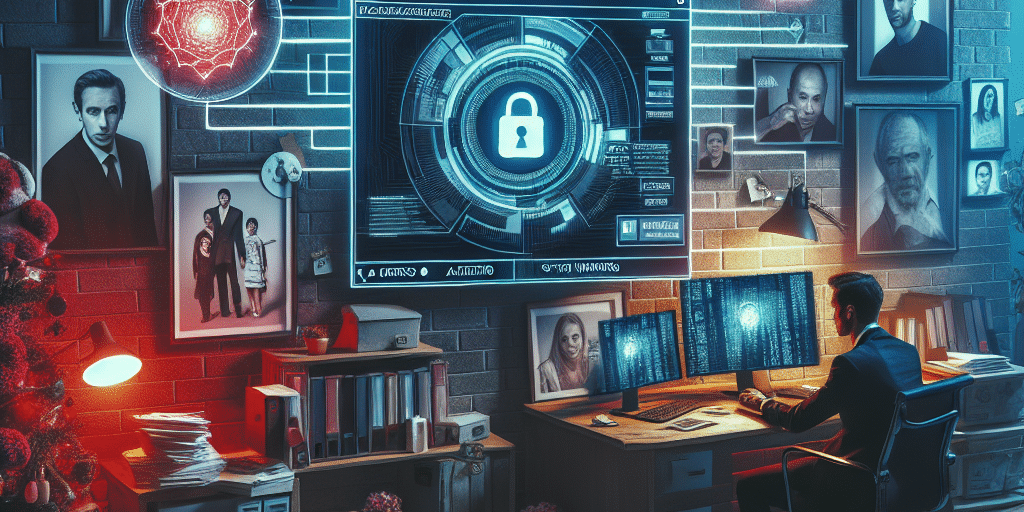

In an age where digitization reigns supreme, the landscape of finance, wealth management, and privacy has evolved rapidly. Family offices, established to manage the financial and personal affairs of high-net-worth individuals and families, are increasingly becoming prime targets for cyber threats. Understanding the unique vulnerabilities that family offices face is crucial to mitigate risks and safeguard assets.

The Unique Nature of Family Offices

Family offices serve a variety of functions, including investment management, estate planning, philanthropy, tax optimization, and personal services. Their intimate nature often leads to a consolidation of sensitive information, from financial records to personal data of family members. This centralization of data renders family offices particularly vulnerable to cyberattacks.

Dimensions of Risk in Family Offices

Complexity of Assets and Investments:

Family offices manage diverse investment portfolios that may include real estate, private equity, hedge funds, and more. Each asset can have its own set of vulnerabilities, from mismanaged digital records to unaccounted third-party vendor risks.

Limited Cybersecurity Expertise:

Many family offices lack dedicated IT and cybersecurity teams, relying instead on outsourced services or personnel who may not have specialized training. This gap in expertise can hinder effective risk assessments and make it difficult to maintain robust security protocols.

High Value of Personal and Financial Information:

The wealth held by families or individuals serviced by family offices makes them attractive targets. Cybercriminals are often motivated by the prospect of sensitive financial information, which could be exploited for fraudulent activities or extortion.

Intergenerational Challenges:

As family offices often span multiple generations, differing levels of tech-savviness can create vulnerabilities. Older family members may be less familiar with cybersecurity best practices, making them more susceptible to phishing scams and other exploits.

- Use of Third-party Vendors:

Family offices frequently work with a range of third-party service providers, including financial advisors, real estate managers, and legal professionals. Each of these partners can introduce vulnerabilities if not properly vetted for their cybersecurity practices.

Common Cyber Threats Facing Family Offices

Family offices encounter several specific cyber threats that can jeopardize their operations and security:

Phishing Attacks:

The use of deceptive emails designed to trick users into divulging sensitive information is rampant. Cybercriminals utilize tailored messages that exploit personal connections, increasing the likelihood of success.

Ransomware:

Family offices are high-value targets for ransomware attacks, where hackers encrypt sensitive data and demand a ransom for its release. Given the critical nature of the information that family offices hold, many might feel pressured to pay.

Social Engineering:

Criminals often rely on psychological manipulation to exploit individuals within family offices. This can include impersonating trusted advisors or creating scenarios that result in unauthorized access to sensitive systems and information.

Malware and Spyware:

Malicious software can be deployed to steal credentials, track keystrokes, and gain unauthorized access to networks. Family office workflows—including transactions and personal communications—can offer fertile ground for such threats.

- Insider Threats:

Employees or contractors with access to sensitive information might become sources of risk, either intentionally or accidentally. Insufficient supervision and lack of security culture in smaller operations may exacerbate this risk.

Best Practices for Securing Family Offices

To enhance cybersecurity resilience, family offices must adopt a proactive approach:

Risk Assessment and Policies:

Conduct regular risk assessments to identify vulnerabilities. Establish clear cybersecurity policies and protocols that employees must follow.

Employee Training:

Regularly train all staff—including family members—on cybersecurity best practices and current threats. Regular workshops can bolster awareness and vigilance.

Robust Authentication Methods:

Implement multifactor authentication (MFA) and strong, unique password policies to protect access to sensitive information and systems.

Vendor Management:

Vet third-party vendors thoroughly, examining their cybersecurity practices before engaging their services. Establish clear expectations regarding data protection.

Incident Response Plan:

Develop a comprehensive incident response plan that outlines specific steps to take in the event of a cyber incident. Test this plan regularly to ensure readiness.

- Regular Audits and Updates:

Conduct continuous cybersecurity audits and ensure that all software is kept up to date to minimize vulnerabilities.

Conclusion

As the digital landscape continues to evolve, family offices must remain vigilant in addressing the unique cyber threats posed to them. Much like traditional risk management practices, a proactive and informed approach to cybersecurity will be essential in protecting family legacies and ensuring the continuity of their financial well-being. Cybersecurity is no longer just an IT concern—it’s a vital component of family governance and wealth preservation in the modern world.