From Heirs to Stewards: Preparing the Next Generation for Family Office Success

In an era where wealth management transcends mere investment strategy, family offices play a crucial role in amalgamating and preserving family legacies. These multifaceted entities do not just manage substantial financial resources; they also incorporate a broader vision of stewardship, governance, and purpose that can shape the family’s future across generations. This evolution from heirs to stewards is paramount in ensuring the sustainability and harmonious management of family wealth. Here, we explore how families can prepare their next generation for a successful transition into stewardship roles within their family offices.

Understanding the Role of a Family Office

A family office provides comprehensive wealth management services tailored to the needs of high-net-worth families. Its functions typically include investment management, tax planning, estate planning, philanthropic advising, and sometimes even family governance and education. As the family’s financial landscape grows more complex, the importance of developing a well-structured family office becomes clear, particularly as wealth transitions from one generation to the next.

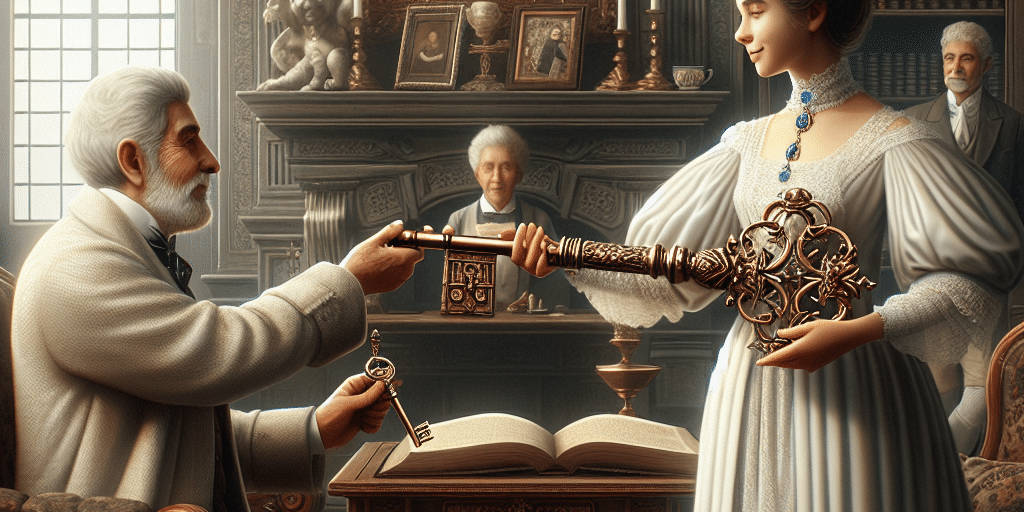

The Cultural Shift: From Heirs to Stewards

Traditionally, inheritors were seen primarily as heirs — individuals who would receive wealth, often without a clear understanding of its management or implications. In contrast, stewarding family wealth involves a significant cultural shift. It emphasizes responsibility, active participation, and a forward-thinking mindset. The next generation must not only appreciate the value of the family’s assets but also understand their significance and the responsibilities they entail.

Preparing the Next Generation

1. Education and Awareness

A fundamental step in preparing the next generation for stewardship involves education, which should start early. Younger family members should be educated not just in financial matters but in the family’s history, values, and mission. This knowledge helps foster a sense of belonging and purpose, connecting them to the family legacy.

Effective education programs can incorporate workshops, mentorships, or even partnerships with financial institutions that specialize in educating the wealthy. Topics might range from investment strategies and risk management to the legalities of estate planning.

2. Encouraging Active Participation

Encouraging young family members to actively participate in family meetings and decision-making processes is crucial. This involvement instills a sense of ownership and responsibility. Youngsters can join advisory boards or committees that govern the family office, engaging openly in discussions about investment strategies, philanthropic initiatives, and community engagements.

Through this participation, they gain valuable insights into the family’s operations and practices, allowing them to cultivate a mindset of stewardship rather than mere inheritance.

3. Cultivating Emotional Intelligence and Leadership Skills

Stewardship goes beyond financial acumen; it requires emotional intelligence, vision, and leadership abilities. Future stewards should be equipped to communicate effectively, navigate interpersonal dynamics, and lead others within the family office. Leadership training and personal development programs can significantly enhance their skill sets.

Moreover, working with coaches or mentors outside the family can provide diverse insights and experiences, preparing them to manage complex family and business relationships effectively.

4. Fostering a Philanthropic Mindset

Philanthropy is often at the heart of wealth management in family offices. Encouraging the younger generation to engage in philanthropic activities not only contributes positively to society but also helps them understand the impact of their wealth. Structuring family giving initiatives allows them to explore causes they’re passionate about while developing skills in strategic philanthropy.

5. Implementing Governance Frameworks

A robust governance framework is essential for instilling discipline and order in family office operations. Establishing bylaws and principles of governance can guide decision-making processes, reducing potential conflicts and ensuring a shared understanding of roles and responsibilities. Involving the next generation in shaping these frameworks cultivates a sense of agency and respect for the family’s values.

Conclusion

Transitioning from heirs to stewards is a significant cultural transformation that families must navigate to ensure the enduring legacy of their wealth. By actively preparing the next generation through education, participation, leadership development, philanthropy, and structured governance, families can position themselves for long-term success.

A successful family office is not merely about financial independence; it is about nurturing responsible stewards who appreciate their heritage, embrace their responsibilities, and are equipped to lead their families into a prosperous future. As we look toward the next generation, instilling the values of stewardship will ensure that family wealth can sustain its impact for generations to come.