Family Offices as Guardians of Heritage: Crafting Effective Succession Plans

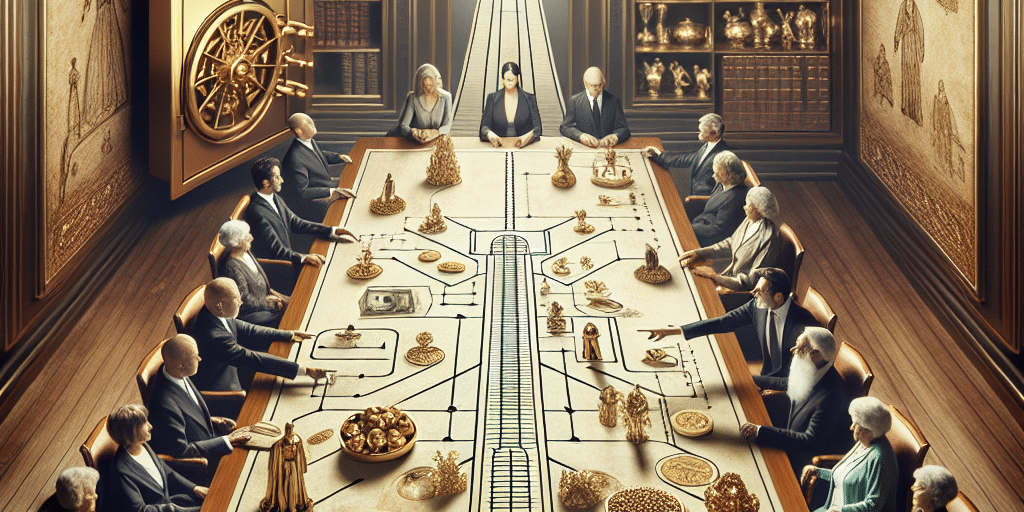

In an era characterized by rapid change and uncertainty, the role of family offices has evolved significantly. Traditionally focused on wealth management and investment strategies, these entities have increasingly become custodians of family heritage and values. As stewards of legacy, family offices possess unique responsibilities when it comes to crafting effective succession plans. This article delves into the multifaceted roles of family offices as guardians of heritage and explores essential strategies for implementing robust succession planning.

Understanding Family Offices

Family offices are private wealth management advisory firms that serve ultra-high-net-worth families. They offer a suite of services, including investment management, tax planning, estate planning, and philanthropic guidance. Beyond financial stewardship, family offices aim to preserve and grow family legacies, ensuring that values and traditions are passed down through generations.

The Importance of Heritage

Heritage encompasses more than just wealth; it embodies a family’s history, values, and identity. A strong sense of heritage can foster unity, purpose, and resilience among family members. In many cases, it is the emotional bonds and shared narratives that bind a family together, making it essential to integrate heritage into succession planning.

Challenges in Succession Planning

Despite the significance of succession planning, many families encounter challenges, including:

Communication Gaps: Open dialogue about wealth and family values can be uncomfortable, leading to misunderstandings and rifts.

Diverging Interests: As families grow and diversify, individual members’ goals may clash with collective interests, complicating succession planning.

Lack of Preparedness: Heirs may feel unprepared to assume leadership roles within the family business or finances, or they may lack a comprehensive understanding of family values and heritage.

- Resistance to Change: Family members may cling to traditional practices that no longer serve the family’s evolving needs, making it hard to formulate a succession plan that accommodates growth and innovation.

Crafting an Effective Succession Plan

To overcome these challenges, family offices must take a holistic approach to succession planning, ensuring it reflects both financial objectives and family heritage. Here are several key strategies:

Incorporate Family Values into Planning: Succession plans should begin with conversations that center on the family’s core values and mission. Family workshops can help articulate a vision that resonates with younger generations, fostering a sense of identity and purpose.

Educate Heirs: Providing heirs with financial education and exposure to family businesses is crucial. Family offices can create mentorship programs or internships that allow younger family members to gain hands-on experience and develop the skills needed for succession.

Establish Governance Structures: Clear governance structures help define roles and responsibilities. Family councils, where family members can participate in decision-making, can provide a platform for discussing the family’s vision and addressing conflicts constructively.

Promote Open Communication: Regular family meetings dedicated to discussing heritage, values, and succession can facilitate transparent communication. Encouraging candid discussions fosters trust and minimizes misunderstandings.

Create a Family Constitution: A family constitution outlines the family’s mission and values, governance structures, and rules for involvement in the family business. This living document can strengthen family unity and serve as a reference point for decision-making.

Philanthropy as a Unifying Force: Engaging in philanthropic initiatives not only reinforces family values but also cultivates a sense of purpose among family members. Collective charitable endeavors can promote collaboration and deepen familial bonds.

- Evaluate and Adapt: Succession planning is not a one-time event; it requires ongoing assessment. Family offices should regularly review and adapt their strategies in response to changes in family dynamics, market conditions, and personal circumstances.

The Role of Family Offices Moving Forward

As guardians of both wealth and heritage, family offices are uniquely positioned to influence how families navigate succession planning. By prioritizing heritage and incorporating it into comprehensive strategies, they can help ensure that family legacies endure beyond financial metrics.

In conclusion, crafting effective succession plans is crucial for preserving both the wealth and the enduring narratives that define family identity. As family offices embrace their role as custodians of heritage, they can cultivate a future where family values thrive alongside financial prosperity, fostering a sense of belonging and continuity for generations to come.