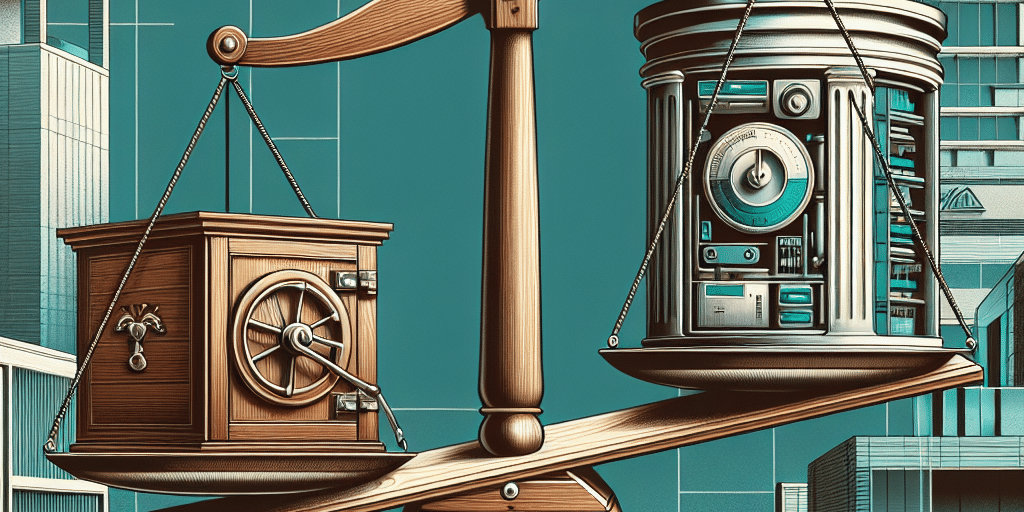

Balancing Legacy and Innovation: Governance Strategies for Family Offices

In the world of wealth management, family offices occupy a unique niche. They are not just financial management entities; they represent the aspirations, values, and legacies of affluent families. However, with the ever-evolving landscape of global finance, technology, and social responsibility, family offices face the challenge of balancing legacy with the need for innovation. Effective governance strategies are essential for achieving this delicate equilibrium, ensuring that family values are preserved while also embracing new opportunities for growth.

Understanding the Dual Focus of Family Offices

Family offices primarily exist to manage the wealth of high-net-worth families. They cater to a wide range of services, including investment management, estate planning, tax optimization, and philanthropic activities. However, the interests of family members often diverge, necessitating a governance structure that accommodates both legacy preservation and innovative pursuits.

Legacy Preservation: Families often attach great importance to their legacies, which encompass their history, values, and traditional investment strategies. Preserving these legacies can provide cohesion among family members, instill a sense of belonging, and ensure that future generations appreciate their lineage and responsibilities.

Innovation: The financial landscape is transforming rapidly, characterized by advancements in technology, changing investor preferences, and emerging asset classes. Family offices have an opportunity—and an obligation—to adapt by embracing innovative investment strategies, digital tools, and sustainable practices that reflect the evolving economic environment and align with the values of younger generations.

Key Governance Strategies for Balancing Legacy and Innovation

To harmonize these two often conflicting priorities, family offices can adopt several key governance strategies to navigate the complexities of wealth management while ensuring a sustainable future.

1. Establishing a Clear Governance Framework

A well-defined governance framework is foundational for any family office. This framework should articulate the family’s mission, values, goals, and guidelines for decision-making. This foundation allows families to engage in honest conversations about their legacy and the potential for innovation, ensuring that all members have a voice in the process.

Family offices can incorporate:

- Advisory Boards: Including both family members and external advisors can provide diverse perspectives on legacy issues and innovation opportunities.

- Family Constitutions: Creating a family constitution can codify the family’s values and governance structures, providing clarity on matters ranging from investment strategies to social responsibilities.

2. Emphasizing Education and Engagement

To foster a culture of innovation while honoring legacy, it’s vital to engage younger generations in the governance process. Providing education about investment methodologies, emerging trends, and innovative financial instruments can empower them to take part in discussions about the family’s future direction.

Family retreats, workshops, and mentoring programs can cultivate an environment where legacy and innovation coexist. By encouraging open dialogue and integrating the perspectives of all family members, family offices can create a sense of ownership and commitment to strategic decisions.

3. Integrating Technology and Data-Driven Decision Making

Embracing technology is crucial for innovation in family offices. This involves utilizing advanced analytics, artificial intelligence, and blockchain technologies to optimize investment strategies and improve operational efficiency. By investing in technology, family offices can also enhance transparency and reduce risks associated with wealth management.

However, implementing new technologies requires careful governance to align with family values. Families should establish criteria for technology adoption, assessing whether new tools or platforms complement their legacy while being forward-thinking.

4. Fostering a Culture of Philanthropy

Many families view philanthropy as a vital aspect of their legacy. Family offices can innovate in this space by exploring new philanthropic models, such as impact investing—investing in ventures that generate social and environmental benefits alongside financial returns. Striking the right balance between traditional charitable contributions and innovative, sustainable practices can reinforce the family’s commitment to social responsibility while addressing modern societal challenges.

5. Planning for Succession

Succession planning is a critical component of governance in family offices. Preparing the next generation is essential for maintaining the family legacy while ensuring a smooth transition to innovative practices. Creating a structured approach to succession that incorporates training, apprenticeships, and knowledge transfer can set the stage for sustained family wealth and investment ethos.

6. Regular Review and Evolution of Strategies

The financial landscape can shift rapidly, and family offices must remain adaptable. Regularly reviewing governance strategies ensures they align with changing family dynamics, market conditions, and emerging opportunities. By establishing a periodic evaluation process, family offices can proactively adjust their approach to balance legacy and innovation effectively.

Conclusion

The challenge of balancing legacy and innovation in family offices requires thoughtful governance strategies that encompass the values of the past and the possibilities of the future. By establishing clear frameworks, engaging younger generations, embracing technology, championing philanthropy, planning for succession, and committing to regular reviews, family offices can navigate the complexities of modern wealth management while upholding the legacies that shape their identities.

In this era of rapid change, family offices have an unprecedented opportunity to redefine their roles—not simply as custodians of wealth but as pioneers of responsible legacy management and innovation, ultimately leaving an enduring impact for generations to come.