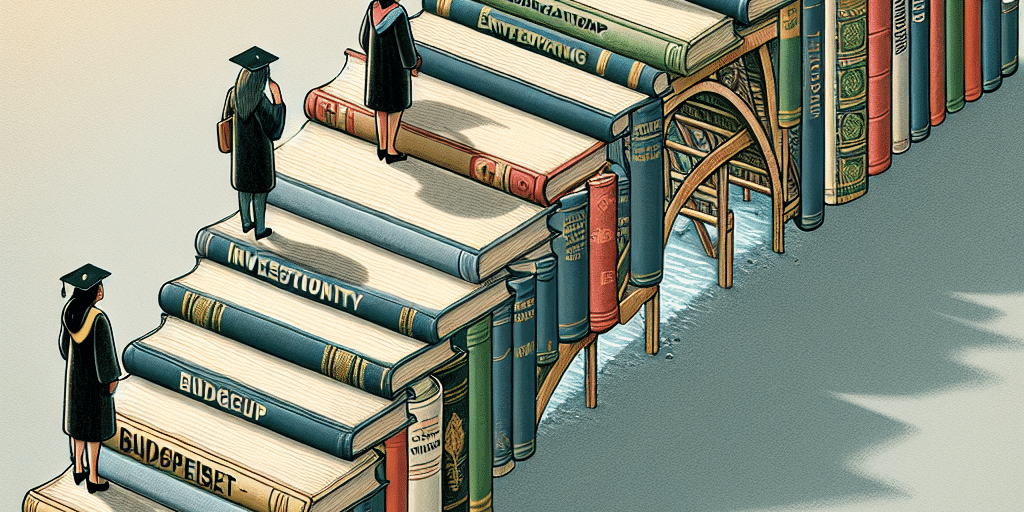

In today’s rapidly evolving economic landscape, wealth preparedness is not solely the domain of the affluent. As economic uncertainties loom and the disparities between different socioeconomic classes continue to widen, the importance of financial education has never been clearer. Bridging the gap between financial literacy and actual wealth preparedness is essential for individuals and communities, leading to economic resilience and empowerment. This article explores effective educational strategies that can be employed to promote wealth preparedness across various demographics.

Understanding Wealth Preparedness

Wealth preparedness encompasses more than just having substantial savings in a bank account or investment portfolio; it involves a comprehensive understanding of financial concepts, planning for future needs, and developing the skills necessary to manage financial resources effectively. It includes budgeting, investing, understanding debt, and saving for retirement. For many, however, these concepts remain elusive, particularly in underserved communities where access to financial education and resources can be limited.

The Importance of Financial Literacy

Financial literacy serves as the foundation for wealth preparedness. Research shows that individuals with higher financial literacy are better at managing debt, saving for emergencies, and making informed investment decisions. Moreover, they are more likely to engage in wealth-building activities, such as homeownership or investing in retirement accounts. Unfortunately, financial literacy rates tend to be alarmingly low among certain demographics, especially among youth, low-income families, and minority communities.

Educational Strategies to Promote Wealth Preparedness

To bridge the gap in wealth preparedness, various educational strategies can be implemented. These strategies should consider accessibility, relevance, and engagement to effectively reach and resonate with diverse populations.

1. Integrating Financial Education into School Curricula

Implementing financial education programs in schools is an effective way to instill financial literacy from a young age. Curriculum development should focus on practical skills such as budgeting, saving, investing, and the responsible use of credit. Interactive activities, simulations, and real-world applications can enhance engagement and motivation among students. Financial literacy courses could be mandatory or offered as electives, ensuring that all students, regardless of their background, have access to this essential knowledge.

2. Community-Based Workshops and Seminars

Hosting community-based workshops and seminars can significantly increase access to financial education for adults. Local community organizations, libraries, and non-profits can serve as platforms for these workshops, making them accessible to individuals who may face transportation or financial barriers. Topics could include managing debt, preparing for retirement, or navigating the complexities of personal finance. Offering sessions in multiple languages can also cater to diverse populations.

3. Developing Online Resources and Platforms

In an increasingly digital world, online resources can play a pivotal role in increasing financial literacy. Creating accessible websites, mobile applications, and video tutorials that cover various financial topics can help individuals learn at their own pace. Interactive tools, such as budgeting calculators and investment simulators, can also enhance learning experiences. Furthermore, social media campaigns can be utilized to promote financial literacy and share success stories that inspire others to take control of their financial futures.

4. Peer-to-Peer Mentoring Programs

Pairing individuals with peer mentors can foster a supportive environment for learning about financial preparedness. These mentoring programs can help demystify financial concepts and create a safe space for individuals to ask questions and share experiences. Additionally, mentoring can build a sense of community and accountability, encouraging individuals to take positive steps toward their financial goals.

5. Collaboration with Financial Institutions

Financial institutions can play a crucial role in promoting wealth preparedness through partnerships with educational organizations. Banks can contribute to financial literacy programs by offering resources, conducting workshops, and providing real-world insights into financial products and services. Moreover, incentivizing participation through bonuses or rewards for engaging in financial education activities can encourage individuals to take part.

6. Focus on Behavioral Change

Effective financial education should also emphasize behavioral change. Understanding the psychology behind financial decision-making can help individuals overcome obstacles such as procrastination, fear of investing, and poor budgeting habits. Programs that incorporate behavioral economics principles can equip learners with tools to develop healthier financial habits.

Conclusion

Bridging the gap in wealth preparedness requires a collective effort from educators, community leaders, financial institutions, and policymakers. By implementing effective educational strategies that promote financial literacy and empowerment, we can foster a culture of wealth preparedness that transcends socioeconomic barriers. As individuals become more financially literate, they are better equipped to navigate the complexities of modern economies, ultimately contributing to their own prosperity and that of their communities. By investing in financial education today, we can create a more equitable and prosperous tomorrow for all.