In recent years, family offices, which manage the wealth and investments of high-net-worth families, have increasingly shifted their focus from traditional investment strategies to embrace the dynamic and often complex world of hedge funds. This evolution underscores a broader transformation in wealth management as these entities seek innovative approaches to enhance returns, diversify portfolios, and adapt to changing market environments.

Historical Context: The Traditional Family Office Model

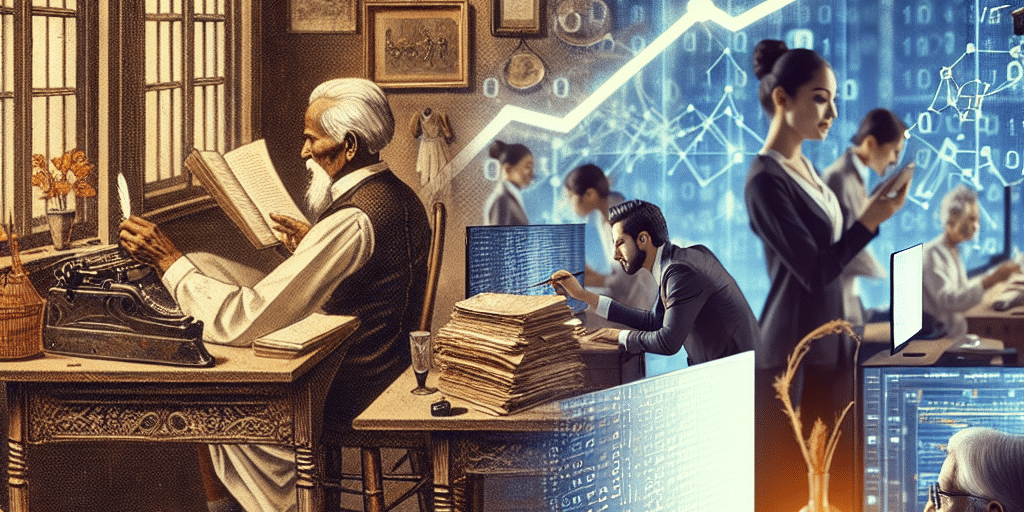

Historically, family offices were primarily concerned with preserving wealth through conservative investments in real estate, fixed income, and blue-chip stocks. The core principle was risk aversion, as families aimed to sustain their wealth across generations. The management of these family-led enterprises often leaned on trusted advisors with expertise in traditional investments, fostering a culture that valued stability over aggressive growth.

While this model has its merits, the rise of globalization, technological advancements, and increasingly volatile markets has prompted many family offices to reevaluate their strategies. Family businesses that once prospered exclusively through traditional channels are now recognizing the need for adaptation and growth.

The Hedge Fund Landscape: New Opportunities

Hedge funds offer a plethora of investment strategies, including long/short equity, event-driven tactics, and global macroeconomic plays, each catering to different risk appetites and return expectations. Unlike the conventional investment vehicles that family offices are accustomed to, hedge funds are characterized by their ability to generate returns in up and down markets through their multifaceted approaches.

This versatility is particularly appealing in today’s economic climate, where uncertainty reigns. Family offices are increasingly favoring hedge funds as an adaptive solution, as they can offer potential for superior returns through sophisticated strategies. Hedge funds’ ability to utilize leverage, derivatives, and short selling enhances their potential for performance, attracting the interest of family offices looking to keep pace with or outperform market trends.

The Shift Towards Diversification

The desire for diversification is one of the most compelling reasons family offices are embracing hedge fund investments. As market correlations rise and the traditional 60/40 investment portfolio becomes less effective in managing risk, family offices are recognizing the need for broader diversification across asset classes. Hedge funds can act as a counterbalance in an investment portfolio, providing exposure to unique strategies and asset classes not typically accessible through traditional investments.

Moreover, family offices are increasingly drawn to niche hedge fund strategies, such as credit-focused funds, distressed assets, and emerging markets. By diversifying beyond conventional equities and bonds, family offices hope to uncover new sources of alpha and reduce overall portfolio volatility.

Embracing Innovation: Technology and Data Analytics

Another crucial factor prompting family offices to explore hedge fund opportunities is the advancement of technology and data analytics. Access to real-time data, algorithm-driven insights, and machine-learning systems allows family offices to make more informed and timely investment decisions. These innovations enable family offices to evaluate hedge fund performance effectively and assess risk parameters with a level of granularity previously unavailable.

Furthermore, many hedge funds have themselves adopted technological advancements to optimize trading strategies and improve operational efficiency, making the collaboration between family offices and hedge funds more fruitful than ever.

A Cultural Shift: Understanding Hedge Fund Dynamics

Transitioning from traditional investment vehicles to hedge funds requires a cultural shift within family offices. As families become more open to diverse investment approaches, the need for education and a thorough understanding of hedge fund dynamics becomes paramount. Many family offices are investing in building their in-house expertise or partnering with consultants to navigate the complexities of hedge fund investing.

This newfound engagement may involve participating in due diligence processes, understanding risk management frameworks, and developing relationships with hedge fund managers who align with the family’s values and investment objectives.

Future Outlook: Balancing Tradition and Innovation

As family offices continue to embrace hedge fund opportunities, the future of wealth management is poised for change. While the traditional values of stewardship and long-term wealth preservation will remain at the forefront, the integration of innovative investment strategies will likely redefine the family office landscape.

The merging of tradition and innovation opens doors to potential rewards, but it also calls for vigilance. Family offices must maintain a balance, ensuring that the pursuit of new opportunities does not erode the foundational principles of wealth management. By blending time-honored values with innovative strategies, family offices can enhance their portfolios, navigate uncertain markets, and, ultimately, secure their legacies for generations to come.

In this evolving realm, understanding when to embrace change and when to lean on tradition will be key to the success of family offices as they venture into the world of hedge fund investments.