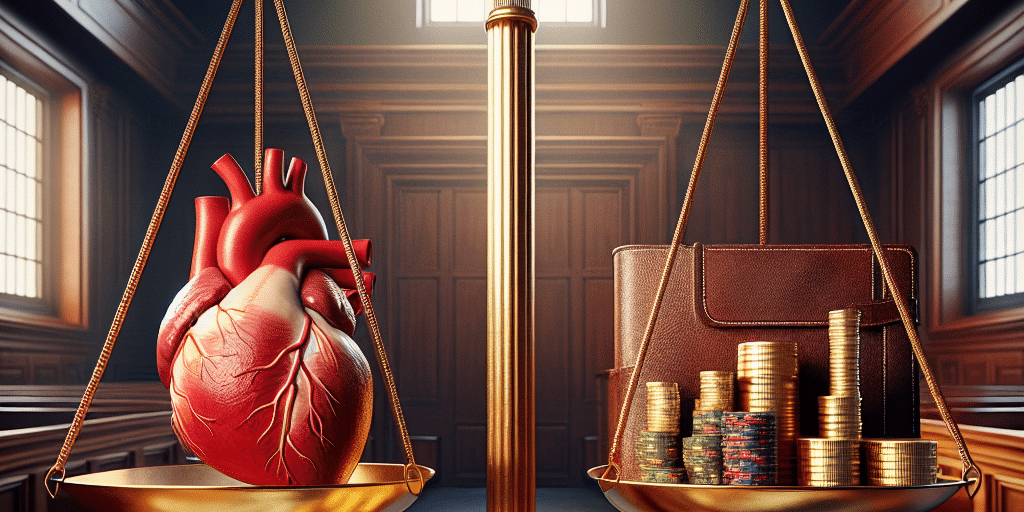

In today’s fast-paced financial landscape, where market fluctuations can feel capricious and returns elusive, a powerful new trend is emerging: aligning investment strategies with family values. This approach transcends traditional financial metrics, focusing instead on cultivating a portfolio that not only aims for economic growth but also reflects the heart and ethos of the family. The art of integrating family values into investing is not only a practice in financial stewardship but also a commitment to a legacy that resonates across generations.

The Rise of Values-Based Investing

Values-based investing has gained significant traction in recent years, driven largely by a generational shift among investors. Millennial and Gen Z investors, in particular, prioritize environmental, social, and governance (ESG) factors when making investment decisions. This shift towards responsible and ethical investing is not merely a trend; it represents a fundamental change in how families perceive their financial roles in society.

Investing with values in mind means taking a holistic approach—one that intertwines the heart and the portfolio. Families are increasingly recognizing that their financial choices have far-reaching implications, from the communities they support to the environmental impacts they foster. This awareness is leading to a call for investment strategies that affirm personal beliefs while potentially driving financial returns.

Defining Family Values

For many, the first step in aligning investment strategies with family values is to define what those values truly are. This process can be as simple as discussing shared beliefs or as complex as a multi-generational retreat focused on vision and purpose. Some families find it helpful to create a family mission statement that encompasses their values and outlines the guiding principles for their investments.

Common values that families might consider include:

Environmental Stewardship: Prioritizing investments in companies that focus on sustainability, renewable energy, or conservation.

Social Responsibility: Supporting organizations that promote social equity, worker rights, and community engagement.

- Ethical Governance: Investing in companies that adhere to high standards of ethics and integrity, promoting transparency and accountability.

The Investment Spectrum: From Traditional to Impact Investing

Once values are identified, families have a variety of investment approaches available to them. Traditional investing typically prioritizes financial returns above all else, while impact investing actively seeks social or environmental benefits alongside financial gain.

Socially Responsible Investing (SRI): This strategy screens investments based on specific ethical guidelines. For instance, families may choose to avoid sectors or companies involved in tobacco, gambling, or fossil fuels while focusing on those that foster positive societal outcomes.

Impact Investing: This goes a step further by targeting investments in projects or companies expected to yield measurable social or environmental benefits. For example, investments in clean technology firms that aim to reduce carbon emissions illustrate a clear alignment between financial goals and environmental responsibility.

- Thematic Investing: This approach allows investors to focus on specific trends that resonate with their values. Themes such as climate change, gender equality, or racial equity can drive decision-making and create portfolios that tell a story reflective of family ethics.

Navigating Challenges

Aligning investments with family values can present challenges, especially when financial performance and ethical considerations seem at odds. Some investors worry that a focus on values may compromise financial returns. However, research and historical data suggest that firms with strong ESG metrics often outperform their peers, especially over the long term. The increasing demand for companies that adhere to ethical practices may lead to greater stability and resilience in the face of market volatility.

Additionally, it’s essential for families to have open conversations about money, investing, and values. Disagreements can arise, particularly when multiple generations are involved, each with their perspectives on risk, return, and responsibility. Facilitating dialogues that allow all voices to be heard fosters understanding and collaboration, strengthening familial bonds while steering clear of potential conflicts.

A Legacy of Values

Ultimately, aligning hearts and portfolios is about more than just financial returns; it’s about crafting a legacy. Families can cultivate an enduring impact through their investments, ensuring that their financial decisions today resonate with their values and aspirations for tomorrow.

Creating a values-aligned portfolio enables families to contribute to causes that matter to them, fostering a sense of purpose and fulfillment. Furthermore, educating younger generations about the significance of values-driven investing helps instill a sense of stewardship and responsibility. By passing down financial wisdom rooted in their core beliefs, families can ensure that their values continue to thrive long after them.

Conclusion

In a world where financial markets are often perceived as dispassionate and driven solely by profit, the concept of aligning investments with family values offers a refreshing perspective. It invites families to participate actively in shaping their financial futures while honoring the principles that matter most to them. By embracing the art of values-based investing, families can forge a path that aligns their hearts with their portfolios, creating a legacy built on intention, responsibility, and meaning. As the trend grows, it has the potential not only to redefine personal wealth management but also to create lasting positive change in society at large.