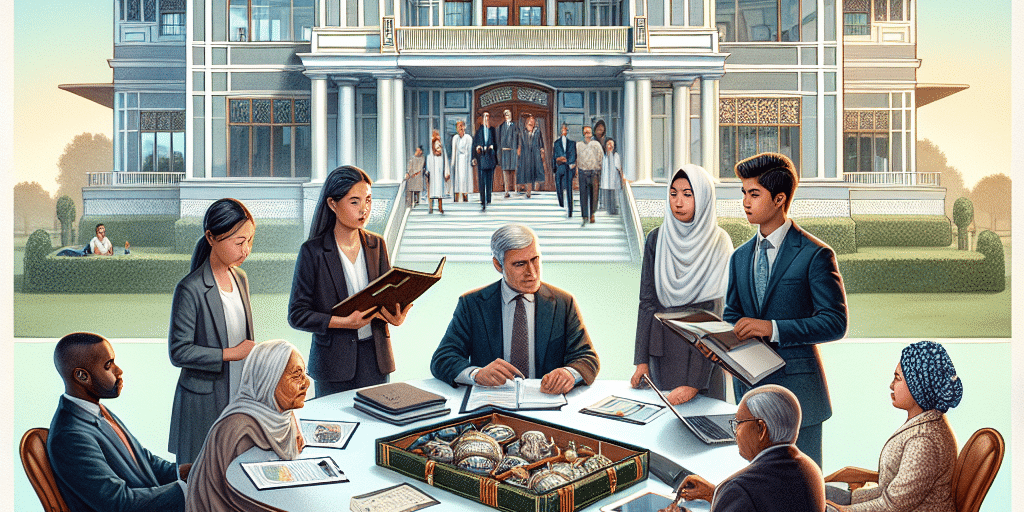

In the intricate landscape of wealth management, family offices stand as a bastion for preserving and growing family wealth across generations. Traditionally, these entities have focused on safeguarding assets, succession planning, and ensuring the family legacy. However, as the dynamics of wealth, family structure, and societal expectations evolve, a pressing question emerges: how can family offices transition from a model of passive inheritance to one of active participation for young heirs?

The Challenge of Passive Inheritance

Historically, many affluent families have taken a somewhat passive approach to involving their heirs in family wealth management. Children often receive financial education only after inheriting wealth, resulting in a disconnection from the family office’s mission, strategies, and operations. This model can breed feelings of entitlement, diminish familial unity, and lead to mismanagement of resources over generations.

The need for a shift in this approach is amplified by the fact that today’s younger generations — often referred to as Millennials and Gen Z — are more attuned to social issues, environmental concerns, and inclusive business practices. They desire to be not just passive recipients of wealth but active contributors to its stewardship. Hence, family offices must rethink their strategies to better engage young heirs.

Creating a Culture of Involvement

In order to cultivate active participation among young heirs, family offices need to foster a culture that welcomes and encourages their involvement. Here are several strategies to consider:

1. Education and Training

Providing financial education from an early age is crucial for developing informed and confident heirs. Family offices should establish structured educational programs that encompass financial literacy, investment principles, and the overarching goals of the family’s wealth. Interactive workshops, mentorship programs, and exposure to real-world investing scenarios can equip young heirs with the skills necessary to make informed decisions.

2. Encouraging Participation in Governance

Involving young heirs in the governance of the family office can promote a sense of ownership and responsibility. Family councils or advisory boards can be structured to include younger members, allowing them to voice their opinions, contribute to decision-making, and understand the intricacies of wealth management. This inclusion can demystify the processes and structures of the family office while fostering accountability.

3. Promoting Philanthropy and Impact Investing

Today’s young people are often driven by a desire to make a positive difference in the world. Family offices can leverage this passion by involving heirs in philanthropic endeavors or impact investing initiatives. By allowing them to play a role in selecting charities, evaluating social enterprises, or driving sustainability efforts, family members will not only help them develop a sense of purpose but also strengthen their connection to the family legacy.

4. Building Networking Opportunities

Young heirs should be encouraged to connect with peers in similarly positioned families and industry professionals. Networking events, conferences, or retreats can facilitate relationship-building, knowledge sharing, and collaborative projects. Engaging with peers who share similar backgrounds can provide invaluable learning experiences and cultivate a broader understanding of wealth management.

5. Leveraging Technology

As digital natives, younger generations are adept with technology and digital financial tools. Family offices should harness technology to provide clear and accessible insights into the family’s assets, investment opportunities, and performance reporting. The use of apps and online platforms can empower young heirs to monitor investments and understand financial decisions with ease.

6. Fostering Open Communication

Communication between generations is vital in creating a healthy family dynamic. Family offices should ensure that there are open lines of communication regarding financial matters, expectations, and family values. Regular family meetings can provide a platform for discussing both operational and emotional aspects of wealth management, fostering transparency and trust.

Conclusion: A New Legacy of Stewardship

As family offices navigate the complexities of modern wealth management, the importance of involving young heirs in decision-making processes becomes increasingly clear. By fostering a culture of active participation, family offices can ensure the continuity of personal values and investment philosophies that have defined their legacies.

Moving beyond mere inheritance, families can cultivate a new generation of informed and engaged stewards who are equipped to navigate the challenges of modern wealth. In this way, the legacy of affluence can thrive, not just as an inherited asset, but as a shared mission to create lasting impact and foster positive change for generations to come.