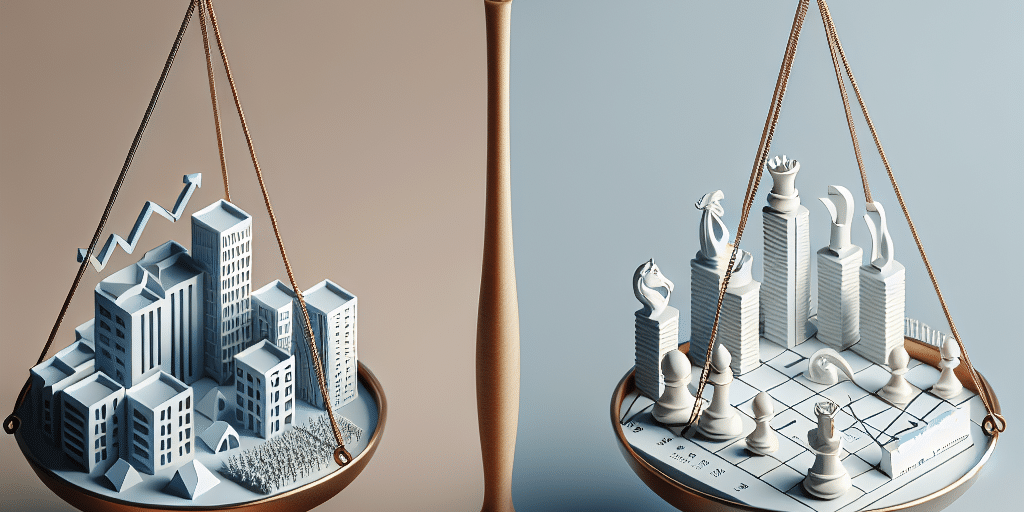

The residential real estate market is undergoing a period of transformation, marked by shifting demand dynamics, changing interest rates, and evolving consumer preferences. Family offices—wealth management advisory firms that serve high-net-worth individuals and families—are increasingly navigating these complexities as they seek to optimize their real estate investments. This article delves into current housing market trends and how family offices can develop strategies to balance their portfolios amidst fluctuating conditions.

Current Housing Market Trends

1. Interest Rate Fluctuations

In the wake of persistent inflation, central banks globally have adopted tighter monetary policies, leading to rising interest rates. Higher borrowing costs have cooled the housing demand, slowing down price appreciation in many markets. Family offices must stay vigilant about the effects of these rate changes, understanding that financing strategies will critically impact their investment choices.

2. Evolving Buyer Preferences

The pandemic has fundamentally altered how people view housing. Remote work has led to an increased demand for homes in suburban areas, where families seek more space, and a better quality of life. Conversely, urban centers, which once epitomized vitality and convenience, have seen some declining interest as families reassess their priorities. Family offices need to consider these shifts when identifying lucrative investment opportunities.

3. Sustainability and Eco-Friendly Homes

As environmental concerns grow, there is a substantial shift toward sustainable living. Eco-friendly homes with energy-efficient features are becoming increasingly desirable among buyers. Family offices can leverage this trend by investing in properties that not only meet current market demands but also align with emerging values around sustainability.

4. Technological Integration

The adoption of technology within real estate—from smart home features to digital transactions—is revolutionizing the industry. Family offices should consider the importance of technology in enhancing property value and catering to modern tenants’ expectations.

Strategic Approaches for Family Offices

Given these market trends, family offices must adopt strategic approaches to real estate investments that are not only adept at navigating current challenges but also structured to capitalize on future opportunities.

1. Diversification

Family offices should pursue diverse real estate investments across various asset classes, including residential, commercial, and mixed-use properties. Investing in varied geographic markets can mitigate risks associated with localized housing downturns and help capture growth in burgeoning regions.

2. Long-Term Focus with Short-Term Flexibility

Real estate should be viewed as a long-term investment, yet family offices must remain flexible and responsive to short-term market fluctuations. By sticking to long-term goals while having the agility to capitalize on immediate opportunities—such as distressed assets or properties in emerging markets—family offices can enhance their portfolio’s resilience.

3. Sustainability as a Value Driver

Investing in green buildings and retrofitting existing properties to meet eco-friendly standards can unlock value and appeal to a growing segment of environmentally conscious buyers and renters. Family offices can create a competitive advantage by positioning their portfolios toward sustainable real estate.

4. Data-Driven Decision Making

Employing data analytics and leveraging technology can significantly improve investment decision-making. Family offices should utilize predictive analytics to assess housing market trends, evaluate prospective assets, and conduct in-depth market research. This data-driven approach allows for more informed choices that align with both current realities and future projections.

5. Building Relationships and Networking

The real estate market thrives on relationships. Family offices should invest time in networking with professionals, from real estate agents to developers and financial analysts. Forming strong partnerships can lead to exclusive investment opportunities and invaluable insights into market trends.

Conclusion

The housing market is a complex landscape influenced by shifting trends and macroeconomic factors. Family offices have a unique opportunity to navigate this balancing act by developing robust, strategic approaches to their real estate investments. By remaining agile and informed—leveraging diversification, sustainability, data analytics, and strong relationships—family offices can adeptly respond to the challenges and capitalize on the opportunities presented by the current housing market landscape, thereby ensuring long-term success for their investment portfolios. As they progress, their strategies will not only preserve family wealth but may also contribute positively to the communities in which they invest.