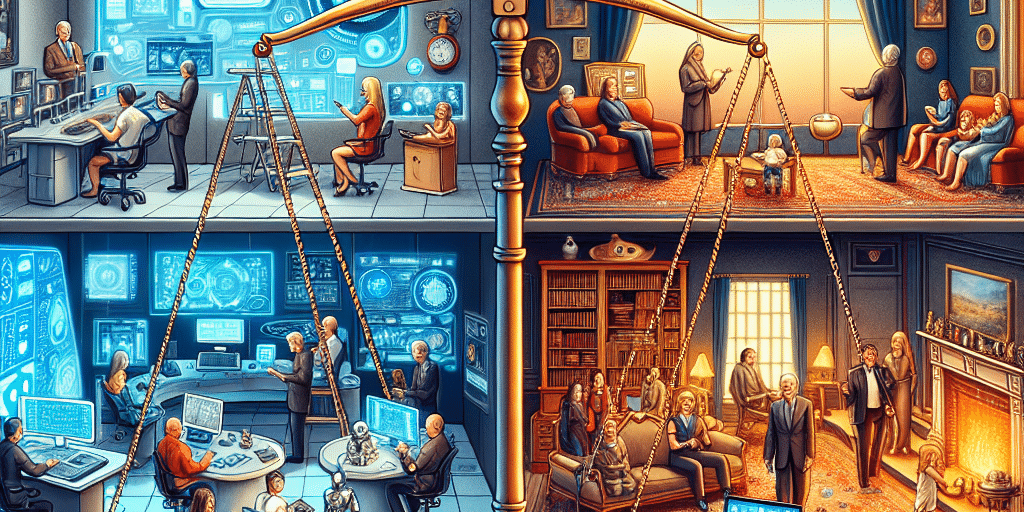

In recent years, family offices—the private wealth management advisory firms that serve ultra-high-net-worth individuals and their families—have experienced a transformative shift. With advances in technology reshaping the financial landscape, traditional practices that have guided family offices for generations are now in a delicate dance with digital solutions. This juxtaposition of technology and tradition raises a critical question: how can family offices find the right balance between adhering to time-honored practices and embracing modern innovations?

The Rise of Technology in Family Office Management

The wealth management arena has undergone dramatic changes due to technological advancements. Family offices are increasingly harnessing digital tools to streamline operations, improve decision-making, and enhance client experiences. Technologies such as artificial intelligence, data analytics, blockchain, and cloud computing are revolutionizing how family offices operate.

For instance, AI algorithms can analyze vast amounts of data to provide insights into investment opportunities, allowing managers to make informed decisions with unprecedented speed. Similarly, blockchain technology ensures secure and transparent record-keeping, while cloud-based platforms facilitate seamless collaboration and communication among family office teams, irrespective of geographical barriers.

The Case for Tradition

While technology offers numerous advantages, the traditional values that have long governed family offices cannot be overlooked. At the heart of traditional family office management are the relationships built on trust, values, and interpersonal communication. Family offices thrive on understanding the unique emotional complexities of their clients’ needs, which often require a personal touch—something that technology alone cannot provide.

Moreover, many families prefer the wisdom that comes from experience. Traditional wealth management involves a deep understanding of the family’s values, history, and long-term goals. Strategies shaped by experience often align closely with the family’s vision and help to foster a sense of stability across generations.

Striking the Right Balance

The challenge for family offices is to blend the best of both worlds. Here are some strategies to achieve this balance effectively:

1. Assess Operational Needs

Family offices should start by evaluating their operational needs and identifying areas where technology can complement traditional practices. For example, data management and reporting processes can be automated without compromising the personal relationship aspect of client interactions. Understanding which functions benefit from technology while maintaining the integrity of family values is crucial.

2. Invest in Training and Development

To bridge the gap between technology and tradition, family office teams must receive proper training. By fostering a culture of continuous learning, team members become adept at using new tools while also appreciating the heritage and values that shape their office’s unique identity. This dual approach not only enhances efficiency but also preserves the essence of family governance.

3. Maintain Open Communication

Regular communication between family members and family office management is vital. Encourage discussions about how technology can enhance or support traditional practices. By involving family members in the decision-making process regarding technology adoption, family offices can ensure alignment with their core values while addressing the family’s evolving needs.

4. Create a Hybrid Model

Consider implementing a hybrid model that leverages both technology and traditional methods. For instance, combining face-to-face meetings with virtual consultations can accommodate different preferences and schedules, ensuring deeper engagement while maximizing convenience. Similarly, using digital tools alongside personalized investment reports can enrich communication and decision-making.

Conclusion

In a world where technology is rapidly changing the financial landscape, family offices have a unique opportunity to redefine their management strategies. By recognizing the value of traditional practices while embracing modern technology, family offices can cultivate a more holistic approach that honors family legacies and prepares them for future challenges. The goal should not be to replace tradition with technology, but rather to create a synergistic relationship where both can thrive, thus ensuring the sustainable growth and preservation of family wealth for generations to come. Balancing technology and tradition in family office management is not merely a challenge; it is an opportunity to forge a resilient future grounded in the values that have guided families throughout history.