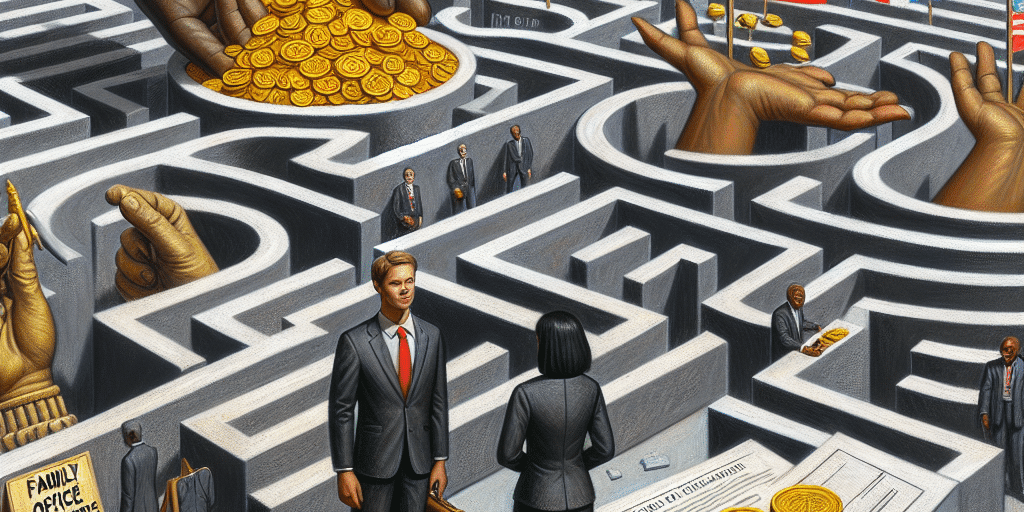

In an increasingly interconnected global economy, family offices—private wealth management entities that serve high-net-worth individuals or families—face a complex labyrinth of financial and regulatory challenges. One of the most significant factors shaping their investment strategies is the interplay of double taxation treaties (DTTs). Understanding and leveraging these treaties can provide family offices with a crucial competitive advantage in optimizing their investments while minimizing tax liabilities.

Understanding Double Taxation Treaties

Double taxation treaties are agreements between two or more countries aimed at preventing the same income from being taxed in more than one jurisdiction. These treaties typically define the taxing rights of each country regarding various types of income, including dividends, interest, royalties, and capital gains. For family offices, which often invest across borders, these agreements can have profound implications on returns and overall investment strategy.

The Importance of DTTs for Family Offices

1. Tax Efficiency and Risk Mitigation

Family offices are tasked with preserving and growing wealth across generations. As such, they will often engage in cross-border investment opportunities. Without DTTs, familial wealth could be subject to double taxation—first in the host country where the income is generated and then in the family’s country of residence. This dual tax burden can significantly erode returns on investment.

DTTs provide clarity on which country has the right to tax certain incomes, thus creating a more predictable tax environment. For instance, if a family office invests in foreign equities, a favorable DTT could mean reduced withholding taxes on dividends. By understanding and navigating these treaties, family offices can strategically allocate investments to jurisdictions that offer better tax outcomes.

2. Enhanced Portfolio Diversification

Family offices often seek to diversify their investment portfolios across geographies to manage risk better. The implications of DTTs can influence where and how family offices choose to invest. For example, markets with a robust network of DTTs may be more attractive, as they lessen the potential tax barriers and allow for greater liquidity of cross-border investments.

Furthermore, understanding the DTT landscape can offer family offices access to investment opportunities that are more tax-efficient. The existence of a treaty can enable investments in real estate, private equity, or venture capital without incurring heavy tax penalties, thus broadening the horizon for portfolio diversification.

3. Strategic Estate Planning

For family offices, estate planning is a critical aspect of wealth management. DTTs play a vital role in estate taxes, particularly when assets are held in multiple countries. In some jurisdictions, DTTs can provide exemptions or reductions on estate taxes, facilitating smoother intergenerational wealth transfer.

For instance, a family office with investments in multiple countries may utilize DTTs to minimize the estate tax burden on heirs when assets pass from one generation to the next. This strategy not only helps preserve wealth but also ensures that the family’s legacy can be sustained without excessive tax liabilities hindering future investments.

Considerations in DTT Utilization

While DTTs provide numerous advantages, family offices must navigate them carefully. Some key considerations include:

Understanding Local Laws: Each country’s interpretation and implementation of DTTs may vary considerably. Family offices must be diligent in understanding local tax laws, regulations, and compliance requirements to ensure proper utilization of the treaties.

Evolving Treaty Landscape: DTTs are subject to change and renegotiation. Family offices need to stay updated with modifications in tax treaties that may impact their investment strategies, especially in light of global trends such as base erosion and profit shifting (BEPS).

- Consultation with Experts: Engaging tax advisors and legal experts well-versed in international tax law is crucial. They can help family offices navigate the complexities of DTTs, ensuring that investments are optimized from a tax perspective.

Conclusion

As family offices continue to engage in a global investment landscape, double taxation treaties will remain a pivotal influence on their investment strategies. By effectively navigating the maze of DTTs, family offices can enhance tax efficiency, improve diversification, and streamline estate planning, all of which contribute to the long-term preservation of wealth. In a world where financial complexities abound, having a strategic approach to DTTs not only protects but also empowers family offices to make informed decisions that align with their unique financial objectives.