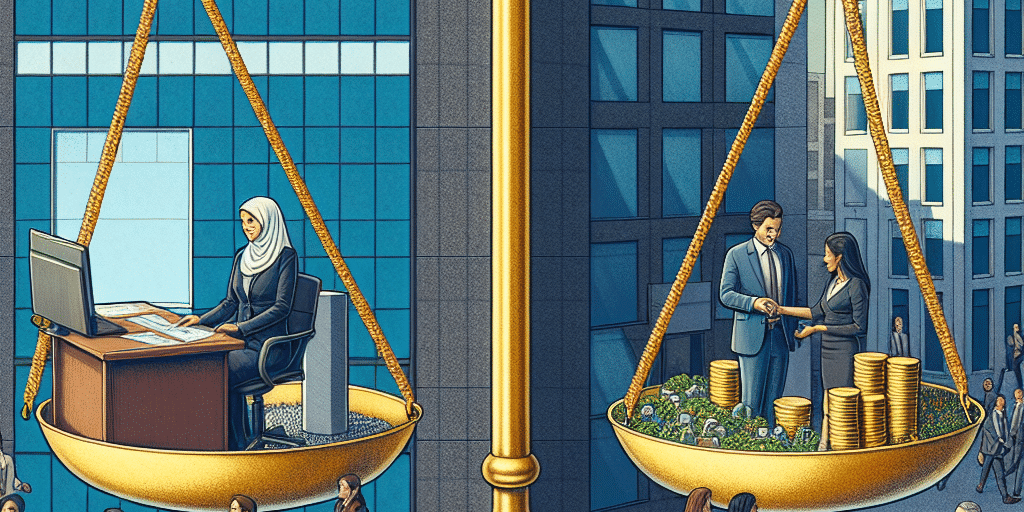

Single vs. Multi-Family Offices: Tailored Wealth Management or Shared Resources?

In the world of high-net-worth individuals, the management of wealth is a paramount concern. As fortunes grow and financial landscapes evolve, families often seek to ensure their financial legacies are not only preserved but also enhanced. Enter family offices — dedicated entities designed to manage the wealth and affairs of affluent families. Within this space, two distinct models have emerged: single-family offices and multi-family offices. This article delves into the differences between these models, weighing the benefits of tailored wealth management against the efficiencies of shared resources.

Understanding Family Offices

Before diving into the nuances of single vs. multi-family offices, it’s essential to define what a family office is. A family office serves as a private wealth management advisory firm that caters specifically to high-net-worth families. These offices manage a range of services, including investment management, tax planning, estate planning, philanthropy, and sometimes even lifestyle management.

Single-Family Offices

A single-family office is dedicated to managing the financial resources, investments, and affairs of one family exclusively. This model is often favored by ultra-high-net-worth individuals with wealth that necessitates robust, customizable services.

Advantages:

-

Tailored Services: A single-family office can create bespoke investment strategies and financial plans that align perfectly with the family’s unique needs, values, and goals without needing to consider the interests of other families.

-

Confidentiality and Control: With a dedicated team, families have greater control over privacy and confidentiality, reducing the risk of sensitive information being shared or mishandled.

-

Long-Term Vision: Single-family offices are positioned to focus solely on the long-term interests of one family, allowing for patient capital allocation and strategies that consider generational transfer and legacy planning.

- Personalized Relationships: The team can build deep, trusting relationships with family members, gaining a nuanced understanding of their aspirations and risk tolerances.

Disadvantages:

-

High Costs: Establishing and maintaining a single-family office can be expensive, requiring significant assets under management to justify the cost of hiring a specialized team.

- Resource Limitations: With only one family to serve, the range of expertise in a single-family office can sometimes be narrower compared to multi-family offices that pool their resources.

Multi-Family Offices

In contrast, multi-family offices serve several families, pooling resources to offer comprehensive services at a potentially lower cost. This model has gained popularity among families that may not have sufficient wealth to justify a dedicated office.

Advantages:

-

Cost Efficiency: By sharing resources, families can access high-quality services without incurring the full costs associated with a single-family office. This can be particularly appealing for families with less excess wealth.

-

Diverse Expertise: Multi-family offices often employ teams comprised of experts in various fields. This diversity allows families access to a wider range of financial services and investment strategies.

-

Networking Opportunities: Families within a multi-family office can benefit from shared investment opportunities and networking with other high-net-worth individuals, potentially leading to collaborative ventures.

- Scalability: As the needs of a family evolve, multi-family offices can adjust services more easily than single-family offices, which may struggle with limited capacities.

Disadvantages:

-

Less Personalization: The shared nature of multi-family offices may lead to a more generic approach to wealth management, potentially overlooking specific family objectives in favor of broader strategies.

- Confidentiality Concerns: With multiple families involved, there’s an inherent risk regarding privacy and security of sensitive information, which can be a significant concern for some families.

Finding the Right Fit

Choosing between a single or multi-family office ultimately depends on the unique circumstances and priorities of each family. For families with substantial wealth, a desire for bespoke services, and a priority for privacy, a single-family office may be the ideal choice. Conversely, families seeking to benefit from shared resources, reduced costs, and a diversified range of expertise may find a multi-family office better suited to their needs.

Conclusion

As the landscape of wealth management continues to evolve, the choice between single and multi-family offices will largely depend on individual family dynamics, financial goals, and values. Understanding the strengths and weaknesses of each model is crucial in making an informed decision that not only preserves wealth but also enhances the family’s financial legacy for generations to come. Ultimately, the best path forward will be one that aligns with the unique priorities and aspirations of the family in question, leading to a more secure and prosperous future.