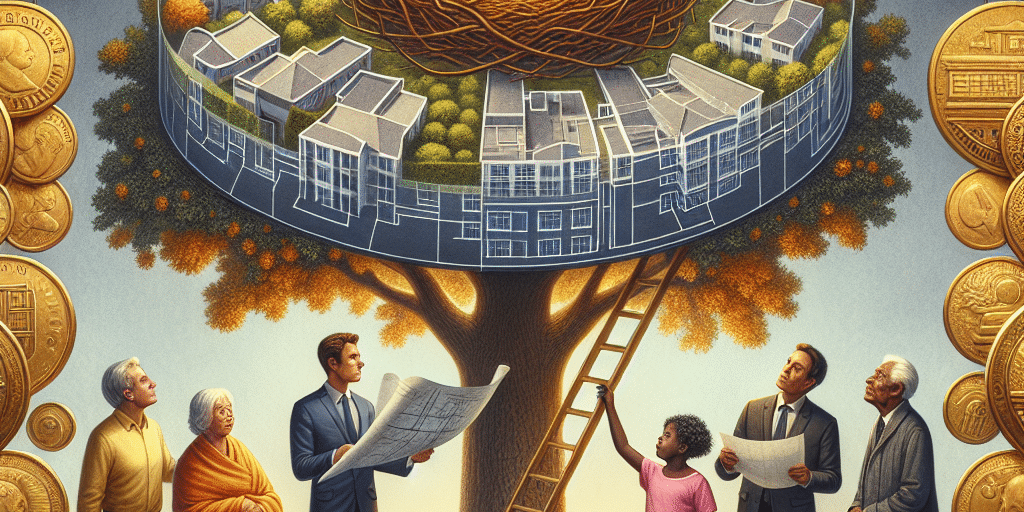

In an ever-evolving financial landscape, where wealth is rapidly changing hands and opportunities are expanding globally, family offices have emerged as a vital solution for affluent families seeking to manage their wealth effectively. These specialized entities offer a bespoke service model that caters to the unique needs of high-net-worth individuals and their families. As we venture deeper into the intricacies of family offices, we uncover why they are becoming essential for today’s wealthy families.

What is a Family Office?

A family office is a private wealth management advisory firm that serves high-net-worth families. Its core purpose is to centralize and manage the family’s financial and personal affairs comprehensively. Family offices can be broadly categorized into two types: single-family offices (SFOs), which serve one family exclusively, and multi-family offices (MFOs), which cater to multiple families by pooling resources and expertise.

Family offices offer a wide range of services, including investment management, tax planning, estate planning, philanthropy, and more. They serve as a central point for coordinating all aspects of a family’s wealth and legacy, ensuring that the family’s financial health is not only maintained but also optimized over generations.

The Rise of Family Offices

1. Wealth Transition

One of the most significant factors driving the rise of family offices is the generational transfer of wealth. With an estimated $68 trillion expected to be inherited by younger generations over the next few decades, the need for structured wealth management increases. Family offices help families navigate complex financial landscapes while preparing the next generation to take on financial stewardship.

2. Complex Financial Landscapes

As families amass wealth, their financial situations often become increasingly complex. Investments in diverse asset classes, international tax liabilities, and a wide array of financial instruments necessitate expert management. Family offices provide a sophisticated approach that integrates investment strategies and tax planning into a single cohesive framework.

3. Personalized Approach

Family offices stand out for their tailored services designed to meet the specific needs and goals of each family. The personalization of financial services is a significant draw for high-net-worth individuals who may find traditional financial institutions lack the attention and customization they require. Family offices are more agile, enabling families to adapt quickly to changing market conditions and personal situations.

4. Focus on Legacy and Values

Wealthy families increasingly wish to align their financial practices with their values and legacy goals. Family offices help in the development and implementation of family governance strategies and philanthropic initiatives that reflect the family’s values. This focus on social responsibility enhances their legacy while allowing families to contribute positively to society.

5. Comprehensive Risk Management

In today’s world, risks are omnipresent and come in various forms, from market volatility to regulatory changes and cybersecurity threats. Family offices employ a comprehensive risk management approach, ensuring that families are prepared to mitigate risks and protect their assets. This proactive strategy is crucial in safeguarding wealth against unseen threats.

The Benefits of Family Offices

Holistic Wealth Management: Family offices treat financial management as a cohesive discipline rather than isolated functions. This synergy fosters a deeper understanding of the family’s financial landscape and aids in making informed decisions.

Intergenerational Education: A core function of family offices is providing education to younger generations about financial literacy and investment principles. By involving family members in discussions, family offices facilitate seamless transitions of wealth.

Time Efficiency: Managing substantial wealth can be time-consuming and stressful. Family offices relieve families of this burden, allowing them to focus on personal interests while ensuring their financial matters are handled professionally.

- Access to Exclusive Opportunities: Family offices often have access to private investments and unique deals that are not available in retail markets. This can open doors to lucrative opportunities in alternative asset classes, enhancing overall portfolio performance.

Conclusion

As financial landscapes shift and wealth becomes ever more complex, family offices are no longer a luxury but a necessity for affluent families. These entities provide a personalized, comprehensive, and strategic approach to wealth management, ensuring that families not only protect their assets but also align their financial practices with their core values. As the trend continues to grow, family offices are positioned to play a crucial role in shaping the future of wealth management for generations to come. Embracing this innovative model is not just a savvy financial decision; it’s a strategic move towards securing a legacy that can endure the test of time.