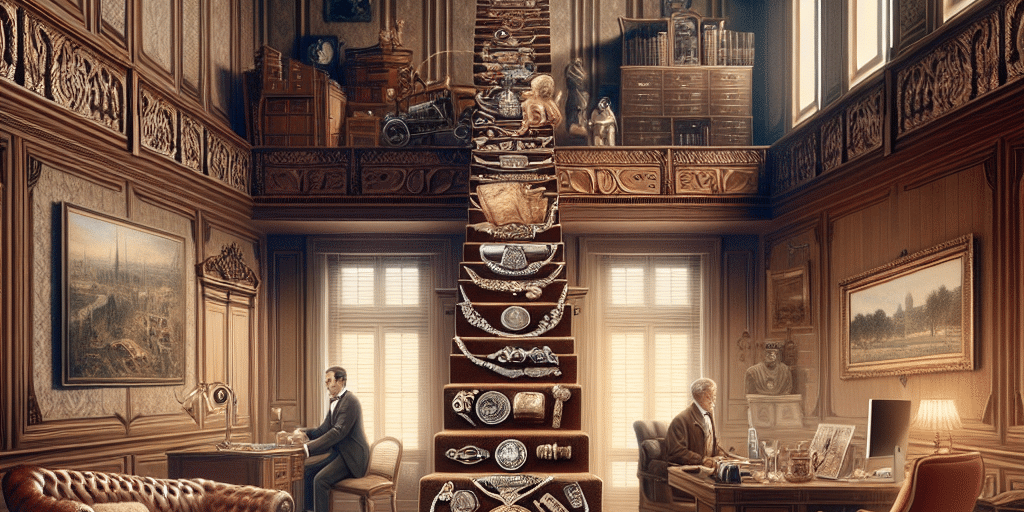

In the world of wealth management, family offices have long been centers of financial stewardship for the affluent. Traditionally, these entities have focused on the typical investment platforms: stocks, bonds, real estate, and private equity. However, in recent years, there has been a notable shift towards collectibles and tangible assets, reflecting an evolution in how wealth is managed, preserved, and grown. This article explores the evolution of collectibles in family offices, from cherished heirlooms to high-value investments.

Historical Context: The Heirloom Mentality

Family offices have historically operated under the principle of legacy; preserving wealth for future generations has been a guiding ethos. Prior to the 21st century, collectibles were often viewed as heirlooms—items passed down from generation to generation without a formal assessment of their monetary value. These included everything from fine art and antiques to vintage wines and rare coins. Their significance lay in their sentimental value, serving as reminders of family history and heritage.

While collecting was often an informal pastime, certain families accumulated remarkable collections that showcased their tastes, interests, and experiences. The focus was on personal significance rather than market valuation.

The Shift: Collectibles as Financial Instruments

As economic landscapes shifted and markets became more volatile post-2008 financial crisis, family offices began reassessing their investment strategies. The realization that collectibles could represent both emotional and financial value sparked a new trend. Collectibles began gaining recognition as alternative investments—assets that could complement traditional portfolios and provide diversification.

The Rise of Digital Assets

The surge in wealth, alongside advancements in technology, has birthed new types of collectibles, specifically digital assets like non-fungible tokens (NFTs). NFTs can encapsulate digital art, music, gaming characters, and virtual real estate, creating a fusion of technology and collectibility. Family offices now find themselves evaluating digital collectibles, seeing not just the potential for appreciation in value but also the opportunity to engage with younger generations who are more inclined to invest in technology-driven assets.

Luxury Items: A Growing Focus

Luxury collectibles, including high-end watches, fine art, and vintage cars, have also seen increased interest from family offices. Unlike traditional stocks or bonds, these tangible assets can offer a hedge against inflation and market downturns. Auction houses and specialized dealers have emerged to cater to this growing demand, providing families with both the education and market access needed to build high-value collections.

Investors like Warren Buffett have famously expressed skepticism about collecting as a serious investment strategy. However, the tangible nature of collectibles presents a unique opportunity for family offices, particularly when accompanied by thorough research and financial due diligence.

Beyond Valuation: Establishing a Collectibles Strategy

As family offices begin to incorporate collectibles into their investment strategies, several key considerations emerge:

1. Valuation and Authentication

Incorporating collectibles requires an understanding of their valuation and authentication processes. Unlike stock markets, where valuations are often straightforward, the collectible market is more subjective and prone to fluctuations. Family offices invest in expert appraisers and authenticity certificates, mitigating the risk of overpaying for items.

2. Provenance and Storytelling

For many collectors, provenance—the history of an item’s ownership—is critical. The narrative behind a collection can significantly influence its value. Family offices are likely to prioritize provenance, ensuring their collections tell meaningful stories that resonate with both current and future generations.

3. Management and Insurance

Similar to other investments, collectibles require a management plan. This encompasses not only the care and maintenance of the items but also insurance coverage to protect against loss or damage. Many family offices are creating dedicated teams or leveraging specialized third-party services to overlook these aspects.

4. Diversification and Risk Management

Just as with traditional investments, diversifying across various types of collectibles can mitigate risk. Family offices might aim to create balanced portfolios that include a mix of art, antiques, luxury items, and emerging digital assets.

Conclusion: The New Landscape of Wealth Management

The evolution of collectibles in family offices reflects a broader shift in wealth management that underscores the importance of diversification, emotional significance, and strategic foresight. As families navigate this transformative landscape, they must balance the allure of collecting with prudent investment practices tailored to their financial goals.

Looking ahead, the intersection of traditional art markets and emerging digital trends promises to redefine the concept of collectibles. Family offices are uniquely positioned to harness this evolution, transforming heirlooms into high-value investments that not only preserve wealth but enrich family legacy for generations to come.