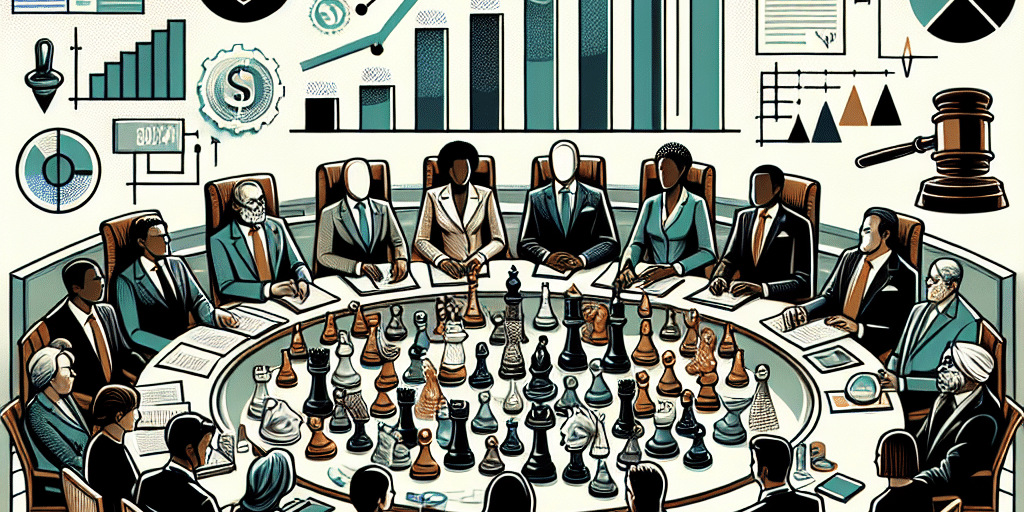

In an era where wealth management is becoming increasingly complex, family offices have emerged as an essential structure for ultra-high-net-worth families to manage their financial affairs, investments, and legacy planning. Central to the functionality and effectiveness of a family office is the Investment Committee, which plays a pivotal role in steering the family’s investment strategy and ensuring alignment with their long-term goals. This article delves into best practices for Family Office Investment Committees, aimed at fostering effective decision-making.

Understanding the Role of the Investment Committee

The Investment Committee (IC) within a family office is tasked with overseeing the investment portfolio, ensuring that it aligns with both the family’s financial objectives and their values. Responsibilities may include:

- Developing and approving investment policies and strategies.

- Evaluating investment opportunities and asset allocation.

- Monitoring portfolio performance and risk management.

- Engaging external advisors and managers.

- Ensuring compliance with regulatory requirements and family governance standards.

As multifaceted as these responsibilities are, the effectiveness of an IC hinges on its structure, composition, and operational guidelines.

Best Practices for Effective Decision-Making

1. Establish Clear Objectives and Mandates

The foundation of effective decision-making is understanding the family’s financial goals and risk tolerance. Investment Committees should work closely with family members to define:

- Investment Horizons: Whether the strategy is focused on short-term growth or long-term wealth preservation.

- Risk Appetite: Articulating how much risk the family is willing to accept, which should be reflected in the asset allocation.

- Values Alignment: Ensuring that investment choices resonate with the family’s values, particularly when considering ESG (Environmental, Social, and Governance) factors.

2. Diversify Committee Composition

Diversity in thought and experience is crucial for robust decision-making. An effective IC should include:

- Family Members: Direct representation ensures that the family’s vision and values are integrated into the investment process.

- Investment Professionals: Advisors with expertise in various asset classes can provide valuable insights and enhance the quality of the decision-making process.

- Independent Members: Including external experts, such as financial analysts or industry specialists, can help mitigate biases and prevent groupthink.

3. Foster Open Communication

To make informed decisions, it is imperative that the Committee engages in open and transparent dialogue:

- Regular Meetings: Schedule consistent meetings to review performance, discuss new opportunities, and revisit investment strategies.

- Encourage Questions: Create an environment where members feel comfortable raising questions and expressing concerns.

- Seek Diverse Perspectives: Encourage members to voice different opinions to enrich discussions and uncover blind spots.

4. Implement a Structured Framework

A structured decision-making framework can enhance effectiveness and accountability:

- Standardized Processes: Establish protocols for evaluating and approving new investments, including due diligence checklists and risk assessment criteria.

- Performance Metrics: Develop clear metrics for evaluating portfolio performance and investment success, based on the family’s objectives.

- Documentation: Maintain thorough records of all discussions, decisions, and rationales to facilitate future assessments and learning.

5. Embrace Technology and Data Analytics

Leverage technology to improve decision-making capabilities:

- Investment Management Software: Use platforms that provide real-time data on portfolio performance, market trends, and risk factors.

- Data Analytics Tools: Employ analytics to assess historical performance, forecast potential outcomes, and identify emerging trends in investment opportunities.

6. Continuous Learning and Training

To remain effective, the Investment Committee must commit to ongoing education:

- Market Updates: Regularly update committee members on market conditions, trends, and emerging opportunities.

- Professional Development: Encourage members to attend workshops and conferences to stay informed about the latest investment strategies and risks.

7. Evaluate and Adjust

Investment landscapes are constantly evolving, and the investment strategy must be flexible enough to adapt:

- Regular Reviews: Conduct periodic evaluations of both the investment strategy and the committee’s performance to identify areas for improvement.

- Feedback Loops: Create mechanisms for gathering feedback from family members and external advisors to refine processes and strategies.

Conclusion

Family Office Investment Committees are central to the effective management of family wealth, guiding investment strategies and ensuring alignment with family goals. By establishing clear objectives, fostering open communication, embracing technological advancements, and committing to continuous education, these Committees can enhance their decision-making capabilities. Through thoughtful implementation of these best practices, family offices can navigate the complexities of financial management and lay a strong foundation for generational wealth.