In an increasingly volatile financial landscape, the quest for investment stability and growth remains paramount for family offices. As custodians of generational wealth, family offices are tasked with not only preserving capital but also enhancing its growth potential. Traditional asset classes like stocks and bonds, while foundational, are no longer sufficient for achieving these objectives alone. This reality has led many family offices to explore alternative investment avenues, with private equity emerging as a particularly compelling option.

Understanding Private Equity

Private equity refers to investment in privately held companies, purchasing either entire businesses or significant stakes, often with the intent to improve operations and drive growth before ultimately selling the investment at a profit. Unlike public equity, private equity investments are characterized by a long-term horizon, illiquidity, and often require a substantial commitment of capital and expertise.

The Case for Embracing Private Equity

1. Enhanced Returns

Historically, private equity has outperformed public markets over the long term. A report from Cambridge Associates found that U.S. private equity funds delivered an annualized return of 11.4% over a 10-year period compared to 5.9% for the S&P 500 index. This performance is attributable to several factors, including active management, operational improvements, and financial engineering.

2. Portfolio Diversification

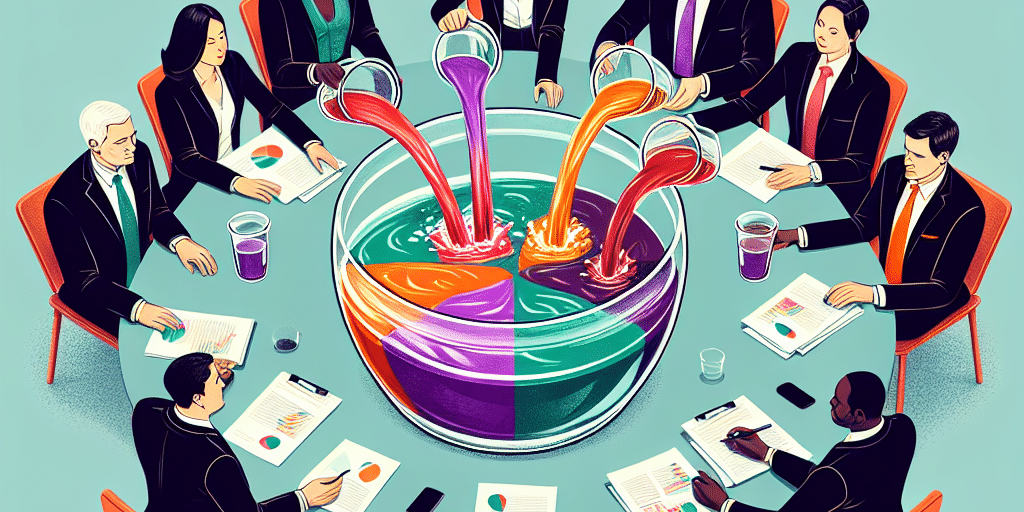

Adding private equity to a portfolio can significantly improve diversification. Equity markets tend to be subject to cyclicality, driven by economic conditions, interest rates, and geopolitical events. Private equity, being less correlated with public markets, allows family offices to mitigate risks associated with market volatility. By investing in different sectors and stages of business, family offices can capture unique opportunities that may not be available in the public domain.

3. Access to Exclusive Opportunities

Private equity investments often grant family offices access to exclusive opportunities that are unavailable to the average investor. Early-stage investments in innovative startups, distressed assets ripe for turnaround, or established businesses seeking growth capital are all within reach for savvy family offices. These unique deal flows can lead to substantial financial gains compared to conventional public market investments.

4. Active Involvement and Influence

One of the defining characteristics of private equity is the level of involvement investors can have in their portfolio companies. Family offices can leverage their knowledge, relationships, and expertise to guide businesses toward growth, often taking board seats or providing strategic direction. This active involvement not only helps drive better returns but can also be personally fulfilling, allowing family members to engage with businesses on a deeper level.

5. Long-Term Value Creation

Private equity investments typically focus on long-term growth rather than short-term market fluctuations. This aligns well with the goals of family offices, which often prioritize sustainable wealth preservation over rapid gains. By taking a patient approach, family offices can support companies through transformative changes, helping to unlock their true potential.

Challenges and Considerations

While the advantages of private equity are compelling, family offices must be aware of certain challenges inherent in this investment class:

-

Illiquidity: Investments in private equity are generally illiquid, with capital often tied up for several years. Family offices need to ensure they have a sufficient liquidity profile to meet immediate cash flow requirements.

-

Due Diligence: Selecting the right private equity fund or investment opportunity requires thorough due diligence. Family offices must rigorously evaluate management teams, investment strategies, and market conditions.

- Time and Expertise: Managing private equity investments demands significant expertise and resources. Family offices may need to develop internal capabilities or partner with established advisory firms.

Conclusion

Given the dynamic nature of financial markets, family offices must continually reassess their investment strategies to ensure they meet their goals. Embracing private equity offers a pathway to enhanced returns, diversification, and active involvement in impactful business ventures. However, success in this arena requires careful planning, diligent execution, and an awareness of the associated challenges.

As the landscape evolves, family offices that can effectively integrate private equity into their portfolios will not only bolster their financial positions but also solidify their legacies through thoughtful, long-term investment strategies. The case for private equity is not just about returns; it’s about forging a sustainable future for families while navigating the complexities of modern investing.