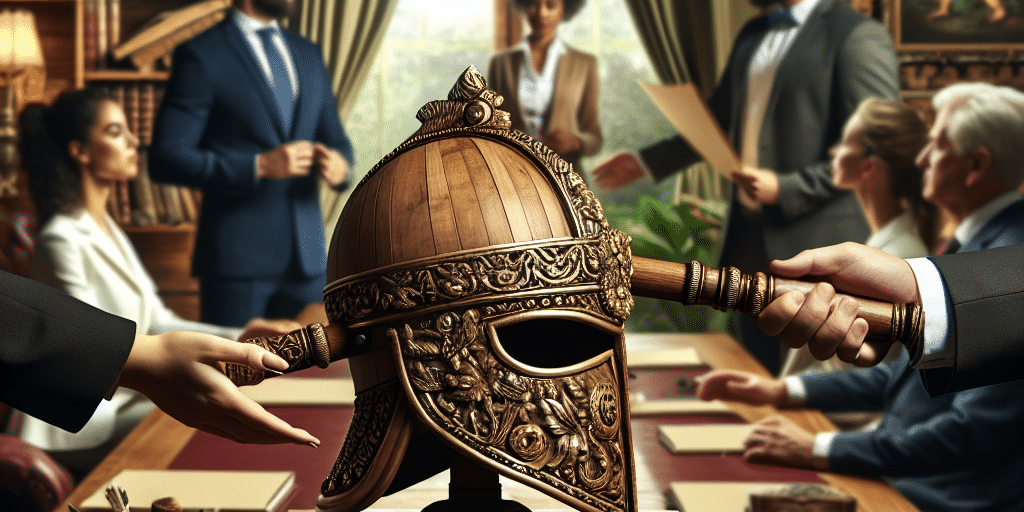

Inheriting the Helm: The Role of the Next Generation in Family Office Governance

Family offices, the private wealth management advisory firms that serve ultra-high-net-worth individuals and families, have long been synonymous with financial stewardship, long-term planning, and a commitment to preserving wealth across generations. However, as the dynamics of wealth creation and preservation evolve, so too must the strategies and governance structures of these entities. One of the most significant shifts in family office governance is the emerging role of the next generation. This article explores how the inheriting generation is stepping up to the helm, their influence on governance, and the essential skills they bring to the table.

The Landscape of Family Offices

Family offices serve an essential function in the management of family wealth, often encompassing a range of services from investment management to estate planning and philanthropic initiatives. Traditionally, these offices have been run by older generations who have amassed their wealth through business ventures, investments, or inheritance themselves. Given the long-term nature of family wealth, effective governance structures are crucial to ensure continuity, risk management, and alignment with family values.

The Next Generation Steps Forward

As wealth becomes increasingly multi-generational, the next generation is being called upon to take a more active role in family office governance. This transition represents a cultural shift within wealthy families, allowing younger members to influence decision-making processes and contribute fresh perspectives. Key factors driving this trend include:

-

Changing Perspectives on Wealth: Younger generations tend to have different attitudes towards wealth compared to their predecessors. With greater emphasis on authenticity, sustainability, and social responsibility, the next generation brings a profound need for governance principles that align with their values.

-

Technological Savvy: Today’s youth are digital natives, comfortable leveraging technology to streamline operations and enhance data analysis. Their tech-savvy nature can drive efficiency in family offices, making governance more responsive and adaptable to market changes.

-

Globalization and Diversity: As families become more globally interconnected, the younger generation often finds themselves navigating multicultural environments and diverse investment opportunities. This exposure fosters a global outlook that is essential for informed decision-making in an increasingly interconnected financial landscape.

- A New Approach to Philanthropy: The next generation is often more engaged in philanthropic activities, pushing for innovative approaches to social impact investing and aligning family office strategies with social and environmental goals.

Changing the Governance Model

The rising influence of the next generation necessitates a reevaluation of governance structures within family offices. Here are several considerations:

-

Inclusive Decision-Making: Family councils or boards that include younger family members can facilitate a collaborative approach to governance and decision-making. This inclusion allows for diverse viewpoints and fosters a sense of ownership among heirs.

-

Education and Mentorship: Developing the skills of the next generation is crucial. Formal training in finance, investment, and governance, alongside mentorship from more experienced family members and professionals, can prepare them for leadership roles.

-

Establishing Clear Values and Vision: Articulating a shared mission and values that resonate with both current and future generations can guide governance in a way that honors family legacies while embracing innovation.

- Risk Management and Adaptability: The next generation should be equipped to navigate new risks associated with modern investing, including cybersecurity threats and environmental concerns, while being agile enough to adjust strategies as needed.

Challenges Ahead

While the transition of governance to the next generation presents many opportunities, challenges also abound. Inheriting the helm can come with unique pressures. The pressure to uphold the family legacy can create tension, particularly if new priorities diverge from traditional practices. Navigating these challenges requires open communication, transparency, and emotional intelligence to foster understanding among family members from different generations.

Conclusion

As the next generation steps into pivotal roles within family offices, their influence on governance structures will be profound. By embracing innovation while grounding decisions in shared values, family offices can ensure continued prosperity and purpose across generations. The inheriting generation has a unique opportunity to shape the future of family wealth stewardship, integrating contemporary principles with long-standing traditions to create a governance framework that enhances both family legacy and societal impact. In an evolving landscape, the collaborative efforts of all generations will be crucial to realizing the full potential of family offices in an increasingly complex world.