs.

Key Components of Multi-Generational Inheritance Planning

Establish Clear Objectives

Start by defining what legacy means to you. Are you focused on financial support, educational opportunities, or fostering family values? Engaging family members in discussions about their aspirations and concerns can provide clarity and purpose in your planning.

Create a Comprehensive Estate Plan

An effective estate plan is crucial for any inheritance strategy. Components include:

- Wills and Trusts: Designate how your assets will be distributed and under what terms. Trusts can help minimize taxes and protect your estate from probate.

- Powers of Attorney and Healthcare Directives: Decide who will make decisions on your behalf in case of incapacity.

- Beneficiary Designations: Ensure that your accounts (retirement accounts, life insurance, etc.) have up-to-date beneficiaries.

Tax Considerations

Understanding the tax implications of inheritance is vital for preserving wealth. Engage a financial advisor or estate planning attorney to navigate:

- Gift and Estate Taxes: Familiarize yourself with federal and state laws regarding taxes on gifts and inheritance.

- Strategies for Minimizing Tax Liability: Explore options like charitable giving or establishing a family limited partnership to reduce tax burdens.

Utilizing Trusts for Protection and Growth

Trusts remain one of the most effective tools for multi-generational planning. Consider:

- Generation-Skipping Trusts: Allow you to pass wealth directly to grandchildren, avoiding estate taxes at the children’s level.

- Dynasty Trusts: Maintain wealth over multiple generations, providing a buffer against creditors and divorce settlements.

- Educational Trusts: Set aside funds specifically for heirs’ education, promoting learning and responsibility.

Integrating Family Values and Education

Beyond financial assets, imparting family values is a crucial aspect of building a legacy. Consider:

- Family Meetings: Regular discussions about finances, responsibilities, and family values can foster communication and collaboration.

- Education: Encourage financial literacy and responsibility among family members. Providing education on managing wealth can empower heirs to preserve the legacy effectively.

- Philanthropic Strategies

Involving charitable giving in your estate plan can amplify your legacy. Establishing a family foundation or donor-advised fund allows you to pass down the values of philanthropy, encourage social responsibility, and offer tax advantages.

Steps to Build Your Legacy

Assess Your Financial Situation

Take stock of your assets, liabilities, and overall financial health. This will inform your planning decisions and help identify potential hurdles.

Engage Professional Assistance

Consider engaging a team of professionals, including an estate planning attorney, financial advisor, and tax professional, to guide you through the complexities of inheritance planning.

Document Your Plans

Clearly outline your wishes in writing. This documentation should be easily accessible to your heirs and regularly updated to reflect changing circumstances.

Communicate with Your Family

Open honest dialogue about your plans can ease potential conflicts and ensure that family members understand their roles and responsibilities.

- Review and Adjust

Life circumstances change, and so should your plans. Regularly review your estate plan to ensure it remains aligned with your goals and family dynamics.

Conclusion

Building a multi-generational legacy is a profound undertaking that requires careful thought, planning, and communication. By establishing a clear vision, creating a robust estate plan, and involving family members in the process, you can ensure that your values and assets are preserved and that future generations benefit from your legacy. As you navigate this journey, remember that the true essence of a legacy goes beyond financial inheritance – it lies in the enduring impact of your values, teachings, and love that you pass down through the generations.