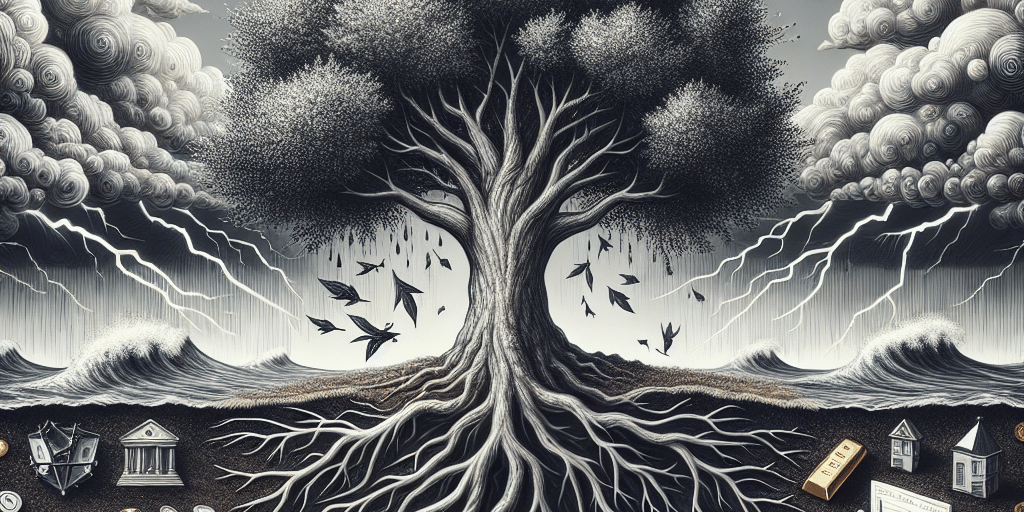

Building Resilience: Diversifying Family Office Portfolios in Volatile Markets

As economic uncertainties continue to loom, family offices are increasingly challenged to safeguard and grow their wealth. The dynamic landscape of global finance, marked by volatility and unpredictability, reinforces the need for a strategic approach to investment. One effective method for preserving wealth and mitigating risks is through portfolio diversification. This article explores how family offices can build resilience by diversifying their investment portfolios amid turbulent market conditions.

Understanding Family Offices

Family offices manage the financial assets of affluent families, providing tailored services that encompass investment management, estate planning, tax advice, and philanthropic endeavors. The primary objective is not only to grow wealth but also to sustain it across generations. Given their complexity and the unique needs of wealthy individuals or families, family offices must navigate market fluctuations with a robust and flexible investment strategy.

The Importance of Diversification

Diversification involves spreading investments across various asset classes, sectors, and geographic locations to reduce risk. In volatile markets, asset values can fluctuate significantly, and concentrated investments may amplify losses. By diversifying, family offices can achieve a more stable portfolio performance, as different assets react differently to market conditions.

Strategic Diversification Approaches

Asset Classes: Family offices should consider allocating funds across a range of asset classes, including equities, fixed income, real estate, private equity, hedge funds, and commodities. Each asset class has distinct characteristics and performance drivers, which can serve to cushion the portfolio during downturns in specific sectors.

Geographic Distribution: Investing in various geographical regions can also help mitigate risks associated with localized economic downturns. Engaging with emerging markets, which may offer growth opportunities despite volatility, can enhance portfolio resilience.

Sector Diversification: Allocating investments across different sectors—technology, healthcare, consumer goods, energy, and more—can further protect against sector-specific downturns. For example, during economic slowdowns, certain sectors may remain resilient, providing a buffer against overall portfolio decline.

Alternative Investments: Expanding into alternative investments, such as venture capital, real estate investments trusts (REITs), and private debt, can yield attractive returns while also providing diversification benefits. These assets often have low correlations with traditional markets, enhancing overall portfolio stability.

- Liquidity Management: Maintaining a balance between liquid and illiquid investments is crucial. Family offices should ensure they have enough liquidity to meet ongoing obligations and take advantage of emerging investment opportunities without being forced to sell other assets at a loss.

Embracing Innovative Strategies

As traditional diversification techniques become increasingly common, family offices might also explore innovative investment strategies. These could include:

ESG Investing: Environmental, social, and governance (ESG) investing has gained momentum and can provide both ethical alignment and potential financial rewards. Integrating ESG criteria into investment decisions can help family offices align their portfolios with their values and societal goals while mitigating risks associated with changing regulations and consumer preferences.

Impact Investing: Similar to ESG, impact investing seeks to generate positive social and environmental impacts alongside financial returns. Aligning investments with family values can create a sense of purpose, enhancing satisfaction and fostering multigenerational wealth transfer.

- Technology-Driven Investments: The digital revolution presents family offices with opportunities to invest in technology companies and innovations that reshape industries. Embracing fintech, healthtech, and proptech can yield substantial returns if managed diligently.

Building a Resilient Governance Structure

Diversification is not solely about asset allocation; it also requires a sound governance structure. Family offices should establish clear investment policies, risk management frameworks, and a dedicated investment committee responsible for monitoring performance and making timely adjustments. Regular assessments of investment strategies, market trends, and performance metrics can ensure that portfolios remain aligned with the family’s long-term financial goals.

Conclusion

In an era marked by economic fluctuations and market uncertainties, building resilience through diversification is a prudent strategy for family offices. By strategically allocating investments across asset classes, sectors, and geographies, leveraging alternative investments, and embracing innovative strategies, family offices can better navigate the complexities of volatile markets. With a strong governance framework supporting these efforts, family offices can safeguard their wealth, uphold their legacies, and position themselves for future growth. Resilience isn’t just about weathering storms; it’s about thriving in environments that challenge the status quo.