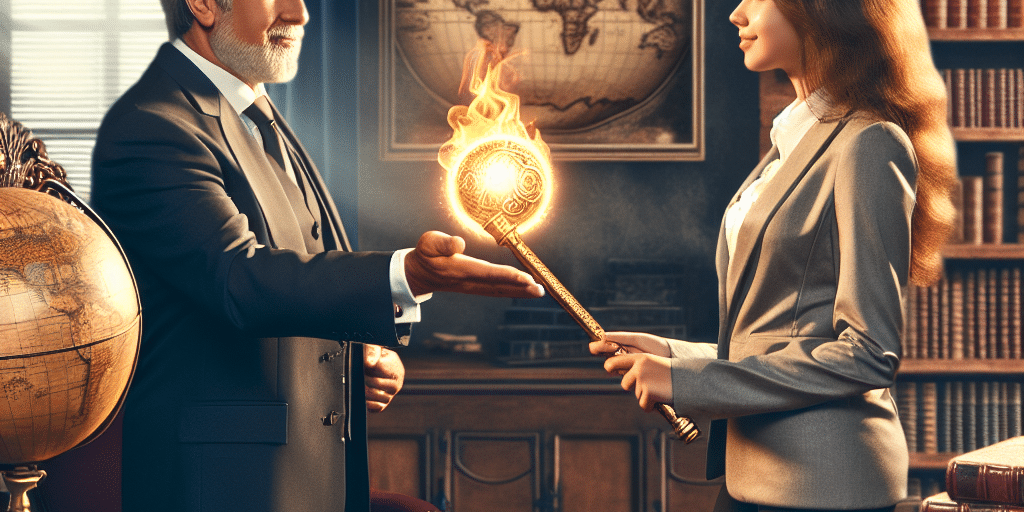

Bridging Generations: Family Offices and the Art of Succession Planning

In an era where family dynamics and financial landscapes are constantly evolving, the importance of effective succession planning cannot be understated—especially within family offices. By definition, a family office is a privately held company that manages the investments and wealth of a single family. As these entities navigate the complexities of transferring wealth and management across generations, crafting a robust succession plan becomes pivotal to ensuring the continued success and harmony of the family legacy.

Understanding the Landscape of Family Offices

Family offices have gained traction in recent years, spurred by an increase in high-net-worth individuals seeking tailored wealth management solutions. Unlike traditional asset management services, family offices provide a comprehensive approach that can encompass financial planning, investment management, tax strategies, philanthropic endeavors, and more. However, with this complexity comes the challenge of making informed decisions that will protect family wealth while fostering intergenerational cooperation and understanding.

The Importance of Succession Planning

Succession planning involves the strategic process of identifying and preparing suitable candidates to assume leadership roles and responsibilities within the family office. It’s not merely about selecting a successor; it involves a holistic view of the family’s values, financial goals, and interpersonal dynamics. Proper succession planning can:

Preserve Wealth: Strategically transferring assets and responsibilities minimizes the risk of financial mismanagement or conflict that can arise during transitions.

Foster Collaboration: A well-structured succession plan encourages family members to work together towards common goals and enhances communication across generations.

Mitigate Conflict: Clear expectations and defined roles can prevent misunderstandings and disputes, which are common during times of transition.

- Strengthen Legacy: By embedding the family’s values and vision into the leadership framework, a family office can ensure that its legacy is preserved and enhanced over time.

Steps to Effective Succession Planning

To successfully implement a succession plan, family offices should consider several key steps:

Initiate Conversations: Open discussions around succession planning should begin early and involve all relevant family members. These dialogues can help surface concerns and aspirations, fostering a culture of transparency.

Identify Successors: Recognizing potential successors within the family requires a blend of objective assessment and subjective insight. Family members should be evaluated based on their skills, values, and commitment to the family’s mission.

Provide Education and Training: To ensure that potential successors are prepared for leadership, it’s crucial to invest in education and skill-building. This could involve formal education programs, mentorship from existing leaders, or hands-on experience in various aspects of the family office.

Document the Plan: Written guidelines provide clarity and structure, detailing roles, responsibilities, and expectations to eliminate ambiguity. This documentation should be revisited and updated regularly to reflect the evolving nature of the family and its business.

Implement a Governance Structure: An effective governance framework—encompassing family councils, boards, or advisory committees—can facilitate decision-making and enhance accountability. Such structures ensure that all voices are heard, and interests are represented.

- Evaluate and Iterate: Succession planning is not a one-time event; it requires ongoing evaluation and adaptation to reflect changes in both family dynamics and the external environment. Regular reviews can help address new challenges or shifts in family goals.

The Role of Professional Advisors

While family members possess invaluable insights into their legacy, engaging professional advisors can lend a wealth of expertise to the succession planning process. Financial experts, legal advisors, and family business consultants can provide insights based on best practices, industry trends, and regulatory considerations. Their objectivity helps mitigate familial biases, ensuring that decisions are made in the family’s best interest.

Conclusion

As families navigate the delicate balance of preserving wealth and passing down values, creating an effective succession plan is essential for family offices. By fostering collaboration and understanding through open dialogue, investing in the next generation, and leveraging professional resources, families can successfully bridge the gap between generations. In doing so, they not only secure their financial legacy but also fortify their emotional and cultural ties—ensuring that the family’s story continues to thrive for generations to come.